AUD/USD is sharply higher for a second straight day. In the European session, the Australian dollar is trading at 0.6484, up 1.412. After losing over 1% on Monday, the Aussie has roared back with gains of over 2.7%.

Australia’s inflation jumps to 7.3%

Australia’s inflation report is the driver behind today’s gains, as third-quarter inflation was stronger than expected. Headline CPI jumped 7.3%, its highest level since 1990. This was way up from 6.1% in Q2 and above the consensus of 7.0%. The key core inflation indicator climbed to 6.1%, up from 4.9% and above the consensus of 5.6%.

The unexpected rise in inflation upsets the apple cart for the RBA, which lowered its October rate hike to 0.25% after four straight increases of 0.50%. The RBA would have liked to continue with a small hike at next week’s meeting, and there has even been talk of a pause in rate hikes.

The hot inflation report changes this thinking dramatically. It’s difficult to see how the RBA can ignore the jump in inflation, which is a painful reminder that inflation is yet to peak. The central bank will likely have to respond with a 0.50% increase, and the Australian dollar has soared today as a result. As the inflation report is the last key release before next week’s meeting, the RBA won’t have any additional data which could temper the need for a 0.50% hike.

The RBA will have little choice but to continue with oversize rates until inflation is beaten, which could take a while. The central has projected that inflation will hit 7.5%, with some analysts expecting it to rise closer to 8.0%. That means that the cash rate, currently at 2.6%, is unlikely to peak until it rises to 3.5% or slightly higher.

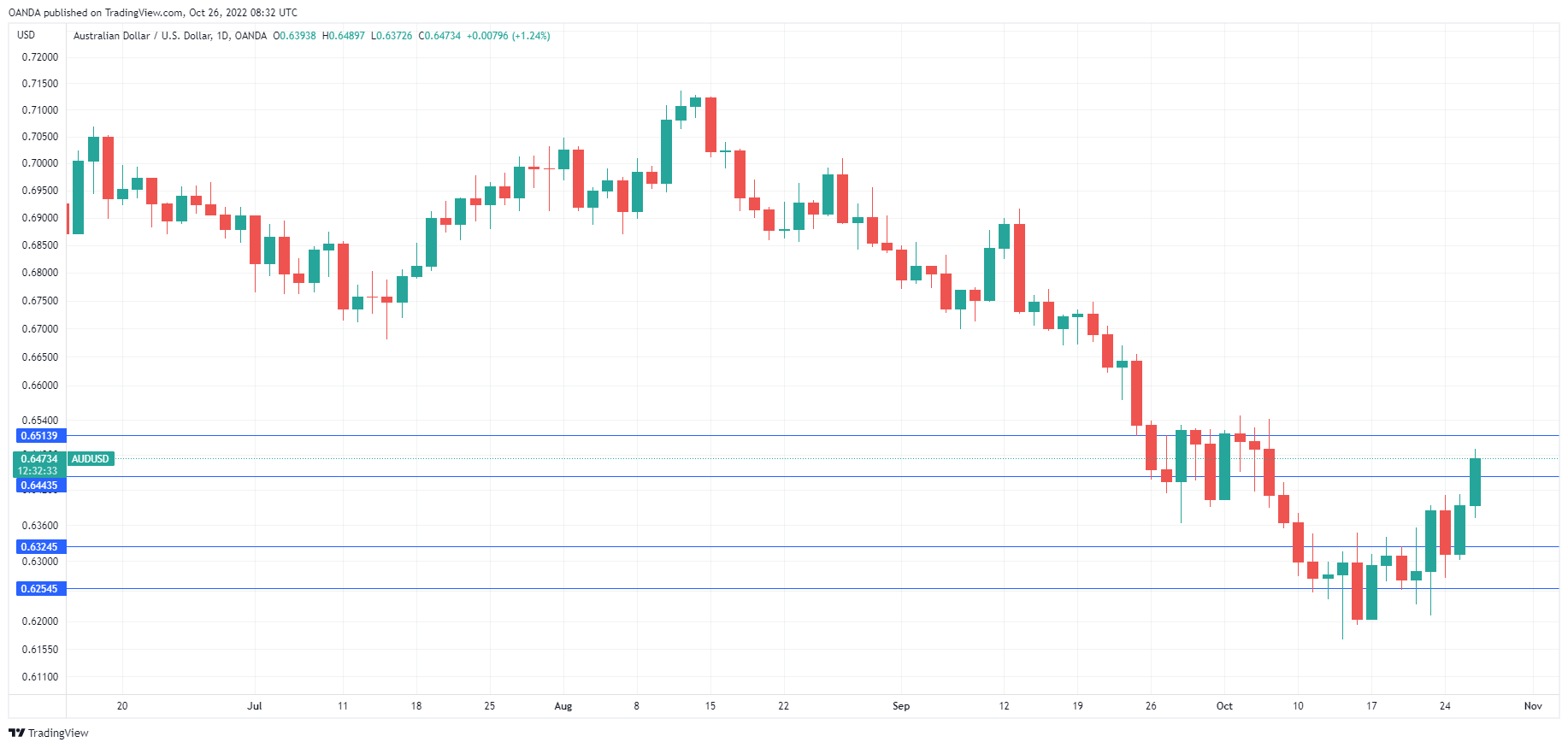

AUD/USD Technical

- AUD/USD continues to test support at 0.6250. The next support level is 0.6121

- There is resistance at 0.6331 and 0.6460