U.S. telecom behemoth,AT&T Inc. (NYSE:T) has unveiled its own Android tablet, Primetime, thus expanding its product portfolio.

Notably, the company’s exclusive tablet’s key feature is, TV Mode, which allows the customer to access their favorite pre-installed video apps like DIRECTV and DirecTV Now, in a touch or swipe.

Also, it embraces features like high-quality HD video, dual front-facing speakers with Dolby audio, 10-inch Full HD screen, dual Bluetooth media streamsand long-lasting battery. Moreover, Primetime supports Android for Work and Enterprise Mobility Management services.

In fact, AT&T Unlimited Plus or AT&T Unlimited Choice customers can include Primetime in their package by paying an additional $20 for a month. Otherwise customers can avail the tablet for either $10 a month for 20 months or for $30, within a two-year contract.

Meanwhile, we note that the launch of the AT&T’s entertainment-focused tablet is a step forward to expand beyond its core telecom business into digital media and advertising as it is interested in generating cross-platform advertising revenues.

In line with its efforts to develop its digital media business AT&T recently agreed to acquire media giant, Time Warner Inc. (NYSE:TWX) , worth a $85.4 billion cash-and-stock deal. If the proposed merger finally goes through, the combined entity will become a major player in the consolidated telecom-media space.

We believe the merger with Time Warner might provide AT&T a portfolio of lucrative contents as it will give the company an ownership of Warner Bros. Pictures, HBO and Turner networks such as CNN, TBS and TNT. The combined entity is also likely to pose challenges to the leading cable MSO (multi service operator) and media and entertainment firm, Comcast Corp. (NASDAQ:CMCSA) , which acquired NBC Universal in 2011.

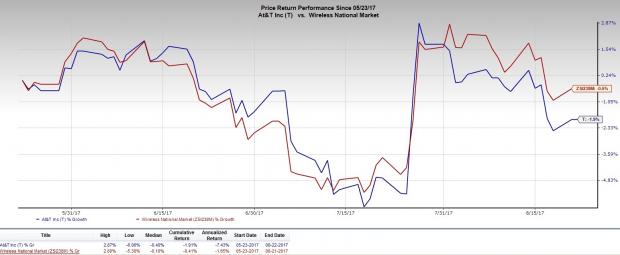

Price Performance & Zacks Rank

AT&T’s price performance has been dull for the last three months. While the company’s stock was down 1.9%, the industry declined 0.5% in the same period. Also, the stock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

Stocks to Consider

Investors interested in the broader Computer and Technology sector may also consider America Movil SAB (NYSE:AMX) , which has an expected EPS growth of 55.87% over the last 3 to 5 years. The company currently sports a Zacks Rank #2 (Buy).

Zacks' 10-Minute Stock-Picking Secret

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

But here's something even more remarkable: You can master this proven system without going to a single class or seminar. And then you can apply it to your portfolio in as little as 10 minutes a month.

Learn the secret >>

Time Warner Inc. (TWX): Free Stock Analysis Report

AT&T Inc. (T): Free Stock Analysis Report

Comcast Corporation (CMCSA): Free Stock Analysis Report

America Movil, S.A.B. de C.V. (AMX): Free Stock Analysis Report

Original post