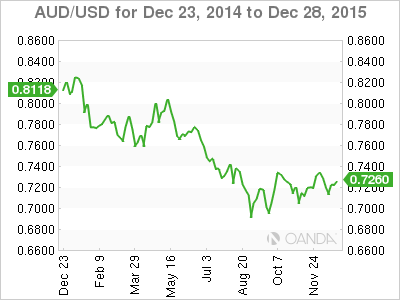

The year 2015 has not been a good one for the Australian dollar. The currency dropped to 6-year lows in September, and as of the first week in December, AUD/USD has plunged almost 12 percent. As we wrap up 2015 and welcome in a new year, let’s examine the major trends that will likely have an impact on the Australian dollar over the course of 2016. Before we look at trends and expectations for 2016, we provide a brief review of the movement of the Australian dollar over the course of 2015:

AUD/USD in 2015

Open: 0.8169 (January 1)

High: 0.8295 (January 15)

Low: 0.6899 (September 4)

Close: 0.7200 (December 8)

The Australian dollar opened 2015 at 0.8169 and hit the yearly high of 0.8295 shortly afterwards. However, the Aussie proceeded to drop sharply in the month of January, losing over 400 points. AUD/USD traded most of the first half of the year between 0.77-0.79. In July, the Aussie slipped another 300 points, dropping below the 0.73 level. AUD/USD touched a low of 0.6899 in September, marking its lowest level since April 2009. The pair has and has since rebounded and is currently trading at the 0.72 level.

Expectations for 2016

China

China is the world’s second biggest economy and Australia’s largest trading partner. In 2014, Australia exported some 34% its total exports to China, including iron ore, coal, oil and gold. Australian exports to China have more than doubled in value since 2011 and have climbed over the A$100 billion mark. Australia and China value their trade relationship to the point that the two countries signed a free-trade agreement in June 2015, although the pact must be ratified by both countries before entering into force. Given this context, it is not surprising that weaker economic growth in China this year has hurt the Australian economy. Chinese GDP slowed in the third quarter of 2015 to 6.9%, marking a six-year low. The manufacturing and construction sectors have also declined, resulting in a decreased demand for Australian raw materials. A decrease in Chinese growth took its toll on the Australian dollar, which suffered sharp drops against its US counterpart in 2015. Will the Chinese economy rebound in 2016? If the Chinese slowdown doesn’t improve, it will continue to weigh on the Australian economy and likely send the Aussie to lower levels.

Global Growth

As a resource-based economy, Australia is heavily dependent on its export sector. This means that the Australian economy is sensitive to the ebbs and flows of Australia’s trading partners across the globe. The outlook for global growth is not a bright one, as one economic forecaster, Oxford Economics, cuts its forecast for global economic growth in 2015 from 2.6 percent to 2.5 percent, and for 2016 from 3 percent to 2.7 percent. Any further downgrades in projections to global growth rates for 2016 could make the Australian dollar less attractive.

Reserve Bank of Australia

Interest rates play a key role in the value of the Australian dollar, as investors are always on the prowl for the “biggest bang for their buck”, i.e. the highest interest rates available for their assets. The RBA has not shied away from cutting rates in order to kick-start the economy, and cut rates twice in 2015. These cuts pushed the Australian dollar to lower levels. Currently, the benchmark rate stands at an even 2.00%, which is considered ultra-low by Australian standards (by way of comparison, in early 2012, the benchmark rate stood at 4.25%). However, compared to North America or Europe, these are high rates and make the Australian dollar more attractive. Given that the Australian dollar is a minor and risky currency, higher rates are needed to entice investors who otherwise might seek the safety of currencies like the US dollar. What does the RBA have planned for 2016? Recent RBA rate statements indicate that the low inflation remains a concern, and the central bank is prepared to further reduce rates if the inflation picture deteriorates. This means that there is a reasonable likelihood of another rate cut early in 2016 if the economy weakens and inflation levels drop. Further cuts in interest rates would likely push the Australian dollar to lower levels.

Commodity Prices

Australia’s key export sector is heavily dependent on commodities. Australia is the world’s second largest gold producer, the number two iron ore producer, and the world fourth largest coal producer. The year 2015 has seen a sharp drop in commodity prices. For example, gold prices have dropped by 9 percent while iron ore plunged some 30 percent. These sharp declines have cut into foreign earnings and reduced economic growth. Decreased exports has directly impacted on the Australian currency, since less demand for Australian raw materials means foreigners need to purchase fewer Australian dollars. Will we see any improvement in 2016? Exporters will not like the answer, because there does not seem to be an end in sight for falling commodity prices. Analysts expect the global slowdown to continue into 2016, and this means that supply will continue to far outstrip demand, resulting in depressed commodity prices, which is bad for the Australian dollar.

Technical Analysis

The Aussie has been in strong decline against the greenback for a few years now and only recently has it shown signs of that easing, or even gains being made. The pair traded in a descending channel since April last year, which it finally broke above in the middle of November. This would typically be quite a bullish signal and indicate the end of the downtrend, but I’m yet to be convinced as the pair has really struggled to gather much upside support since. That said, an ascending triangle appears to be forming which is also a bullish signal and a break above this could propel the pair higher, with 0.80-0.83 being the next major zone. Until I see this, I will find it difficult to become too bullish on the pair, while a break below September’s lows of 0.6908 would suggest more lows are to come, albeit possibly at a slower pace than previously. Under this scenario, the pair could grind back towards 0.60, last hit in October 2008.