In our last analysis we focused on the NZD/USD. We were not disappointed by the price movement as the NZD/USD went down, which was in line with our expectations. Today we focus on another currency from this region – AUD. Six from the last eight days were bearish here which definitely shows who is the dominant force on the Aussie.

Price went from seven months highs to five months lows just in few days. We had two dominant factors here. First, one was was obviously fundamental, with the odds for an interest rate hike in US close to 100%, which was caused mostly by Donald Trump being elected as a President. Odds for a rate hike spiked, which increased appetite for the USD.

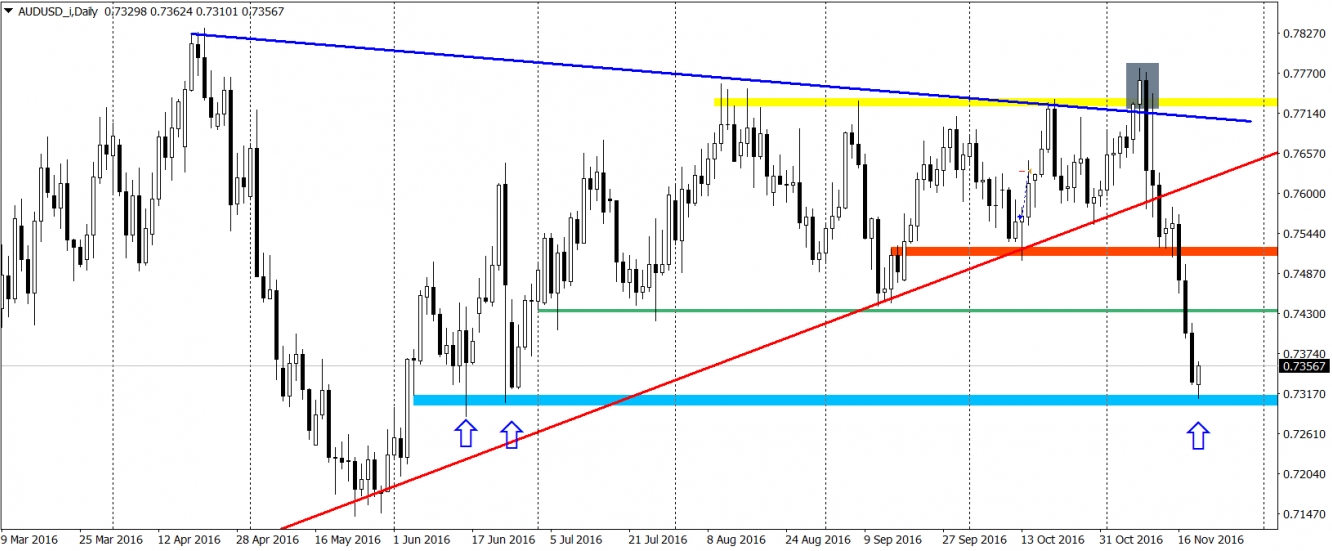

The second one was technical with the false breakout (gray) as main cause of the bearish reversal. After that, the price broke many important horizontal supports along with the bullish long-term trendline (red). Whole drop had over 450 pips.

New week started with a small correction here, which started on 0.7310. This level is not a coincidence as it was already a support in the second half of June. It is also a 50% retracement of the whole 2016 uptrend. This creates an opportunity for a short term bullish upswing but in our view, the long-term sentiment remains bearish and forthcoming upswings can be used for opening new short positions with better prices.