The Australian dollar traded sharply higher on Monday following Australia’s election outcome over the weekend. The unexpected victory for Prime Minister Scott Morrison and his conservative Liberal National coalition party came after six volatile years of government. The center-left Labor party had been favored to win the federal election. Despite the spike, the Aussie still faces several notable headwinds.

RBA Governor Philip Lowe Speech

Analysts are now eyeing the speech on the economy and monetary policy from RBA Governor Philip Lowe scheduled to be delivered at 12.15pm Brisbane time on Tuesday. The market will be looking for hints of a rate cut in June and just how dovish Governor Lowe will be.

Disappointing jobs data, slowing economic expansion and sluggish wage growth have increased anticipation that the RBA will lower rates at its June 4th policy meeting. The Australian central bank held its cash rate at a record low 1.5 per cent at its May meeting and stated at its April meeting that if inflation did not rise and unemployment increased, an interest rate cut would “likely be appropriate”. Widespread expectations that the Reserve Bank of Australia (RBA) will cut official interest rates in the coming months continue to undermine the Australian dollar.

US/China Trade

US-Sino trade tensions also continue to weigh on the Aussie. The recent escalation of the trade war between the United States and China has dampened risk appetite and pressured the Australian dollar and other commodity currencies. Additionally, China’s industrial production and retail sales figures missed estimates in April. China is Australia’s largest trading partner and soft economic data threatens demand for Australian commodities such as iron ore and coal.

ASX 200

Meanwhile, the benchmark ASX 200 share index rallied to its highest level since late-2007 on the heels of the Scott Morrison coalition victory. Bank stocks were among the major winners on the day.

The Bottom Line

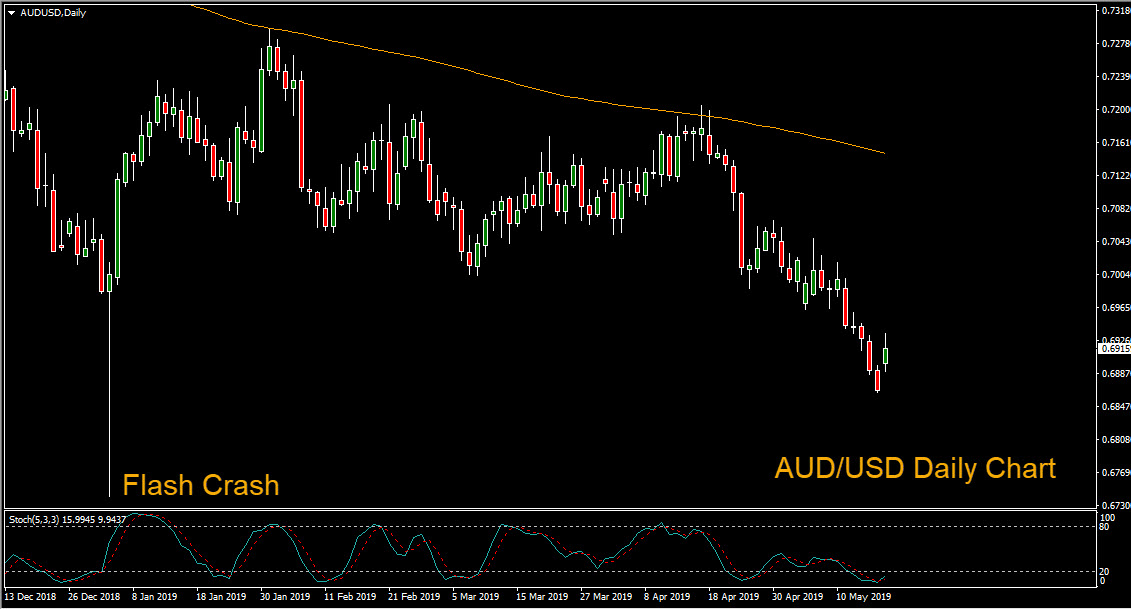

Early gains are being eroded as analysts look to Tuesday’s speech from RBA Governor Lowe. Downside risk remains with no major support level until the January flash crash low of .6750.