Key Highlights

· Aussie dollar managed to recover against the Japanese yen, but facing a major resistance on the upside.

· The AUD/JPY pair is currently forming a breakout structure on the 4-hours chart, which may spark the next move in the near term.

· Australian trade balance released by the Australian Bureau of Statistics posted a trade deficit of 2.218B in May 2016, compared with the forecast of -1,500M.

· Later today, the RBA Interest Rate Decision will be announced by the Reserve Bank of Australia, which may ignite volatility in AUD/USD and AUD/JPY.

AUDJPY Technical Analysis

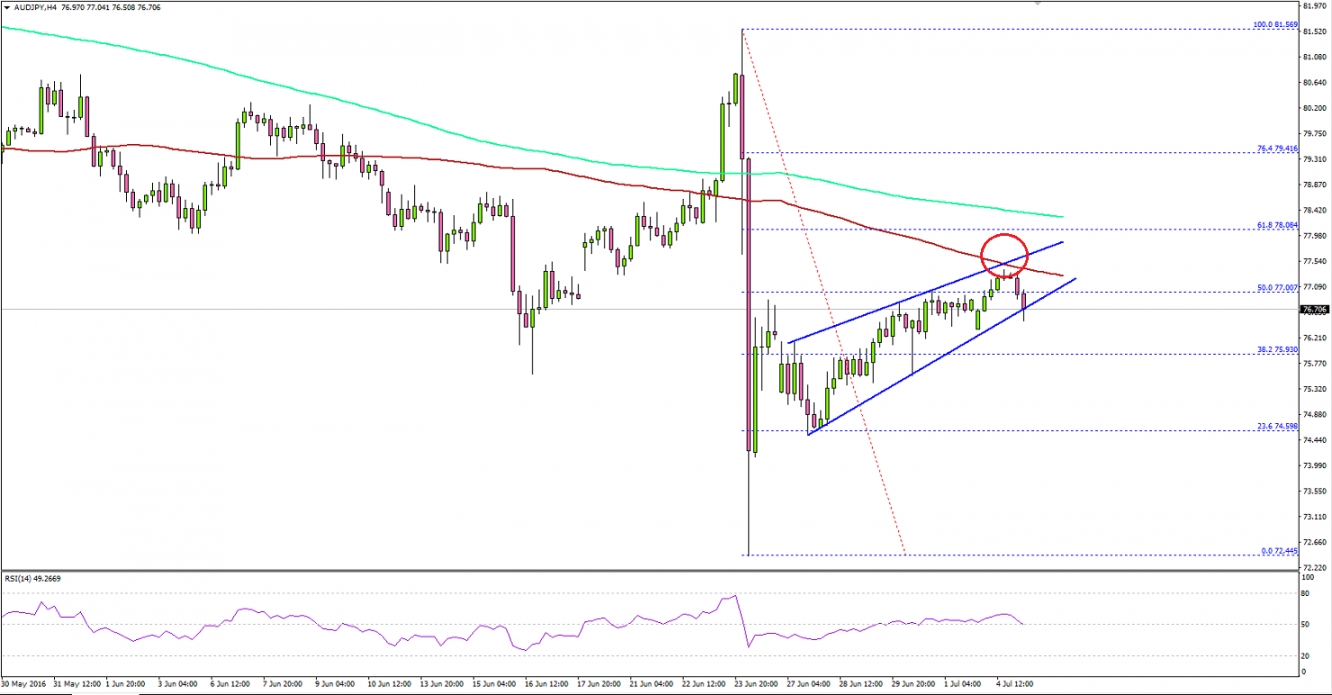

The Aussie dollar after tumbling below the 75.00 support area against the Japanese yen managed to recover. The AUD/JPY pair is currently trading above the stated level, which is a positive sign.

However, the pair is yet to break the 100 simple moving averages (H4 chart), which is a critical resistance for the Aussie dollar buyers.

There is a contracting triangle pattern formed on the 4-hours chart of the AUD/JPY pair, which might provide us the next break moving ahead. The pair is attempting a break below the support area, and if the bears success it may increase bearish pressure on AUD/JPY in the near term.