Unemployment may have remained steady, but it’s not on track for RBA’s target, which is seeing a rise in calls for a July cut by the RBA.

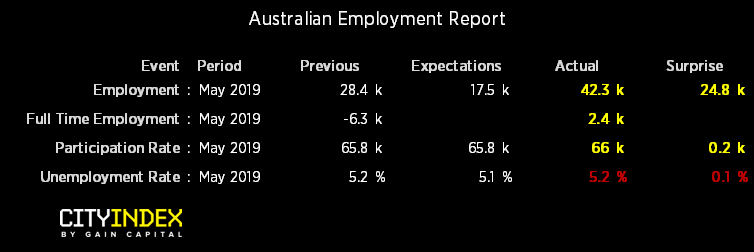

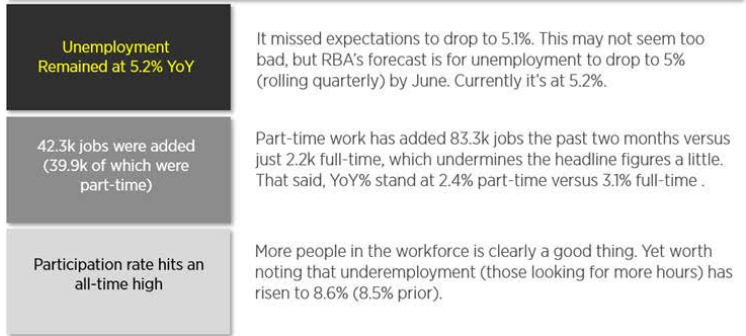

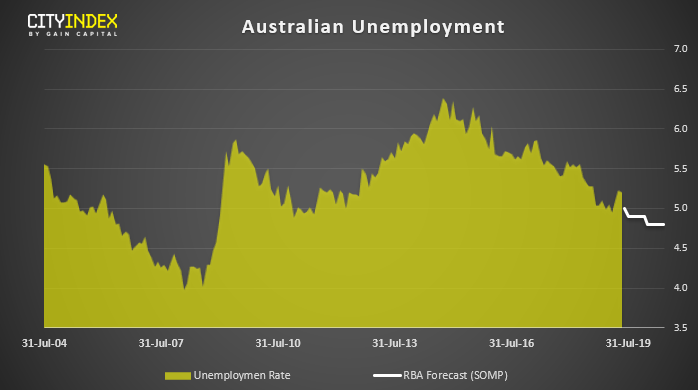

Today was really all about the unemployment rate, which remained steady at 5.2% but missed expectations to fall to 5.1%. Were it not for the fact that RBA has a target 5% by the end of Q2, this may have been OK. But as markets were already pricing at 50% chance of a July cut yesterday, we suspect today’s employment data could tip the scales towards a July cut by the close of today. We can see unemployment rising against RBA’s SOMP forecast and, with it penciled in to drop to 4.8% by June 2021, further rises with unemployment will only hear calls for further cuts and sooner.

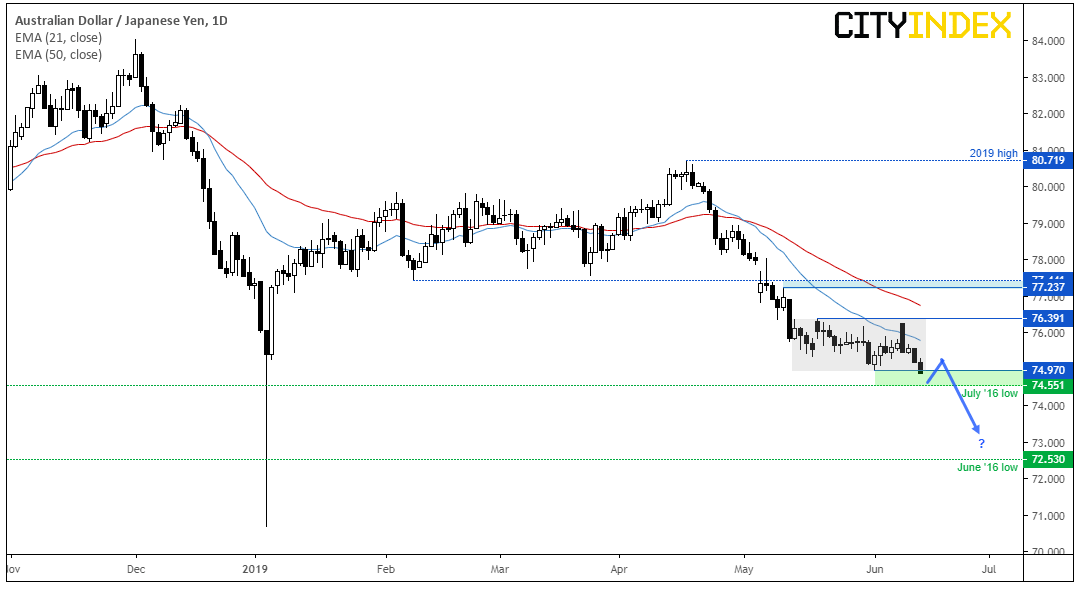

AUD is currently today’s weakest major with AUD/JPY being today’s biggest mover (and loser). We can see on the daily chart that AUD/JPY has just broken to its lowest level since January’s flash crash, in a bid to breakout of a sideways correction pattern. Moreover, a prominent swing high has formed with Monday’s bearish engulfing bar. The 74.55 low makes an obvious, near-term target, although we expect AUD/JPY to break beneath the July 2016 low after an initial bounce, given the strength of bearish momentum leading into the correction.

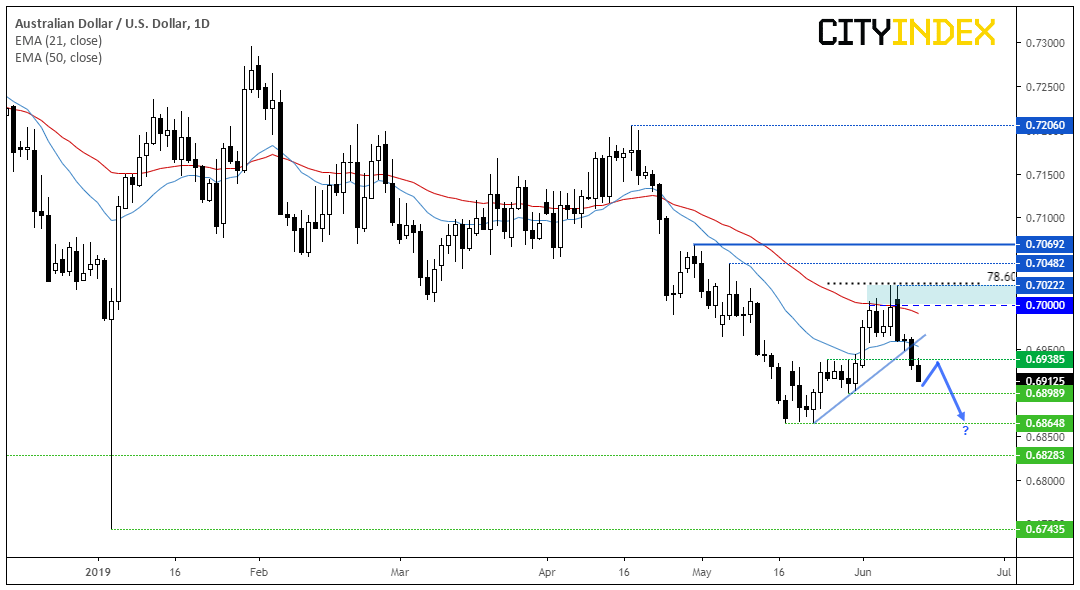

The retracement line and 0.6938 pivotal support level gave way ahead of the meeting (with the latter acting as today’s high). Currently, at a 9-day low, momentum favours the bear-camp so we’d prefer to sell into intraday rallies and target key support levels.