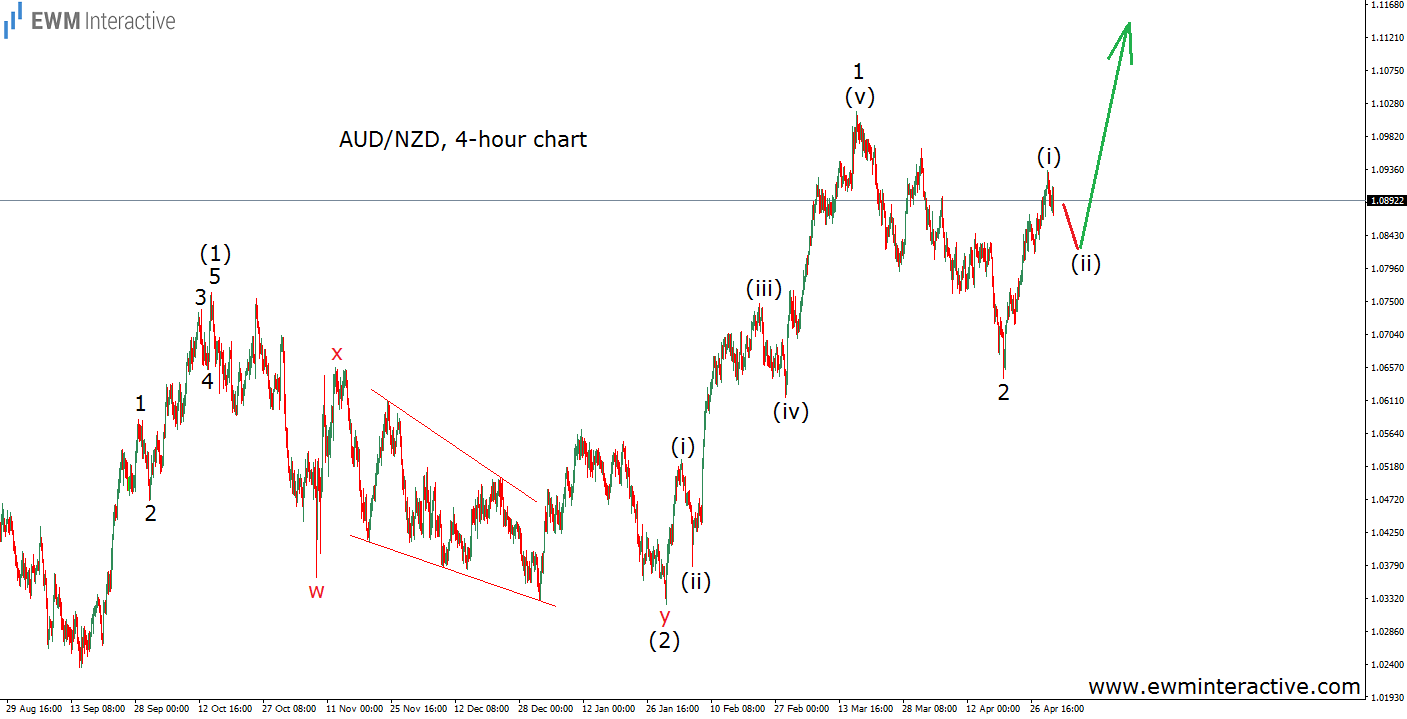

Nearly a month ago, on April 6, the AUD/NZD exchange rate was trading close to 1.0820, after falling from as high as 1.1018. But instead of buying the dip right away, in an article called “AUD/NZD Navigating Through Elliott Waves”, we suggested traders would be better off waiting for the pair to improve the risk/reward ratio of the long trade by declining to the support area of wave (iv) of 1, as shown below.

As visible, the rally from 1.0324 to 1.1018 was a five-wave impulse with an extended wave (v). According to the Elliott Wave Principle, extended fifth waves are usually retraced completely by the following three-wave correction. That is why we thought AUD/NZD was not done falling and more weakness could be expected before the uptrend resumes. Almost a month after that analysis the Australian dollar is trading around 1.0890 against the New Zealand counterpart. Without looking at a chart, you might think almost nothing has happened during that time, so let’s see one.

As expected, the bears were not ready to give up yet. They applied more pressure until AUD/NZD plunged to 1.0642, retracing the entire wave (v). However, the trend was supposed to resume in the direction of the five-wave impulsive sequence, which is the Elliott Wave explanation for the pair’s quick recovery to 1.0934 as of May 1st. Now we want to take a closer look at this rally’s wave structure.

The bulls’ efforts produced a nicely-looking impulsive rally from 1.0642 to 1.0934. This means two things. First, the buyers are still in the driving seat. And second, that once again, a pullback to the support area of the fourth wave – iv – should be anticipated. Even if it extends further to the downside, the outlook remains positive, as long as the starting point of the pattern – 1.0642 – is intact, because wave (ii) cannot retrace the entire wave (i).

If this analysis is correct, the powerful phase of the bull run – wave (iii) of 3 of (3) – might be just around the corner. According to our big picture outlook, long-term targets near 1.1600 remain plausible.