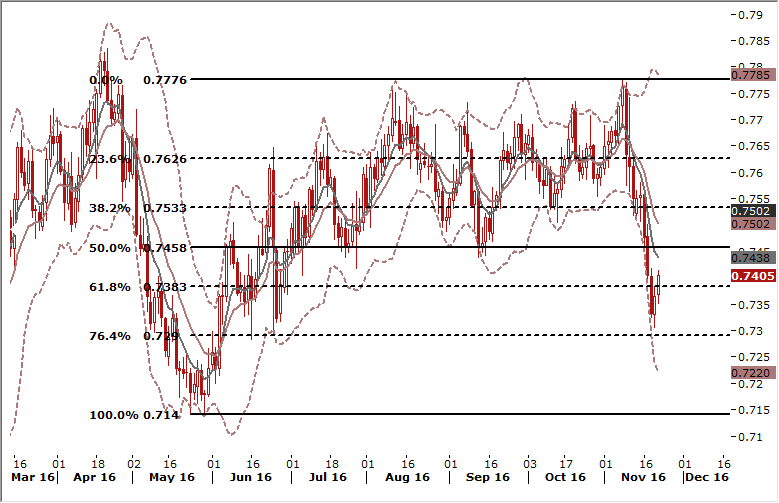

AUD/USD Recovers On Higher Commodities Prices

- The Australian dollar edged higher on Tuesday as its U.S. counterpart consolidated after its recent rapid ascent, while gains in key commodity prices offered some fundamental support. Aiding the Aussie were gains in copper, coal and iron ore prices, all major export earners for Australia. Coal, in particular, has enjoyed huge gains in the last few months and promises to sharply shrink the country's monthly trade deficit, if not eliminate it.

- Reserve Bank of Australia Assistant Governor Christopher Kent said headwinds that were holding back Western Australia and Queensland were set to abate. In his opinion there are reasonable prospects for stronger growth of nominal demand in the mining states and, by extension, for the economy overall.

- The upbeat comments were the latest sign the central bank is likely done easing policy for now, following cuts in August and May that took interest rates to a record low of 1.5%.

- Fed vice chairman Stanley Fischer said the central bank, in deciding policy, will consider the rise in the dollar since the U.S. election but it will not stop the Fed from "doing what we should do" based on the economy's goals.

- Our medium-term AUD/USD outlook remains positive. The second white candlestick in a row suggests the AUD/USD may recover to at least 0.7560. We opened long position today, at current market price (0.7400) with the target at 0.7560. The stop-loss is 0.7320.

- We also keep our bullish AUD/JPY position with the near-term target at 83.10.

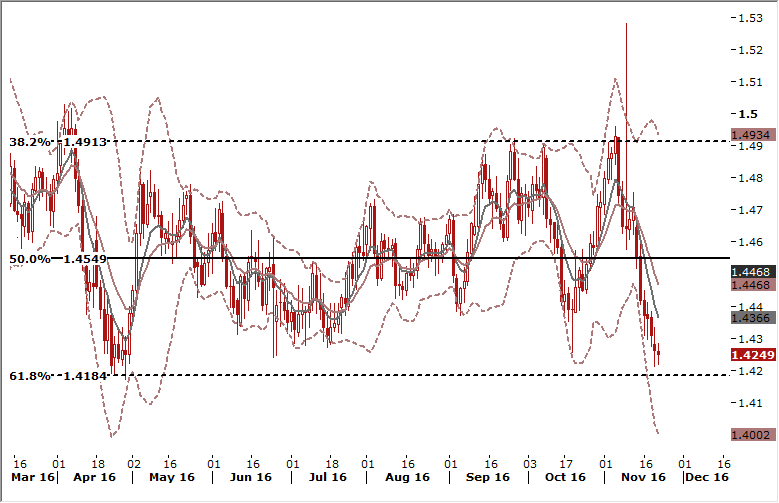

EUR/CAD: Looking To Get Short Again On Upticks

- The CAD gained against its U.S. counterpart as a rally in oil eclipsed weaker-than-expected domestic wholesale trade data. Oil prices jumped to their highest in three weeks on Monday, catching a lift from a weaker U.S. dollar and as OPEC appeared closer to agreeing on an output cut when it meets next week.

- The value of Canadian wholesale trade unexpectedly fell by 1.2% in September from August, Statistics Canada data showed. The market had predicted a 0.4% gain. Canada's retail sales report for September is due today and we expect a rebound from a decline in August, in a possible sign that consumers have begun to spend their new child benefit payments from the government.

- Our EUR/CAD trading strategy is to get short on upticks. We have placed a sell order at 1.4500.