Australian Employment Data: Why it Can’t be Trusted & Why it Doesn’t Matter:

Here we are again on the morning of one of the most highly anticipated data releases on the Australian economic calendar, employment data day!

“AUD Employment Change: -11.0K expected, 71.4K previously.”

“AUD Unemployment Rate 5.9% expected, 5.8% previously.”

It’s just too bad that the actual headline numbers have basically become the laughing stock of the trading community with nobody… and I mean nobody, trusting what the ABS releases. I like to use the ‘random number generator spin’ joke when the Chinese government releases their data from time to time, but really should be looking closer to home for this one.

A day after the laughing stock that was December’s number (+71.4K v the -10.0K expected), I tried to answer why the Australian employment data can’t be correct:

“1/8th of the 26,000 households surveyed each month by the Bureau of Statistics must be rotated from time to time. It is the fact that the newly surveyed households are sometimes very different to the old ones surveyed which is being blamed for the occasional jumpy nature of Australian unemployment data.”

And once again I’ll repeat that the fact the numbers are right or wrong, doesn’t actually matter to us as Forex traders. The only thing that matters is price and the perception of where traders think price should be. Just remember that if you’re trading around an obviously insane number.

———-

Chart of the Day:

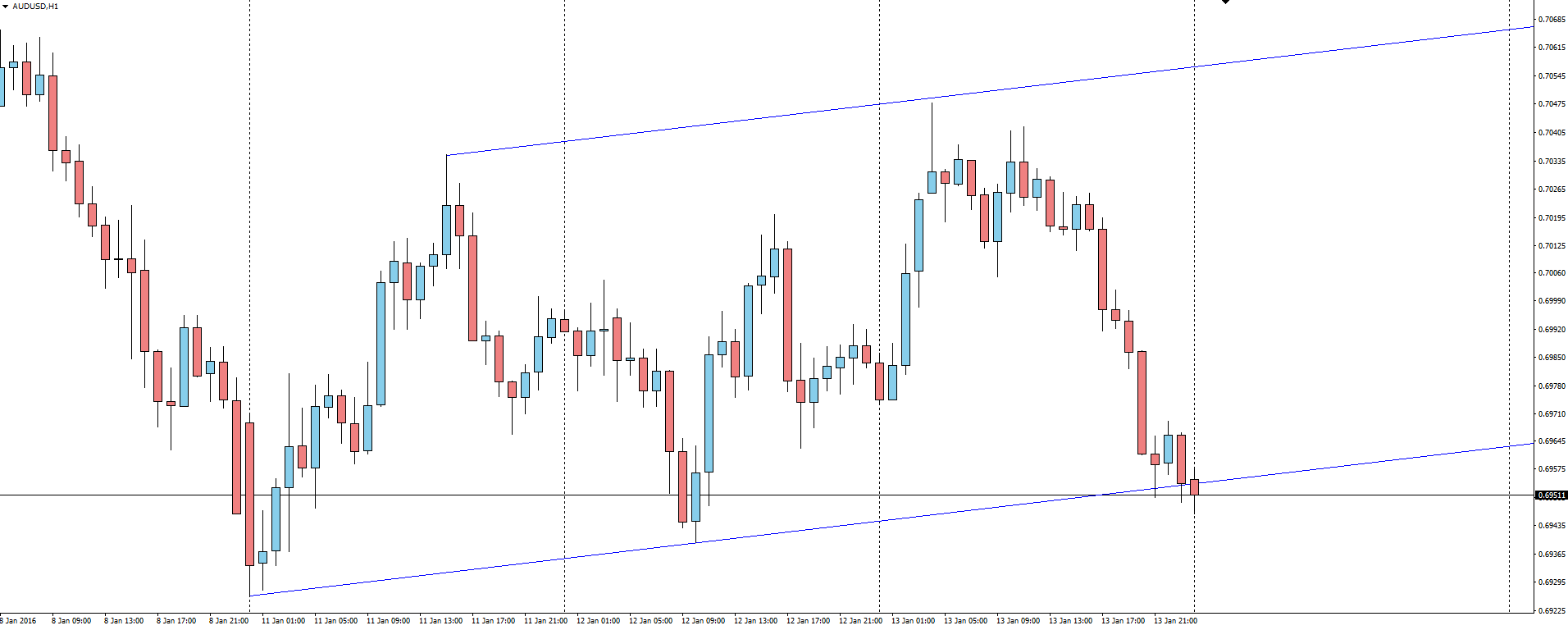

Leading into the Aussie employment data, we have to take a look at the AUD/USD chart. Just keep in mind the big picture with our old friend the weekly trend line support is still in play.

AUD/USD Hourly:

Click on chart to see a larger view.

But it’s the hourly that I wanted to focus on today, with price forming a short term bullish channel following the pair’s solid beat down that it has experienced all of January.

With price teetering on the brink at support, we’re set up nicely for the 11.30am Sydney time employment data release. Are you trading the AUD/USD channel into the release or waiting for the dust to settle?

On the Calendar Thursday:

AUD Employment Change

AUD Unemployment Rate

GBP MPC Official Bank Rate Votes

GBP Monetary Policy Summary

GBP Official Bank Rate

USD Unemployment Claims

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by ECN Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and STP Forex broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.