We spoke yesterday about it being a quiet start to the week in terms of event risk, and with the theme continuing today, it would be wise to keep things brief and continue to focus on the technicals.

The high yielding currencies of AUD and NZD continue to outperform so this is where our attention has been drawn. We spoke yesterday about the technical nature of NZD/USD, and offered some levels to look to enter long off of.

Focusing on the low risk setup of identifying a higher time frame level of support for the trade then zooming into the lower time frames for an entry once the trade is confirmed, has been working a treat for us lately. Definitely a simple approach to technical analysis that you can incorporate into your own trading style.

Now, with kiwi longs continuing to put along nicely, attention turns to the other of the southern brothers, the Aussie.

RBA Governor Glenn Stevens speaks early during the Asian session at the Anika Foundation Luncheon in Sydney, and while not quite a traditional medium for Stevens to express anything too revolutionary when it comes to monetary policy direction from the central bank, the timing of the speech immediately following last week’s interest rate cut gives a chance for some further policy clarification. And of course Forex market direction.

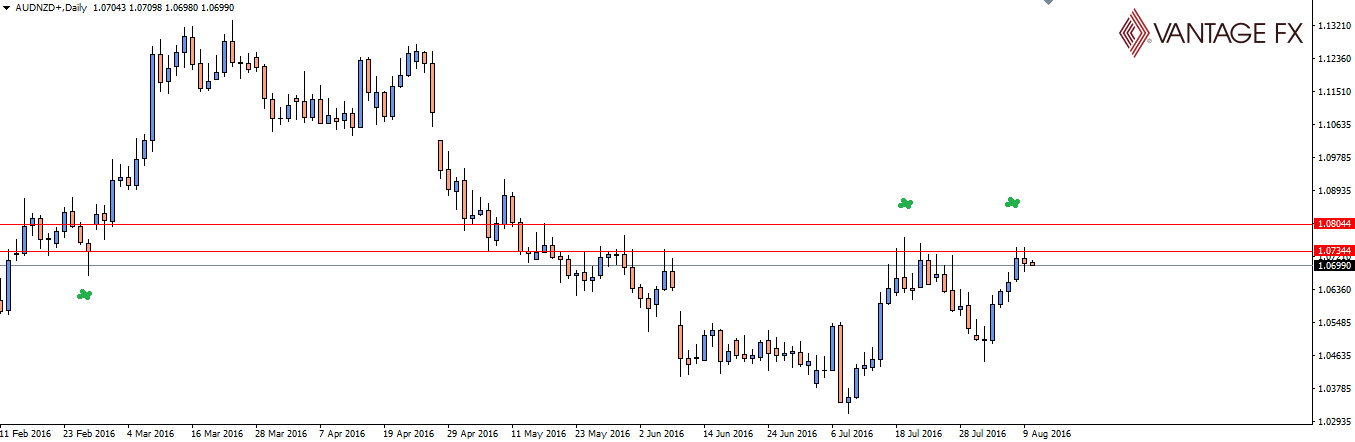

Today’s chart of the day encompasses both currencies in focus, taking a look at the AUD/NZD currency cross:

AUD/NZD Daily:

With both currencies strong, it’s interesting to see that the Aussie seems to be winning the battle over here, having its tracks halted at this nice confluence of resistance.

As you can see marked on the chart above, we see the key February gap levels which have been reactivated multiple times as price has continued to move above and below the level.

Being below it right now and forming some sort of a double top into the level has given us a clear level to manage our risk around.

Are you going with, or fading AUD/NZD around this level?

On the Calendar Wednesday:

AUD RBA Gov Stevens Speaks

USD Crude Oil Inventories

Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and FX broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.