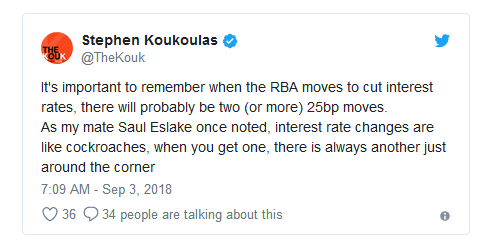

In recent weeks, I have seen calls for the Reserve Bank of Australia (RBA) to cut interest rates.

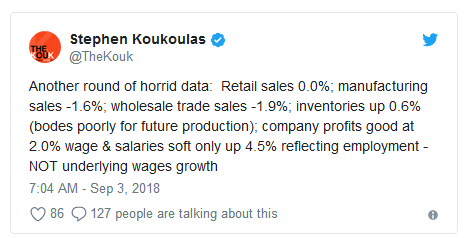

Part of the alarm no doubt came from some troubling economic data points…

So I looked forward with great anticipation to tonight’s announcement on monetary policy from the RBA. Not only was there apparent economic tension, but technical tension existed across major Aussie currency pairs. Surprisingly, the RBA was definitively bullish in a statement that was not made at all to hint at imminent rate cuts. Instead, I can see a case for imminent rate hikes.

First of all, the RBA made zero mention of global trade wars and characterized China’s growth as only slowing “a little.” Traders have tended to sell the Australian dollar (Guggenheim CurrencyShares Australian Dollar (NYSE:FXA)) on global and Chinese economic risks. Most importantly, the RBA made a bullish forward forecast on the economy along with an upbeat forecast on inflation:

“The Bank’s central forecast is for growth of the Australian economy to average a bit above 3 per cent in 2018 and 2019. In the first half of 2018, the economy is estimated to have grown at an above-trend rate…

Inflation is around 2 per cent. The central forecast is for inflation to be higher in 2019 and 2020 than it is currently. In the interim, once-off declines in some administered prices in the September quarter are expected to result in headline inflation in 2018 being a little lower, at 1¾ per cent.”

Employment and wages look good as well:

“The outlook for the labour market remains positive. The unemployment rate has fallen to 5.3 per cent, the lowest level in almost six years. The vacancy rate is high and there are reports of skills shortages in some areas. A further gradual decline in the unemployment rate is expected over the next couple of years to around 5 per cent. Wages growth remains low, although it has picked up a little recently. The improvement in the economy should see some further lift in wages growth over time, although this is likely to be a gradual process.”

With the policy rate at a historically low 1.50%, the RBA’s bullish statement suggests that rates are much more likely to increase before they decrease. Under this assessment, it makes sense that the Australian dollar surged in the immediate wake of the policy statement. I originally intended to wait until the dust settled to follow the post-staement momentum, but I think the messaging from the RBA is sufficiently clear. The Australian dollar is oversold at current levels.

I started buying the Australian dollar against the Japanese yen (Guggenheim CurrencyShares Japanese Yen (NYSE:FXY)) as the yen is likely to get sold in a risk-on environment. I can also collect carry while I wait for the new upside momentum to extend itself. I am also targeting buys against the euro (Guggenheim CurrencyShares Euro (NYSE:FXE)) and perhaps the British pound (Guggenheim CurrencyShares British Pound Sterling (NYSE:FXB)) as a combination play on Brexit drama.

The Australian dollar continued a bounce from 10-month lows against the Japanese yen. AUD/JPY should soon challenge its last peak with a move above downtrending 50DMA resistance setting up potential for fresh bullishness.

The 5-minute view on AUD/USD shows the initially sharp buying interest in the Australian dollar after the monetary policy statement from the RBA.

Be careful out there!

Full disclosure: long AUD/JPY