Despite expectation of an RBA cut tomorrow, AUD/USD has broken to a 3-week high thanks to a weaker U.S. dollar

We expected RBA to cut in May. Yet, instead they held off due to the federal election and bears were squeezed at the lows. However, expectations to ease tomorrow remain high with last month’s employment miss, underwhelming employment and strong clues from RBA that they will indeed cut rates.

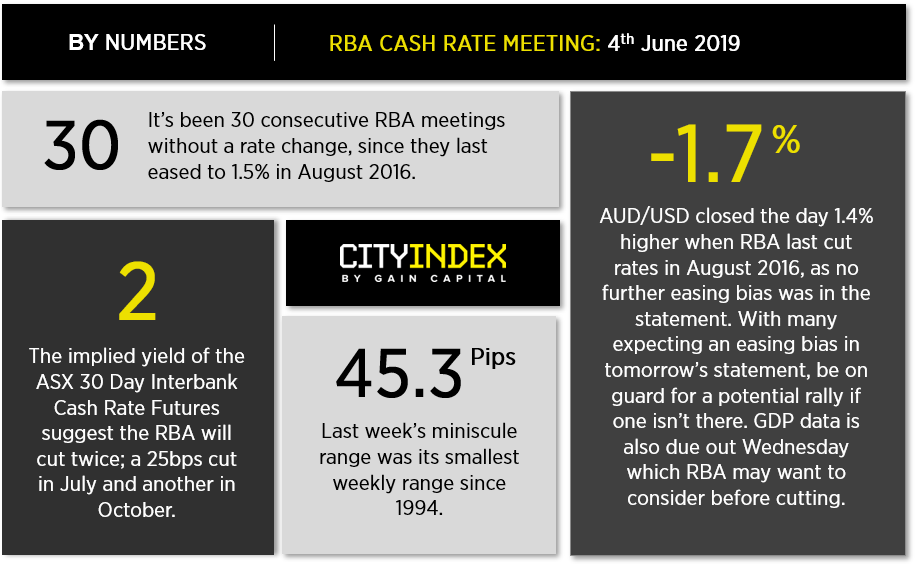

The ASX interbank cash rate future suggest RBA will cut twice this year, although we have seen calls from some economists to expect up to 4 cuts in total. We remain a little more reserved, given RBA have acknowledged that lower rates will have less of an economic impact, but we expect two cuts this year and will reassess as the data as it comes in. The RBA need wages to pick up and employment remain strong to feed into inflation, so any further weakness in these areas could see us revise our expectations and call for further cuts.

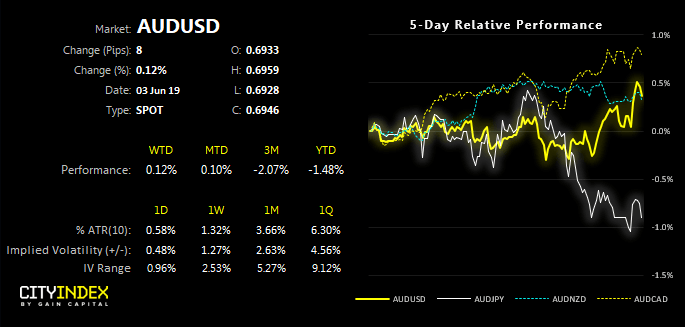

We can see on the daily chart that trend remains bearish, although a broadly weaker USD has allowed AUD to break to a 3-week high. We’ll see if resistance around 0.6963 holds overnight, and this may provide a decent area to fade into ahead of RBA anticipated cut tomorrow. Bears will look to target the 0.6898 and 0.6864 lows.

However, for them to stand any chance of hitting fresh cycle lows, we’d need to see RBA cut with an easing bias (and hint at forthcoming cuts) and for GDP data to miss the mark on Wednesday. Upside risks will arise if tomorrow’s statement includes no easing bias and could be exacerbated if we see a persistently weaker USD this week. And, given AUD/USD rallied 1.4% when RBA last cut without including an easing bias, we could expect a similar reaction if they hold off from being too dovish after their cut tomorrow.