Yesterday’s broad US dollar strength was ignored by the the Aussie dollar, as it bounced off lows.

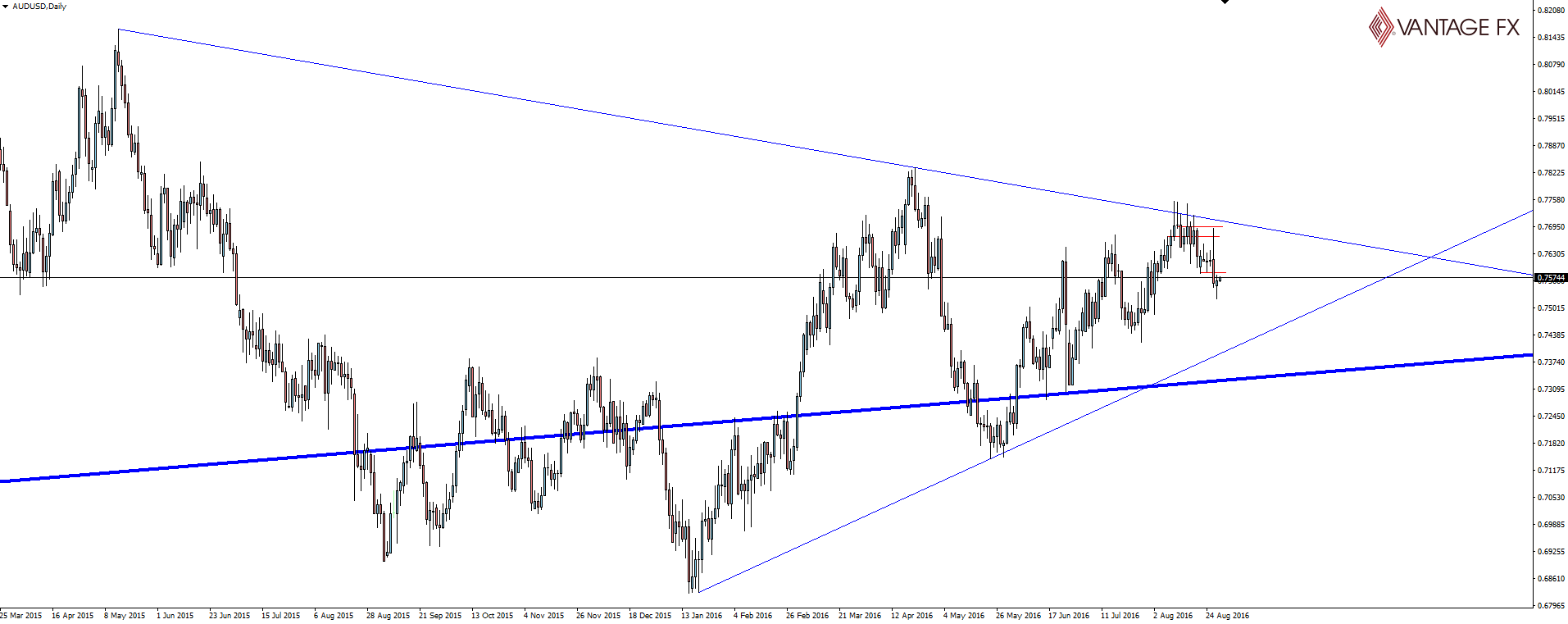

Price action like this can be put down to intraday technicals, not having broken any major levels along the way and most importantly still respecting the higher time frame resistance level we have been following on the daily chart.

AUD/USD Daily:

My longer term bias has been to play for a breakout as the thick blue line is weekly support, but this little bout of Yellen inspired excitement means we might have to wait a little longer yet.

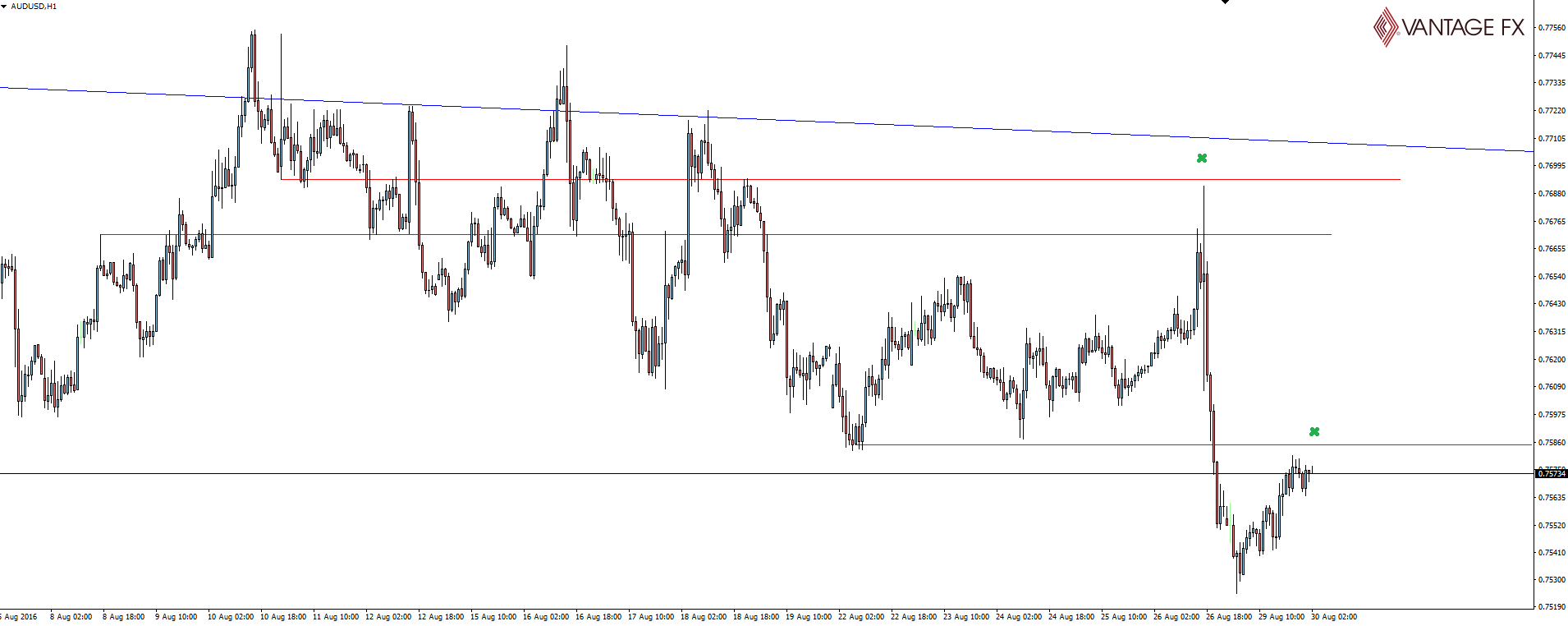

I wanted to include this AUD/USD hourly chart just to highlight the intraday price action. Retail traders often love to blame ‘broker stop hunting’ when they get taken out of a trade, but any of you who were short should have cleaned up.

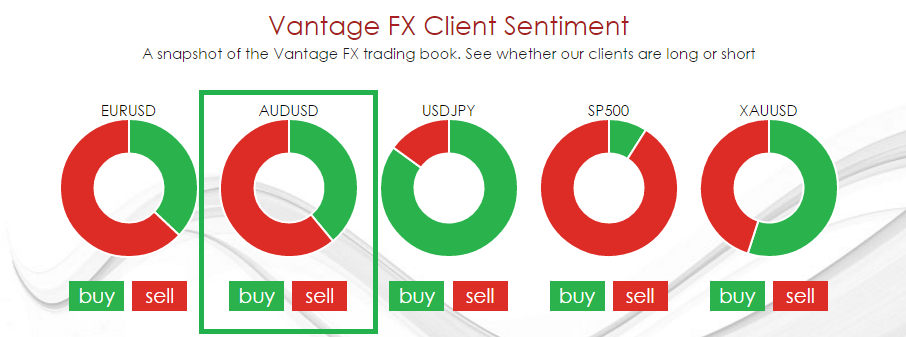

Looking at the Vantage FX client sentiment sliders on our homepage and currently that’s 61% of our book. Nice!

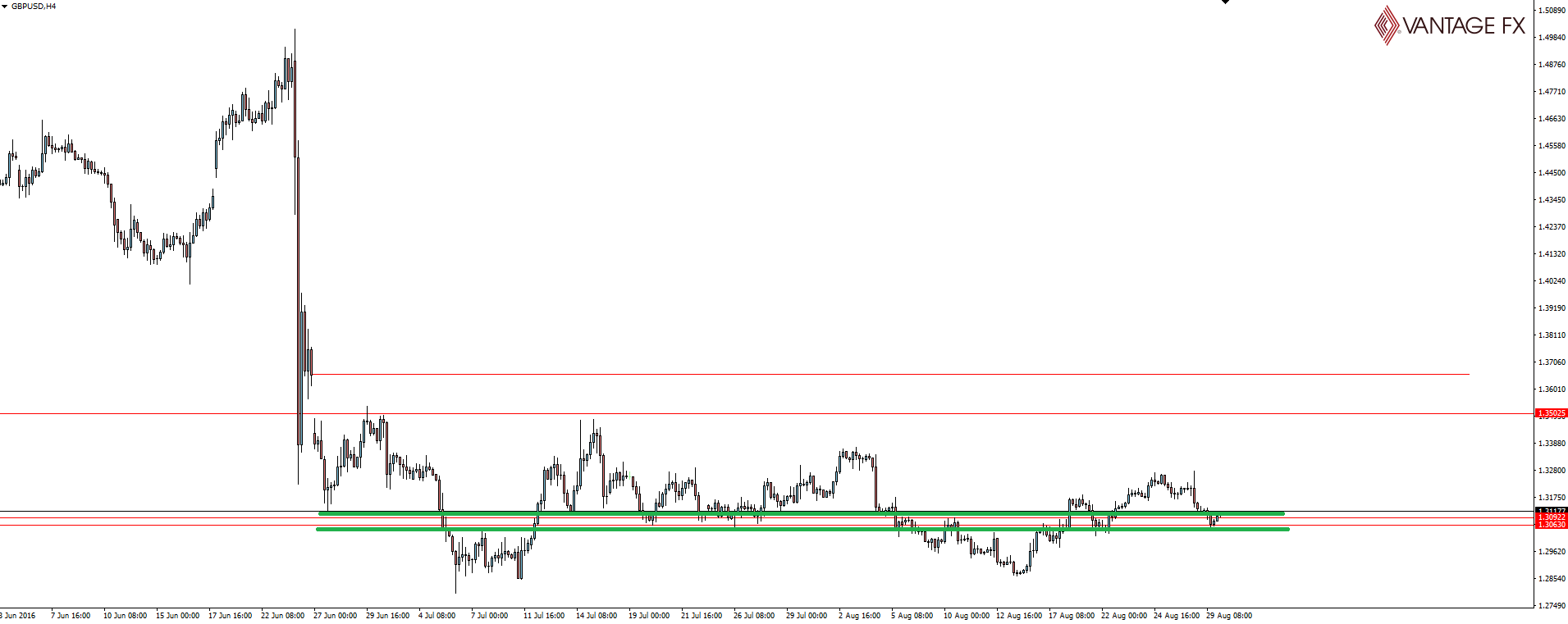

Continuing to tick through the majors and this {{0|GBP/USD}} level just won’t go away.

GBP/USD 4 Hourly:

There isn’t any point in including a higher time frame cable chart, because of the Brexit drop to new lows. We’re trading in the era of ‘AB’ now. This is the new dawn.

Finally, I just wanted to include that Fed interest rate futures are only pricing in a 36% chance of a September rate hike, and following it up with a 61% chance in December. Friday’s NFP is going to be HUGE!

On the Calendar Tuesday

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, forex news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and FX broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.