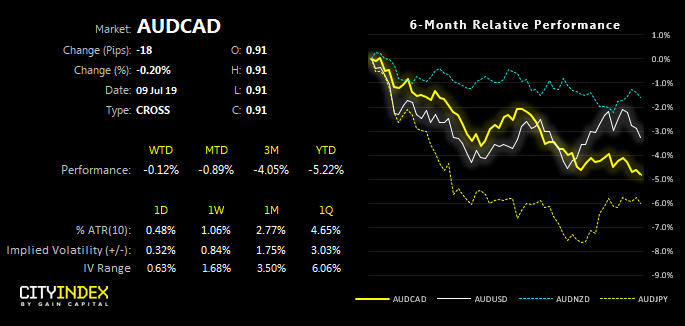

The Canadian dollar has continued to gain traction and remains the strongest performing major this month, putting AUD/CAD on the back ropes just above the 2018 lows.

The Canadian dollar has continued to gain traction and remains the strongest performing major this month. EUR/CAD posted a weekly close beneath its 2015 trendline last week and, whilst here’s risk of a minor rebound the structure remains predominantly bearish after breaking out of a multi-week compression pattern. However, the Loonie’s next potential victim appears to be the Australian dollar, with AUD/CAD on the verge of breaking key support.

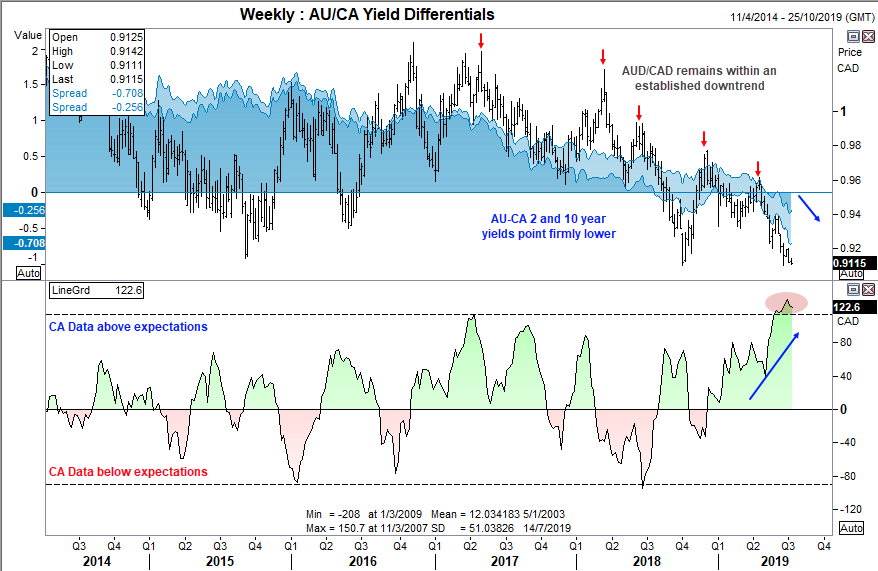

Starting with the bigger picture, there are several forces which are weighing on AUD/CAD.

- Yield differentials: RBA have cut rates to 1% versus BoC’s 1.75%. Moreover, further cuts from RBA are expected whilst BoC remains neutral.

- This is seeing the AU-CA 2 and 10-year differentials point decisively lower, dragging the cross down with them.

- Canada’s economic data is on a tear whilst, overall, Australia’s data continues to underwhelm. We can see on the CESI chart (Citi Economic Surprise Index) that Canada’s data is beating expectations by a wide margin. That said, the CAD CESI is over +2 standard deviations from its long-term average so potentially at risk of a reversing but, for now, continues to outperform the consensus one the less.

- Large speculators have switched to net-long on CAD futures and remain overwhelmingly short on AUD futures.

Technically, AUD/CAD sits at a critical juncture, just above the 2018 low.

- The daily structure is clearly bearish, and the prior two corrections having respected 50% and 38.2% retracement levels respectively. The 20-day eMA is also capping as resistance.

- A break below 0.9100 appears likely at this stage, although we remain bearish below 0.9207.

- Next major support levels are not until the July and June 2010 lows at 08873 and 0.8584 respectively. So we’d seek to trail a stop with an open target towards these.

Keep in mind the BoC meeting is tomorrow which leaves CAD crosses prone to bouts of volatility. However, whilst BoC are expected to hold, we’d expect a slightly hawkish statement if they veer away from neutral, given the pick-up with inflation and data in general. If so, this should provide another pillar of strength for the Canadian dollar.