The Aussie found itself under pressure ahead of today’s wage data, thanks to soft consumer growth and Trump’s latest trade-twist. Just 27pips above 69c, it may take more than stronger employment tomorrow for this level to hold.

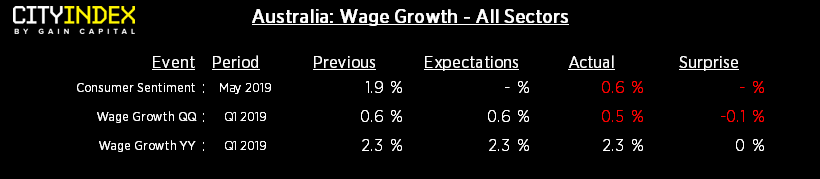

Quarterly wage growth slightly undershot expectations, coming in at 0.5% versus 0.6% expected, whilst the annual rate remained unchanged at 2.3%. Transport, warehousing, education and training saw the highest rises at 0.7% which seven of the sub-indices were a mere 0.2%.

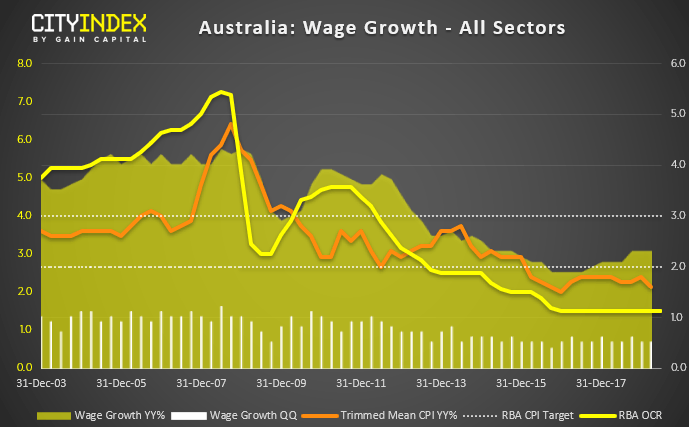

Tomorrow’s employment data will be a core focus for traders. In their May OCR statement, the RBA emphasized they’ll ‘be paying close attention to developments in the labour market at its upcoming meetings’. As it stands, they remain optimistic with employment data which they believe will ‘further lift wage growth over time’ – so any weakness to the labour market should lower expectations for wages, inflation (which is already pointing lower) and therefor see a rising expectation for further easing. The RBA caught bears off guard at their last meeting by holding rates at 1.5%, although this is most likely to be due to their federal election on Sunday. But they’ll be looking to reinitiate positions if employment starts to buckle.

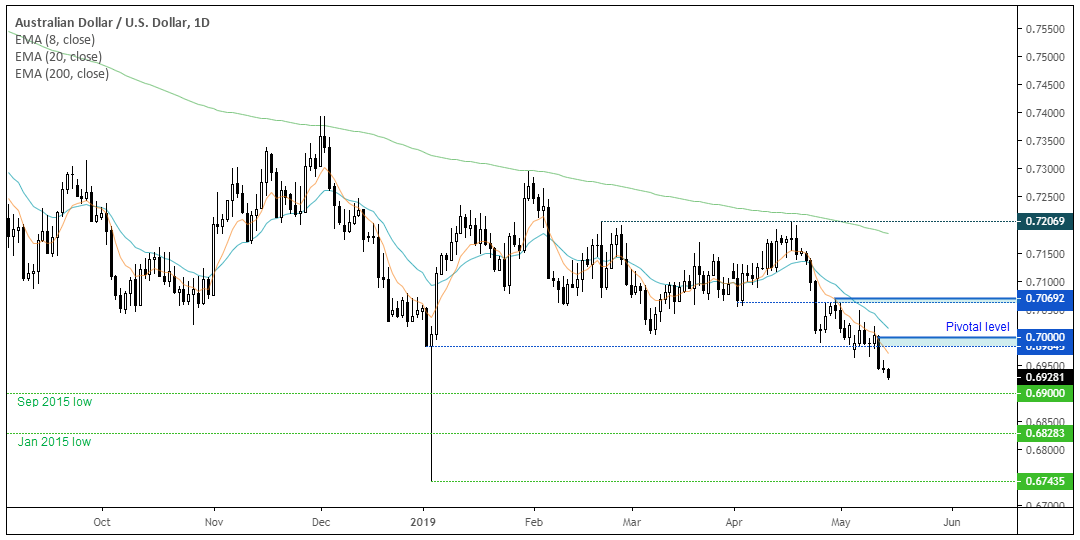

70c remains a key line in the sand for traders. Currently trading at its lowest level since January 2016, AUD is also under pressure from soft consumer sentiment and news of Trump’s forthcoming executive order to ban US companies form using Huawei (SZ:002502) technology. In a move clearly designed to stir up trade tensions, the usual rules applied which saw traders move towards safety (CHF and JPY) and short commodity currencies (AUD, NZD and CAD).

AUD/USD is currently closer to 69c than 70c, but we could see bears fade into any moves below 0.7000 in hope of testing the March 2014 low. It’s difficult to see how a mediocre employment set (hitting consensus) would see AUD/USD explode higher unless trade tensions are to thaw. Although if unemployment were to fall to 4.9% and employment beat expectations, then we can consider a counter-trend rally back to 70c. For now, trade tensions remain a key driver of AUD headwinds so a poor employment set tomorrow could see it break below 69c.