Followers of the Vantage FX blog know the narrative style we like to follow, following the story of financial markets as they unfold from day to day. A story that has led us to an expansive valley between the Teton Mountain Range and the Gros Ventre Range in Wyoming, USA.

The Jackson Hole economic policy symposium, or as one of our local Australian news presenters eloquently put it, “summer camp for nerds”, certainly dominated the narrative this last week. After a spluttering start to the week full of rumours and innuendos, Janet Yellen delivered in her late Friday night speech, signalling the possibility of TWO rate hikes before the time ball in NYC is dropped on 2016.

For Vantage FX traders, the most important part of following the narrative, is to put themselves in a position to benefit from a market re-pricing when expectations aren’t met. Something that all last week we were looking for across the Forex majors:

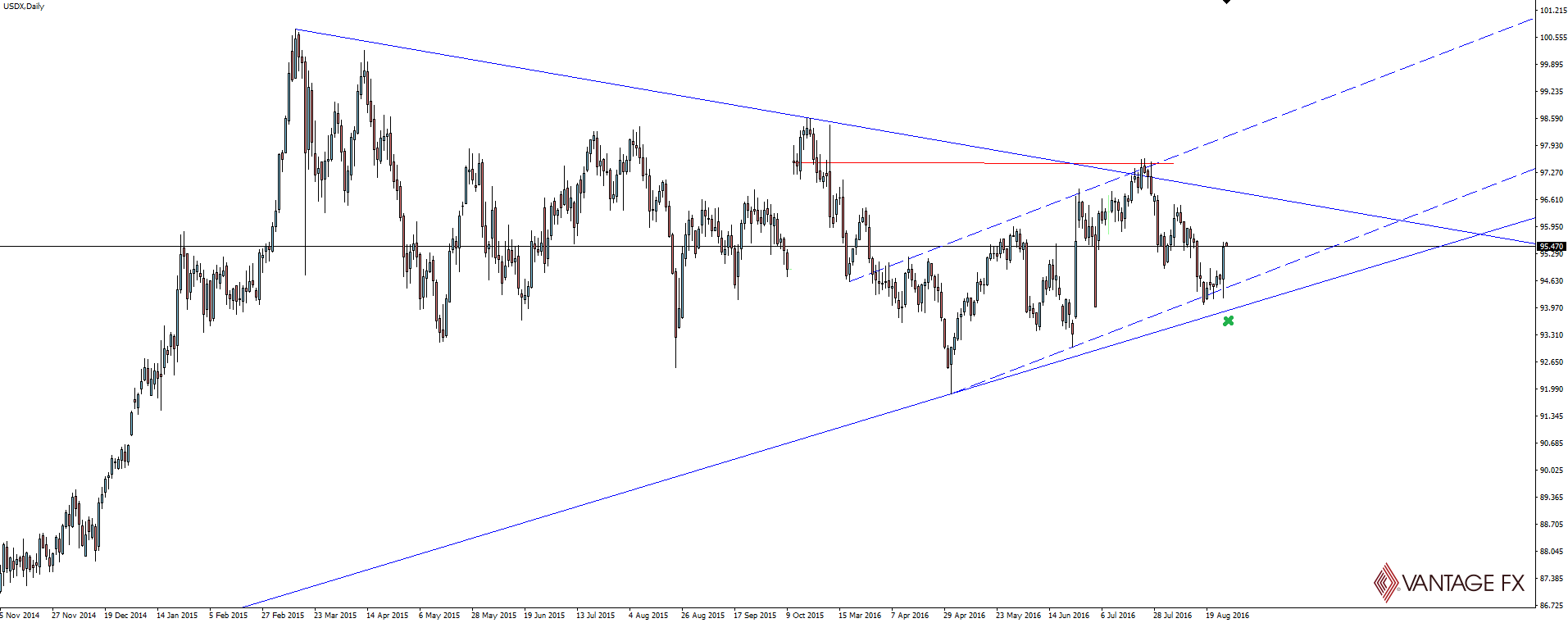

“With the US Dollar Index still sitting at higher time frame support, I still see the greater risk reward and ability to take advantage of the chance of a market re-pricing coming by playing USD from the long side.”

Heading into a major decision, it really doesn’t matter if markets are right or wrong. The way you make money is by going with the herd and following the money. However, this all changes when reality hits after decisions, data releases, or in this case major speeches and it’s clear that things have been overcompensated for.

Over and over we see technicals and fundamentals align. It’s the personality of markets that see them try to predict the future and just like in your personal relationships, Jackson Hole’s effect on the US Dollar was a clear example of how forex traders can take advantage of getting to know the personality. (Wow, that sounds more manipulative than it actually was!)

With USDX at support from a technical perspective and the largest shock being if the Fed was to hit the market with a hawkish tone, there was opportunity for a large jolt to the upside as the market would be forced to re-price.

With Janet Yellen and her fellow FOMC members signalling the possibility of two rate hikes in 2016, that’s exactly what we got.

“In light of the continued solid performance of the labour market and our outlook for economic activity and inflation, I believe the case for an increase in the federal funds rate has strengthened in recent months.”

Now you may be wondering why I went with a shady looking clown as the featured image at the top of the post? Because now markets are starting to price in the possibility of two hikes in 2016, the fun of expectations starts all over again!

I’ll let you think about where we go from here. Enjoy the week!

On the Calendar Monday:

GBP Bank Holiday: Summer Bank Holiday

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, forex news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and FX broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.