The auto sector has been performing well so far in the Q2 earnings season. Nearly 27.3% of the sector’s companies have posted results as of Jul 22. These companies recorded 30.4% year-over-year growth in earnings and 7.8% in revenues, per our Earnings Preview report. In comparison, total S&P 500 companies that had reported through Jul 22 posted a 1.1% decline in earnings and a 2.6% rise in revenues.

By the end of Q2, auto sector earnings and revenue growth is projected to be around 18.4% and 2.1%, respectively. Meanwhile, total S&P 500 earnings and revenues are expected to decline 3.4% and 0.5% year over year, respectively.

Revenues of auto companies are being driven by strong sales in major markets like the U.S., Europe and China, in the first half of 2016. Meanwhile, the bottom line is benefiting from an increase in the sales of higher margin vehicle segments, such as SUVs and light trucks, due to low fuel prices. Nonetheless, the pressure to maintain the attractive incentives and deals may weigh upon margins for automakers. Sluggishness in some markets and expenses related to safety recalls are other hurdles. The negative impact of foreign currency translation also remains a headwind for the auto sector.

Among the many stocks lined up to report this week, let’s see what awaits these five auto stocks slated to release their second-quarter 2016 results on Jul 27.

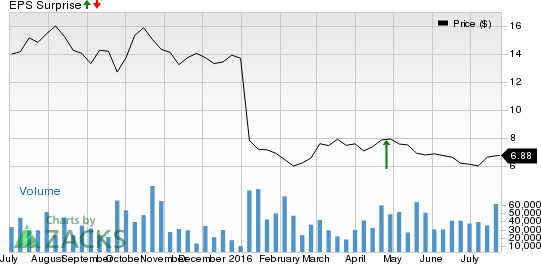

Fiat Chrysler Automobiles N.V. (NYSE:FCAU) carries a Zacks Rank #4 (Sell). Earnings ESP for the company is currently pegged at +9.76% as the Most Accurate estimate of 45 cents stands above the Zacks Consensus Estimate of 41 cents. We note that the company delivered a positive earnings surprise in the last quarter (read more: Fiat Chrysler Q2 Earnings: A Surprise in Store?)

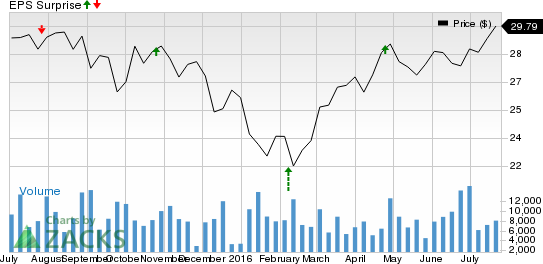

Allison Transmission Holdings, Inc. (NYSE:ALSN) has an Earnings ESP of +6.35% and a Zacks Rank #3 (Hold). The Zacks Consensus Estimate for the quarter is currently pegged at 63 cents. Allison Transmission surpassed earnings estimates in three of the last four quarters. This resulted in a positive average surprise of 8.01%.

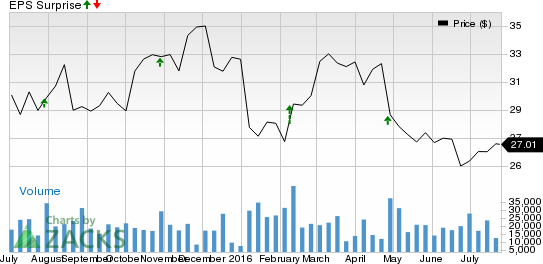

The Goodyear Tire & Rubber Company (NASDAQ:GT) currently carries a Zacks Rank #2 (Buy). The company has an Earnings ESP of -8.65% because the Most Accurate estimate of 95 cents stands below the Zacks Consensus Estimate of $1.04. Goodyear surpassed earnings estimates in each of the last four quarters. This resulted in a positive average surprise of 10.77% (read more: Goodyear to Report Q2 Earnings: What's in the Cards?)

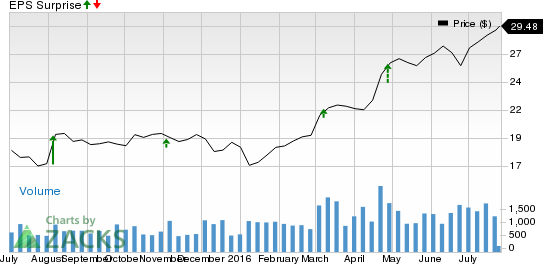

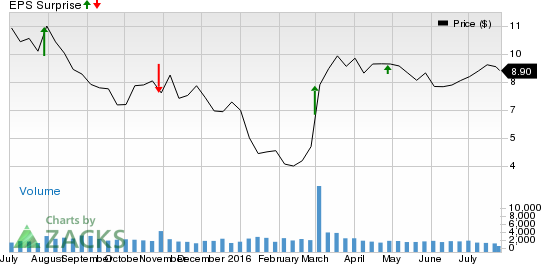

Superior Industries International, Inc. (NYSE:SUP) has an Earnings ESP of 0.00% and a Zacks Rank #3. The Zacks Consensus Estimate for the quarter is currently pegged at 45 cents. Superior Industries beat earnings estimates in three of the trailing four quarters. This resulted in a positive average surprise of 28.49%.

Federal-Mogul Holdings Corporation (NASDAQ:FDML) carries a Zacks Rank #3. The Earnings ESP for the company is currently pegged at 0.00% as the Most Accurate estimate and the Zacks Consensus Estimate both stand at 31 cents. We note that the company delivered a positive earnings surprise in three of the last four quarters. This resulted in a positive average surprise of 28.11%.

FIAT CHRYSLER (FCAU): Free Stock Analysis Report

SUPERIOR INDS (SUP): Free Stock Analysis Report

FEDERAL MOGUL-A (FDML): Free Stock Analysis Report

GOODYEAR TIRE (GT): Free Stock Analysis Report

ALLISON TRANSMN (ALSN): Free Stock Analysis Report

Original post

Zacks Investment Research