The AUD/USD bulls are overly optimistic about the prospect of the trade conflict ending between the US and China

Investors' belief in a successful resolution of the US-China conflict, the fall in the probability of three acts of monetary restriction by the Fed until mid-2019, strong statistics on the labor market and the fastest growth in the Australian economy since 2012, as expected, contributed to the rally of the AUD/USD in the direction of the highest marks since the end of August. The Aussie is the second best performer of the G10 for the last month, and Westpac predicts that, together with the US dollar, it has already reached the bottom, from which it managed to push off.

In October, the loss of the Australian dollar since the beginning of the year exceeded 10%, and there was no ray of hope. Different vectors of the monetary policies of the Fed and the RBA and the trade wars confidently pulled Ozzy to the area of two-year lows. While the Federal Reserve raised the rate three times in 2018 and is going to bring it to 3.25% by the summer next year, the Reserve Bank has set a course for keeping the cash rate at 1.5% since August 2016. The IMF considers this policy to be correct and notes the increased risks the slowdown of the economy of the Green Continent under the influence of protectionism and the tightening of financial conditions in the United States.

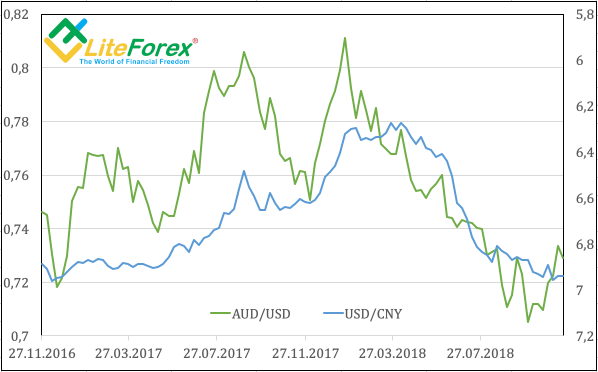

The close dependence of the Australian economy on China and the growing likelihood of China's GDP slowing down due to trade wars lead to an increase in the correlation between the Aussie and the yuan. At the same time, BMO Capital Markets forecasts further growth of the USD/CNY against the background of the first time the 12-month US Treasury bonds overperformed their Chinese counterparts since 2008. Only sales of the greenback against the main world currencies in the second half of November somewhat broke the connection.

Dynamics of the Australian dollar and RMB

Source: Reuters.

In my previous article I noted higher risks of correction of the AUD/USD against the background of investors' optimism about the potential de-escalation of the trade conflict between Washington and Beijing after the meeting between Donald Trump and Xi Jinping. Pessimism has now returned to the market. For the first time in 29 years, the APEC countries could not sign the memorandum due to the phrase “we are against protectionism, including unfair trade practices”. It is doubtful that the presidents in Buenos Aires will quickly come to a consensus.

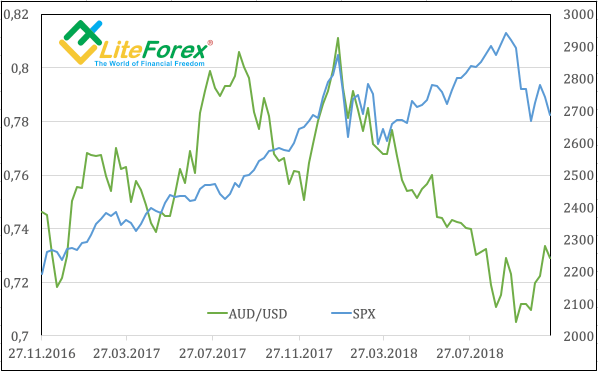

The AUD/USD bulls are irritated by the correction of US stock indices, which indicates a decrease in global risk appetite. For most of the year, the Australian dollar and S&P 500 went in different directions, which should be associated with trade wars, but the Aussie is a profitable currency, its rate usually falls amid sales in the US stock market and vice versa.

Dynamics of the AUD/USD and S&P 500

Source: Reuters.

In my opinion, excessive optimism about the upcoming end of the trade conflict between the United States and China, as well as the overestimated expectations of the RBA's monetary policy normalization start can play a cruel joke with the Australian dollar. The absence of a breakthrough at the G20 summit will be a catalyst for sales of the AUD/USD and AUD/JPY. In this regard, in the current situation it makes sense to use the growth of the pairs for the formation of short positions.