Monday morning and welcome back to your trading screens!

We have another packed week of data to give Forex markets the kick they need, but a relatively slow Asian session means we get a chance to focus on some key technical levels that we’re sitting at across our MT4 charts.

AUD/JPY Daily:

As you can see on the AUD/JPY daily, it is a nice, higher time frame trending pair that respects major support/resistance levels. As a technical trader, there’s not much more you can ask for in a currency pair you’re looking to trade.

Price has been trending steadily downward inside a bearish channel and has been using the roughly 150 pip horizontal zone, marked on the chart above, as the stepping block to move down the trend line.

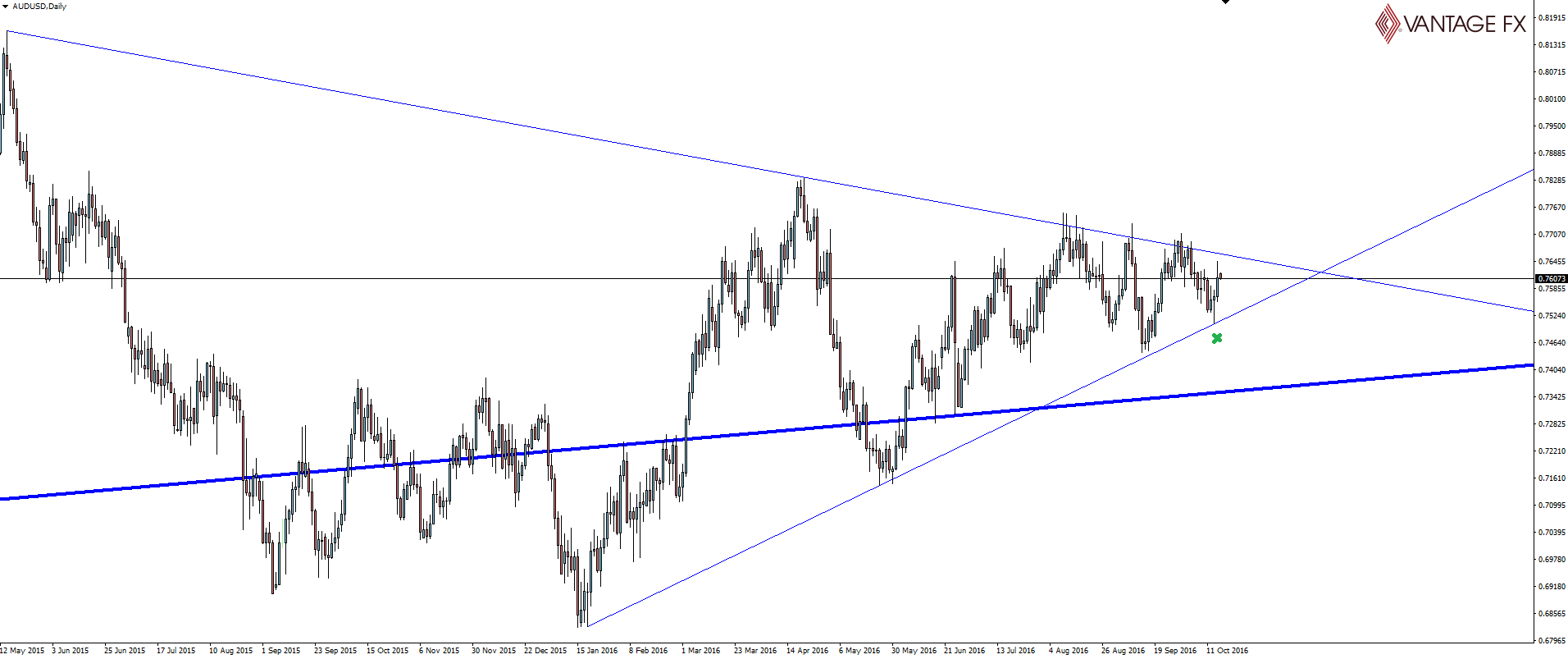

Even with USDX ripping faces off, rallying higher out of the giant flag pattern that you can see on the chart below, the Aussie dollar has actually still put in a week of gains. AUD/USD has bounced off trend line support (to the pip just quietly), while strength in commodities and the consensus finally sinking into markets that the RBA no longer has to be as dovish as they once were.

Some nice textbook, trending market patterns in those two charts. If you ever wonder why people say ‘the trend is your friend’, then this sort of price action is what they’re referring to.

Price respecting higher time frame trend line support, flagging as it pulls back to the level and finds buyers once again.

Have a great week!

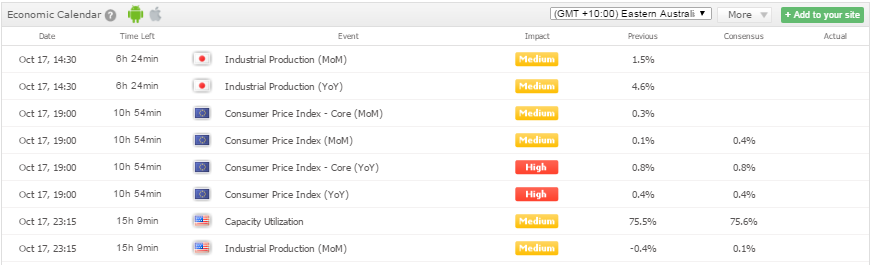

On the Calendar Monday:

Pretty quiet calendar to start the week here in Asia, with the EUR CPIs probably only second tier. I’m not expecting too much short term impact in terms of data release volatility during any of today’s trading sessions.

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, forex news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and FX broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.