- RBA repeats no rate cuts until confident inflation will return to 2-3% target range.

- The labour market remains tight, with strong employment growth and elevated vacancies.

- Australian bond futures fall to new lows, with AUD/USD supported by narrowing US yield differentials.

Overview

The Reserve Bank of Australia (RBA) won't cut interest rates until it’s confident inflation will return to the midpoint of its 2-3% target, delivering a long list of reasons why it can't rule anything in or out regarding the outlook. The hawkish tone of its November monetary policy statement has seen markets dial back easing expectations further, with key three-year Australian government bond futures breaking to fresh lows. This, along with gains in Chinese equity markets, has pushed AUD/USD higher.

Labour Market Strength Sees RBA Retain Hawkish Tone

The latest RBA statement delivered a stark message for those expecting near-term rate cuts, headlining the first section with “underlying inflation remains too high.” It pointed out that “aggregate demand remains above the economy’s supply capacity,” meaning demand outstrips supply, even if demand is weak. Hinting at potential demand growth, it referred to “declines in real disposable incomes” in the past tense, implying it's no longer a limiting factor.

On the labour market, the RBA’s tone was also hawkish. Conditions remain “tight,” with employment growing “strongly,” and cyclical measures such as youth unemployment and underemployment having “declined.” Despite record participation levels, it noted that “vacancies are still elevated.”

This is not the language of a central bank preparing to cut rates, especially with underlying inflation well above target and productivity gains uncertain. As long as labour market conditions stay strong, the RBA can’t be confident inflation will sustainably return to target.

“There are uncertainties regarding the lags in the effect of monetary policy and how firms’ pricing decisions and wages will respond to slow growth and weak productivity outcomes at a time of excess demand, while labour market conditions remain tight,” it said.

Given these uncertainties, and with underlying inflation not forecast to reach 2.5% until the end of 2026, the RBA again warned it remains “vigilant to upside risks and…is not ruling anything in or out.”

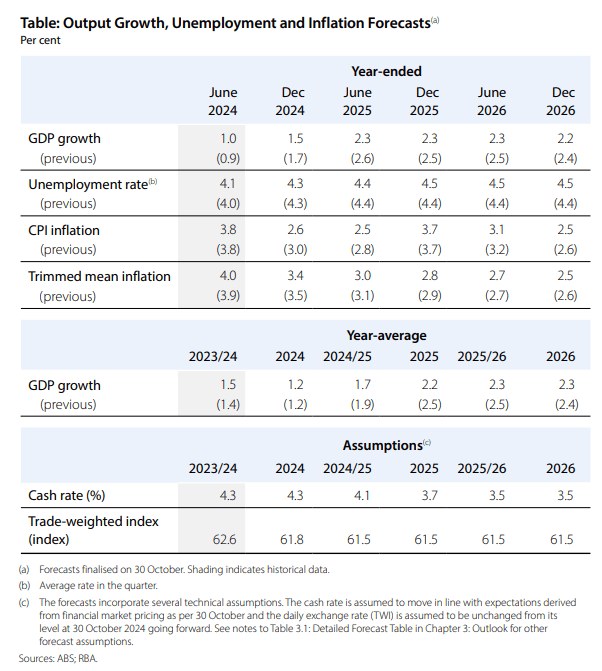

RBA Forecasts Reflect Rates Remaining Higher for Longer

The RBA’s latest forecasts are shown below, alongside the previous estimates from three months ago.

Rather than suggesting the bank is moving closer to rate cuts, the slight downward revisions to the GDP growth and underlying inflation forecasts, along with a minor upward revision to unemployment, largely reflect the shift in domestic rates pricing over the past three months. Essentially, the deviations are driven by the expectation that the cash rate will stay higher for longer.

Source: RBA

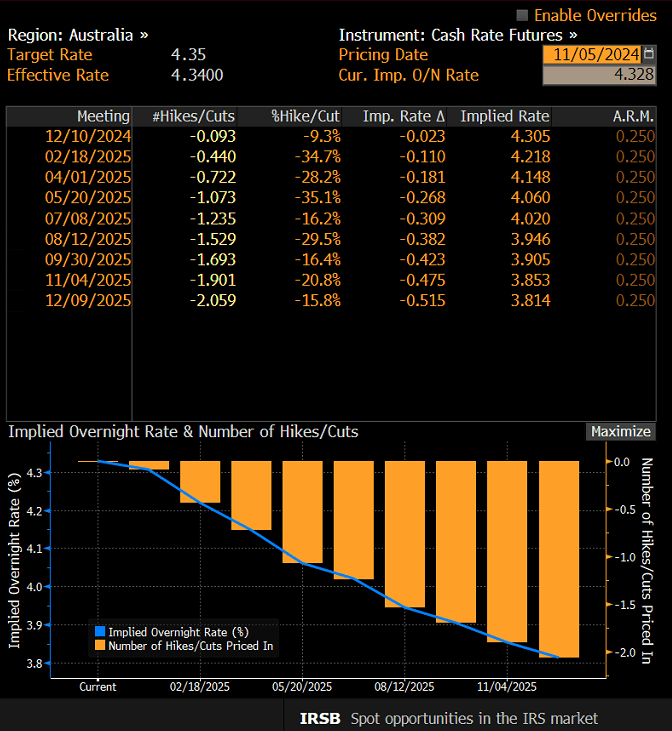

Rate Cut Pricing Dwindles Further, Hammering Bonds

As seen in the next table, just two full rate cuts are now expected by the end of 2025, with half a cut removed from swaps pricing over the past week alone.

While some of this repricing reflects international factors, the RBA’s reluctance to cut rates has seen Australian bonds underperform relative to other advanced economies recently.

Source: Bloomberg

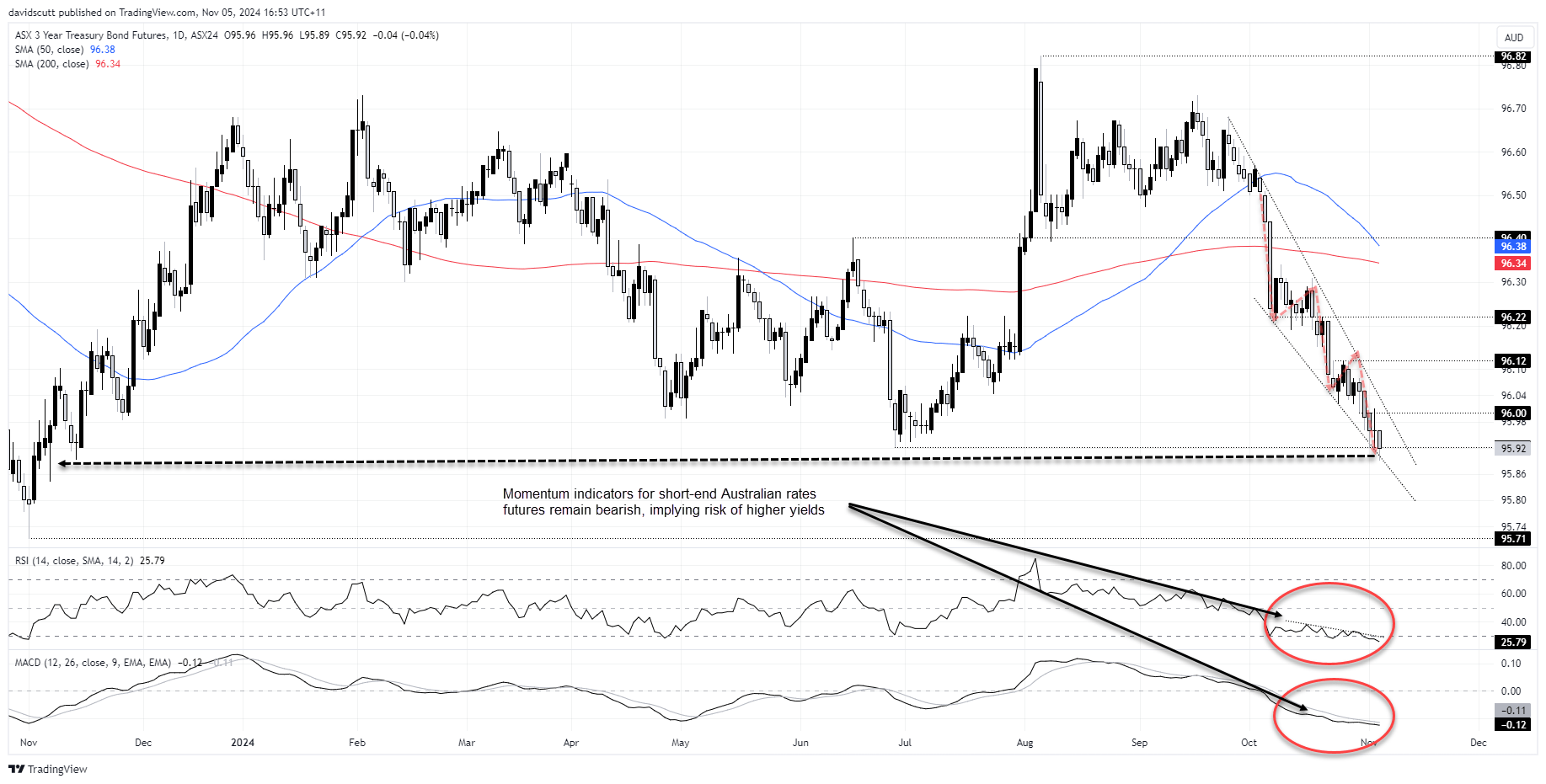

Australian three-year government Australia 3-Year have been hammered since late September, falling to lows not seen since last November when the RBA last hiked rates. With the price comfortably in a descending wedge and momentum indicators like RSI (14) and MACD continuing to flash bearish signals, the path of least resistance remains lower, especially when fundamentals align with the technical picture.

Source: TradingView

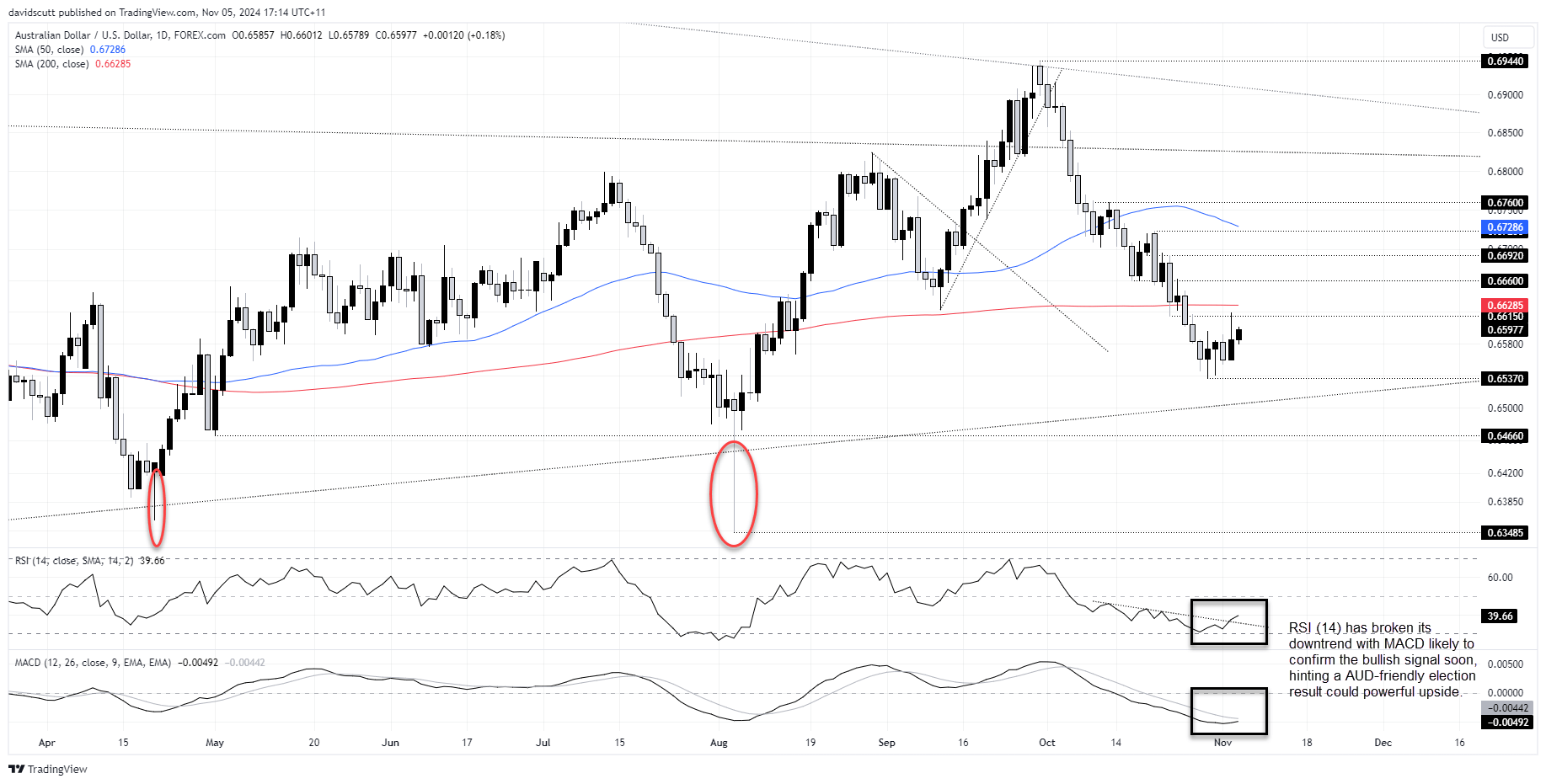

AUD/USD Rangebound Before US Election

While the RBA rate outlook is a secondary factor for AUD/USD traders, the narrowing of yield differentials with the US, since Australia’s Q3 inflation report last week, has likely helped the recent bounce off the lows printed in late October.

Source: TradingView

AUD/USD remains rangebound heading into the US election, oscillating in an 80-pip range over the past week. Support is at .6537, with an uptrend around .6505 today, which triggered large bullish reversals during previous tests. On the topside, .6615, the 200-day moving average, .6660, and .6682 are levels to watch. RSI (14) has broken its downtrend and MACD looks like it may soon confirm the bullish signal, hinting upside may be easier won than downside near-term.

As for the US election outcome, a split Congress may be AUD/USD positive, especially with Harris winning the presidency. Alternatively, a red or blue wave could drive US Dollar higher, especially if the former.