The Australian dollar eased on Thursday following weaker-than-expected economic data. The Australian Dollar took an initial knock on Wednesday on news of tepid consumer price data, which came in at 0.6% compared to an expectation of 0.7%. This showed that a relatively strong economy has yet to translate into significantly higher inflation. The Reserve Bank of Australia (RBA) will make its next monetary policy decision on Tuesday next week. Although no change is expected, the market will react to any comments from the RBA. On Thursday, Australia’s building permit approvals data showed a slump of 20% on the month and 5.5% on the year, when a respective fall of 7.6% and a rise of 11.5% had been expected.

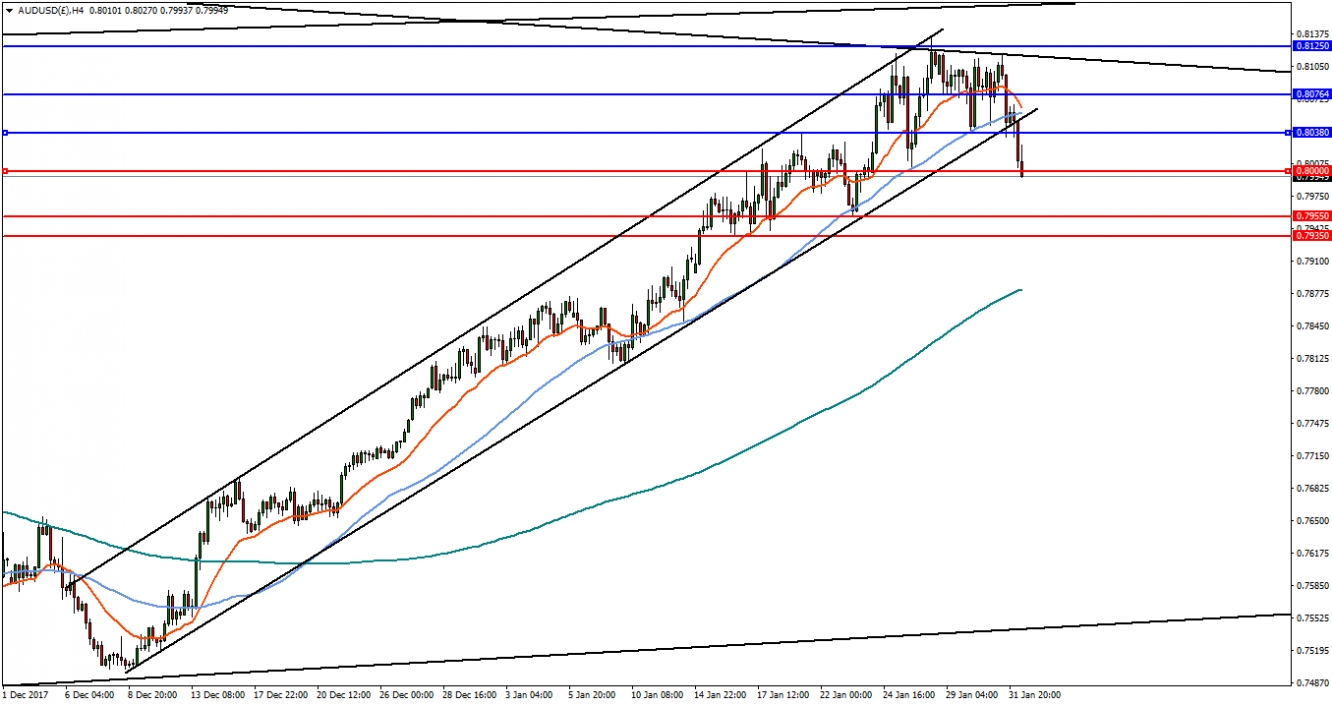

A hawkish FOMC yesterday helped to revive USD demand, and so this pair was seen to decline overnight. AUD/USD was rejected from the 0.8125 level, where there is a confluence of highs from 2017 and trend line resistance from 2013. In the 4-hourly time frame, the pair has broken a channel and is now retracing lower. The pair is testing 0.8000 and a confirmed break could lead to a move to the next major support at 0.7955, followed by 0.7935. A reversal above 0.8038 is needed to once again test the highs.

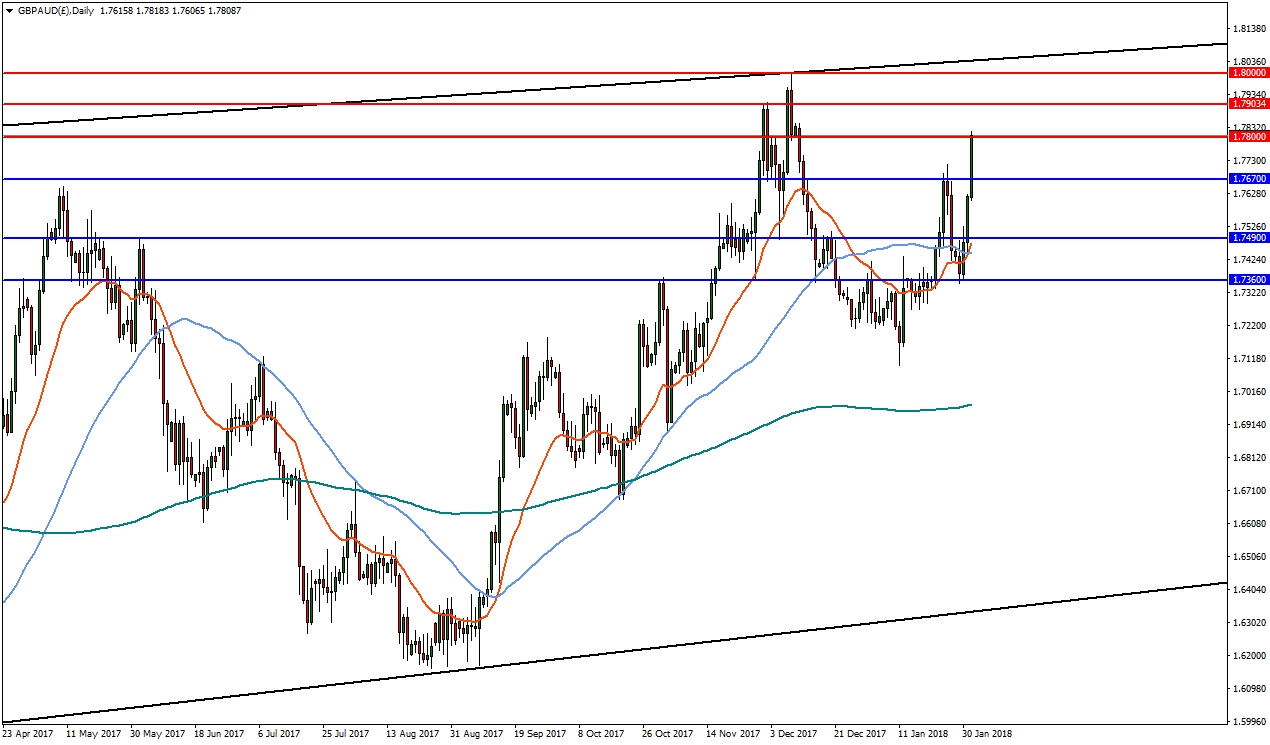

The GBP has been strong recently on the back of Brexit optimism, so combined with a weaker AUD, the GBP/AUD pair could see significant movement. In the daily time frame, the pair acquired some bullish momentum and is now testing 2016 highs around 1.7800. A break here could lead to a test of the November high and channel resistance at 1.800 but there is some near-term resistance at 1.7900. On the flip-side, a reversal and break below 1.7670 is needed to change the outlook with a move to support near 1.7490.