AstraZeneca Plc. (NYSE:AZN) announced a subgroup analysis from SIROCCO and CALIMA phase III studies. The studies evaluated the efficacy and safety of a regular subcutaneous administration of benralizumab (fixed 30mg dose) for up to 56 weeks in exacerbation-prone adult and adolescent patients between 12 years of age and older.

Moreover, the studies revealed the efficacy of benralizumab and also showed that this antibody provides increased benefits to patients who experience more frequent exacerbations, despite being on standard-of-care medicines and/or who present with higher baseline blood eosinophil counts. Furthermore, patients on oral corticosteroids and with nasal polyposis were more likely to have an enhanced treatment response.

Currently, benralizumab is under regulatory review in the United StateS, European Union, Japan and several other countries, with a U.S. action date during the fourth quarter of 2017 and expected regulatory decisions elsewhere during the first half of 2018.

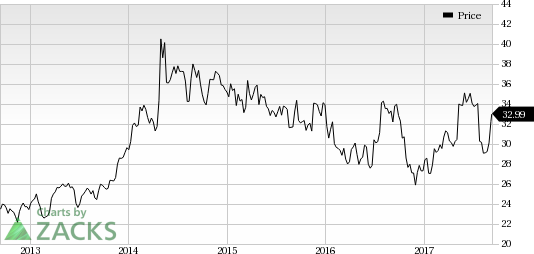

Shares of AstraZeneca outperformed the industry year to date. The stock has been up 20.5% compared with the industry’s gain of 15.8% in the same time frame.

In fact, asthma is a chronic inflammatory disease of breathlessness and has a significant unmet medical need. This is because it affects 315 million individuals worldwide and up to 10% of patients who have severe asthma, despite high doses of standard-of-care asthma controller medicines and can require the use of chronic oral corticosteroids (OCS).

Recently, Regeneron Pharmaceuticals, Inc. (NASDAQ:REGN) and partner Sanofi (NYSE:SNY) announced that Dupixent (dupilumab) met its two primary endpoints in a phase III study conducted on patients with uncontrolled, persistent asthma. Data from the LIBERTY ASTHMA QUEST study also showed that Dupixent, when added to standard therapies, reduced severe asthma attacks and improved lung function.

Zacks Rank & Stock to Consider

AstraZeneca currently carries a Zacks Rank #3 (Hold). Another better-ranked stock in health care sector includes Alexion Pharmaceuticals, Inc. (NASDAQ:ALXN) sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Alexion Pharmaceuticals’ earnings per share estimates have moved up from $5.32 to $5.61 for 2017 and from $6.53 to $6.92 for 2018 over the last 60 days. The company delivered positive earnings surprises in all the trailing four quarters, with an average beat of 11.12%. The share price of the company has increased 16.9% year to date.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

Sanofi (SNY): Free Stock Analysis Report

Astrazeneca PLC (AZN): Free Stock Analysis Report

Alexion Pharmaceuticals, Inc. (ALXN): Free Stock Analysis Report

Regeneron Pharmaceuticals, Inc. (REGN): Free Stock Analysis Report

Original post

Zacks Investment Research