There's a myriad of charts that many will be watching during the week ahead, especially with all the data being light. So expect technicals to play a big role in a lot of pairs as they move on weak data, bar the pound crosses which will rely heavily on data this week.

The AUD/CAD is trending downwards currently in its long term wedge, and after touching its trend line, we could see a slight pull back before further trending lower. However, with the Australian weakness being of concern lately we could see it bounce lower over the course of the week towards the current long-term trend line.

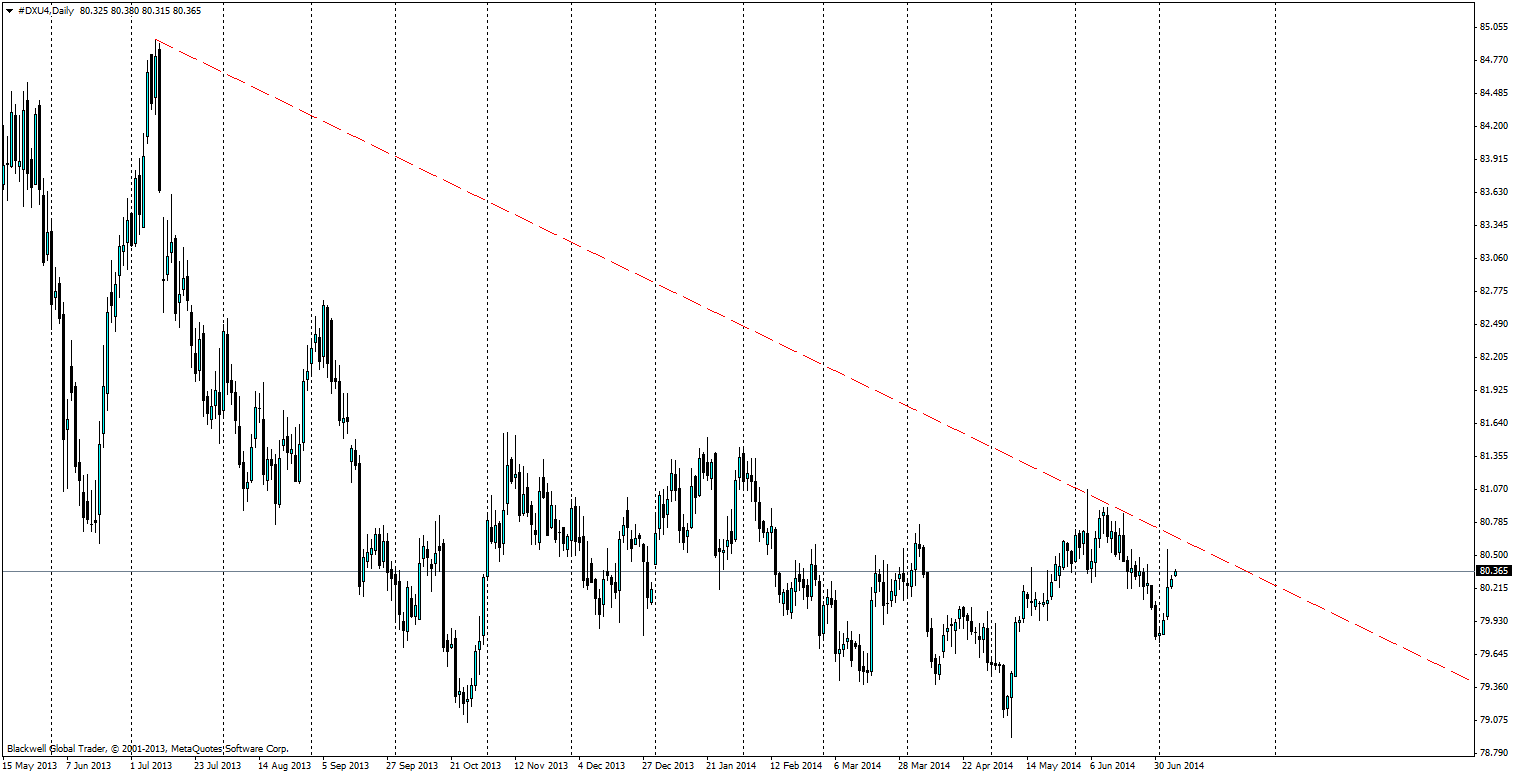

The Dollar Index has been looking strong as of late, but it continues to fall lower again as a strong trend line dominates it currently. Markets will likely test it but pull backs are certainly lower as there is plenty more ground to cover on the way down in the present climate.

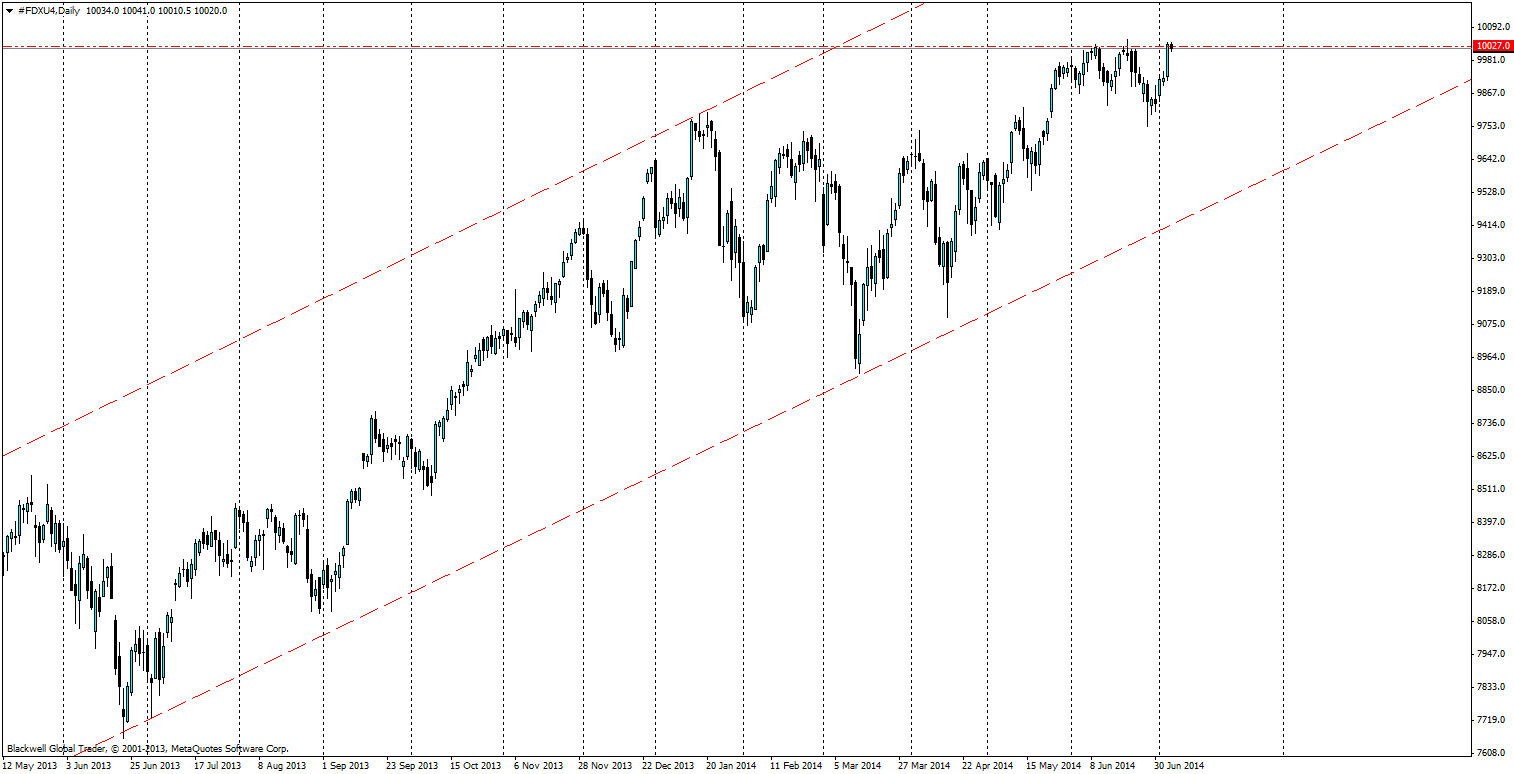

The DAX has been trending strongly upwards on the charts and has been looking very bullish. However, it has struggled to break through the 10027.00 level and many are now wondering if it will be able to at all. Consolidation may be a more logical argument, either way traders should be watching this key level at present.