Australia’s CPI will be the core focus for AUD traders on Wednesday. If inflation remains below 2% as expected, it will mark two years since it dropped below RBA’s 2-3% band. Clearly this is not an enviable milestone for the RBA, but we’d expect quite a bullish follow-through if inflation was to sneak back within the band. Yet if we are to see CPI soften it will push back hike expectations well into 2019. Either way, we’d expect volatility to spike regardless of which side of the consensus it lands on.

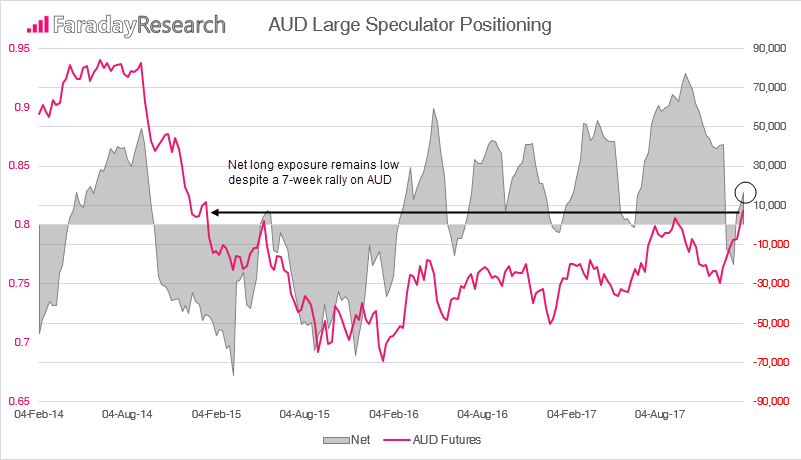

Despite markets recently bringing forward expectations for tightening to November, large speculators appear underwhelmed at the prospect of a hike. Moreover, net-long exposure has only crawled to a 6-week high whilst AUD closed to its highest level since 2015 on a weekly-close basis. And the lack of bullish enthusiasm undermines the 7-consecutive bullish weeks since the December low. Granted, the rally has predominantly been fuelled by a weaker US dollar and stronger commodities but, as CPI data is likely the single most important variable for RBA’s policy expectations, CPI could make a noteworthy impact on this group of traders this week.

Whilst we make no attempt to predict the outcome of this event, we’d expect volatility to spike regardless of which side of consensus it lands. It may even reveal whether large specs were right not to join the rally, or whether they have been behind the times.

AUD/USD has stalled beneath the 2017 high after a failed attempt to break above it on Friday. This could be taken as a sign of weakness over the near-term but we also note the two-bullish range-expansion days at these highs. Couple this with strong bullish momentum it suggests the markets want to push higher if CPI allows.

From a tactical standpoint we’d need to see 0.8125 cleared with momentum before seeking a low-volatility retracement to enter. If CPI is to miss, we’d expect a bump from the highs but, whilst the trend remains bullish we’d continue to monitor for potential long setups whilst holding above 0.7957 – 0.8000.