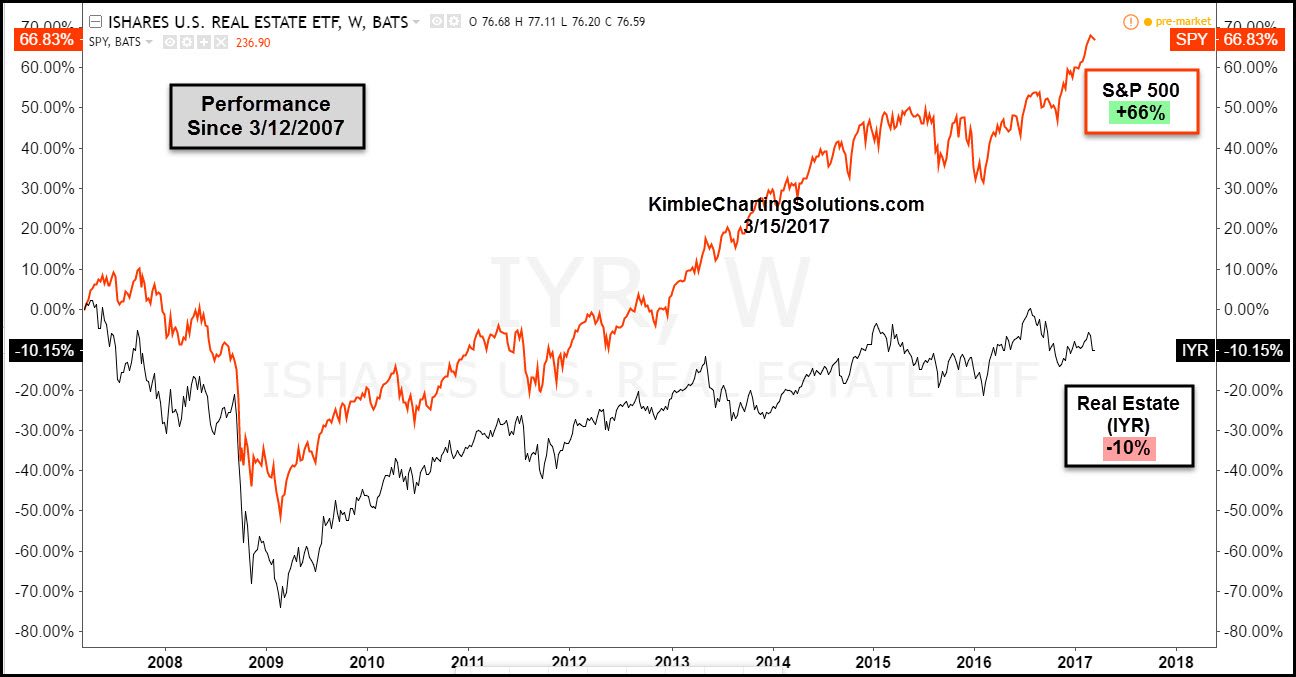

Below compares the performance of the S&P 500 and Real Estate ETF IYR over the past 10 years. Since the highs in 2007, IYR has had little to brag about as its net asset value has declined 10%. The S&P during this same time frame is up 66%.

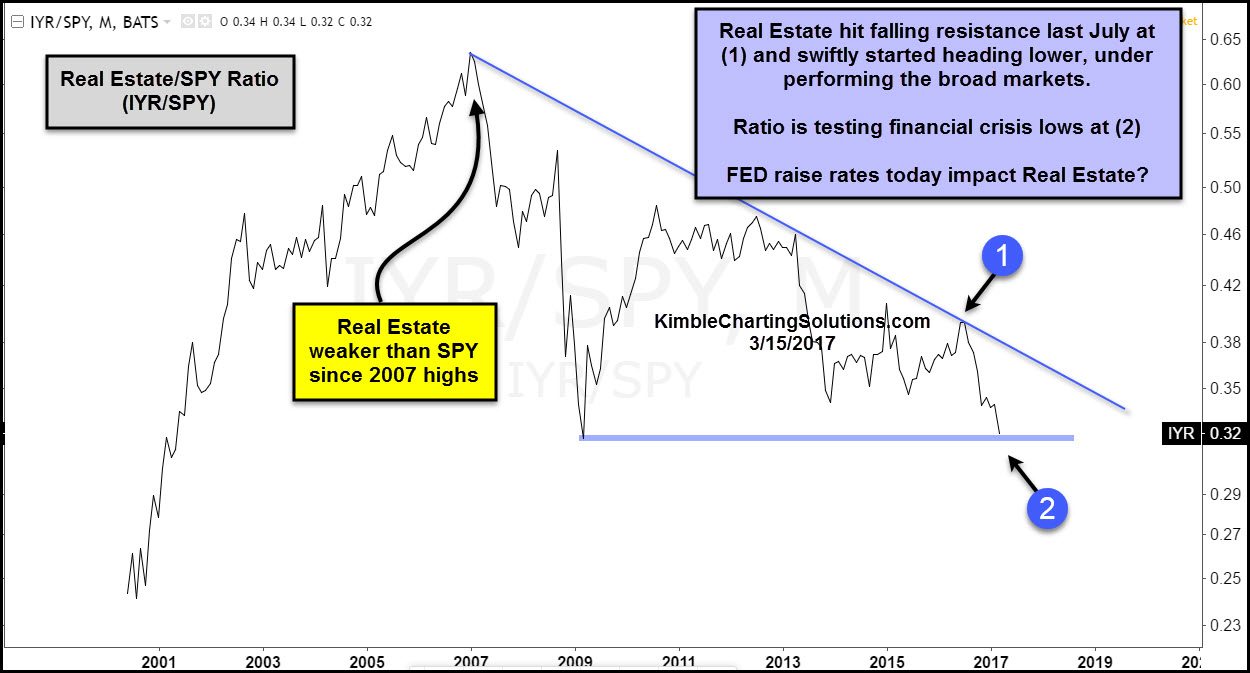

Below compares the relative performance of Real Estate to the S&P 500 since 2001.

This chart reflects how IYR has been much weaker than the broad market for the past 10 years, as the underperformance now has the ratio testing 2009 financial-crisis lows.

Many think that IYR benefits from falling rates and is challenged when rates head higher. If the FED raise rates today or in the near future, would that put downside pressure on IYR? With this ratio now testing an extreme financial-crisis low, could this be an opportunity in play at (2) above?

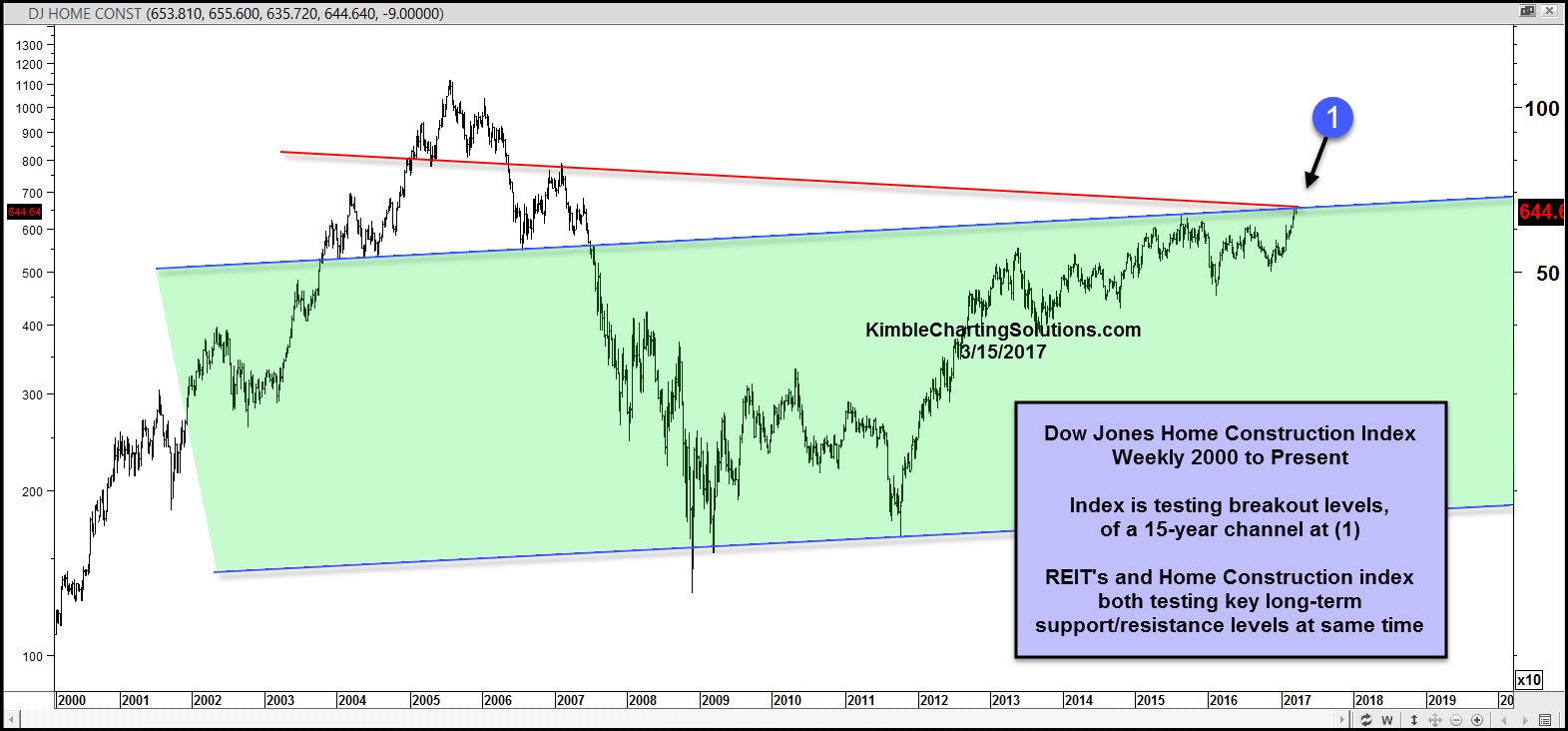

What the ratio does in the top chart at 2 (testing financial-crisis lows) and what the Dow Jones Home Construction index does at (1) could tell us whether or not the “reflation trade” is peaking or about to gain speed to the upside.

I find it very interesting to see two different real estate plays at support/breakout tests just as the FED is looking to raise rates.