11.30 am Sydney time sees the release of two hugely important data releases out of Australia:

AUD Employment Change: 15.2K expected.

AUD Unemployment Rate: 5.7% expected.

The employment change number shows the change in the number of employed people during August, while the unemployment rate shows the percentage of the total work force that is unemployed and actively seeking employment during August.

This excerpt is from NAB, who are expecting a 22K employment change print and a steady unemployment rate:

There’s no obvious risk tilt from sample rotation issues but there is likely to be some further flow on from workers hired to complete the Census (as was the case for July). A 22K print for employment is a little stronger than required to keep the unemployment rate steady; our pick is for the unemployment rate to remain steady at 5.7 per cent.

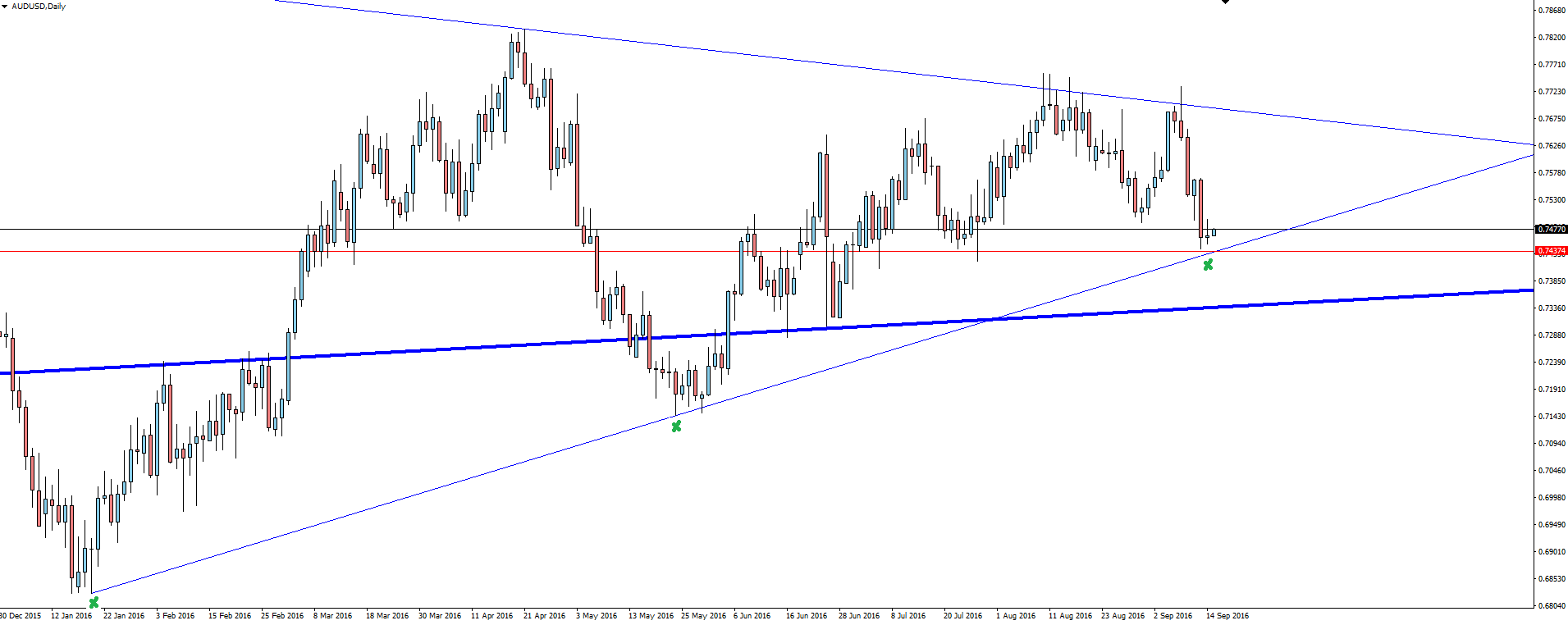

AUD/USD Daily:

Taking a look at the daily AUD/USD chart, we can see that price is coiling up inside this triangle pattern and has quickly found itself back at support after a week or so of falls.

At higher time frame support, the technicals are backing up the above call for a slightly better than expected data print and would most likely see the Aussie Dollar rally if this came to fruition.

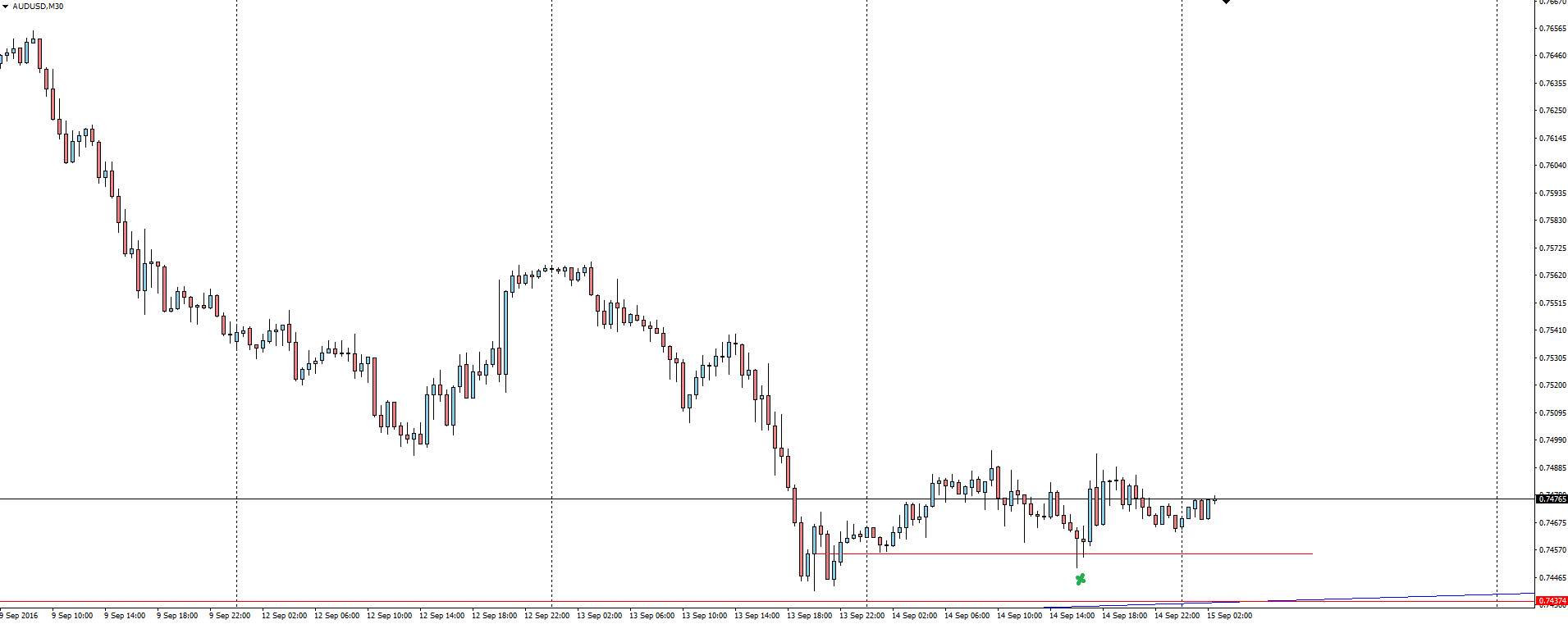

AUD/USD 30 Minute:

The intraday Aussie chart shows after having bounced off higher time frame support, price came back to re-test where price was first halted. If you’re the type of day trader that likes to wait for confirmation on support/resistance levels holding, then this could be your ticket for taking longs.

Something else to keep in mind heading into this morning’s Australian employment data, is the issue of trust surrounding the release. You can see my thoughts on why it doesn't even matter to traders, in that blog post from back in January.

Keep an eye on out as we take a look at GBP/USD in further detail heading into tonight’s Bank of England decision.

On the Calendar Thursday:

CNY Bank Holiday: Chinese banks will be closed in observance of the Mid-Autumn Festival;

NZD GDP q/q

AUD Employment Change

AUD Unemployment Rate

CHF Libor Rate

CHF SNB Monetary Policy Assessment

GBP Retail Sales m/m

GBP MPC Official Bank Rate Votes

GBP Monetary Policy Summary

GBP Official Bank Rate

USD Core Retail Sales m/m

USD PPI m/m

USD Philly Fed Manufacturing Index

USD Retail Sales m/m

USD Unemployment Claims

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, forex news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and FX broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.