Not much seems to worry markets these days, but we are in a period where very little seems to inspire either - such as the period of transition and reflection we find ourselves in. The cross-currents playing out in markets are promoting great debate, and trends in economics need more time to fully play out and to resolve the questions held by market participants.

With that in mind, the coming 24 hours will offer essential insights and important information in the puzzle we find ourselves. We’ve had enough colour from China to understand credit expansion is filtering through to the real economy, with the credit impulse looking like it may even go positive in the months ahead, for the first time since March 2017. I nearly fell off my chair when I saw the industrial production print come into 8.5% yesterday, some 2.6 percentage points above consensus.

To put this beat into context, it was a ten standard deviation beat, which is such an outlier it occurs statistically once every 8,000,000,000,000,000,000,000 years or so. It makes me question if we should even consider the economist's consensus forecasts in Chinese data when it's mostly finger in the air stuff. Either way, the end result was the same; solid economic data, and with the NDRC (National Development and Reform Commission) drafting a proposal to stimulate consumption, and specifically in electrical products, home appliances and autos, we can feel a confidence that the Chinese economy has weathered a storm.

The next big data release from China will be the PMI manufacturing and services series on 30 April. However, perhaps we should be focused more intently on retail sales (15 May) given the drive for consumption. China remains a positive for financial markets, and while there are increased ST risks of a pullback in the CSI 300 and iron ore futures, the economics throw weight that we have seen a trough in global economic fragility. Consider that last night’s US trade deficit hit an eight-month low and this will not just support US Q1 GDP, but there was a broad positive macro read through too. Specifically, US exports to China gained an impressive 18%, while the US imported 20% less from China. The world, through the eyes of Donald Trump, would look a little more balanced and this has to be a tailwind in the US-Sino tensions.

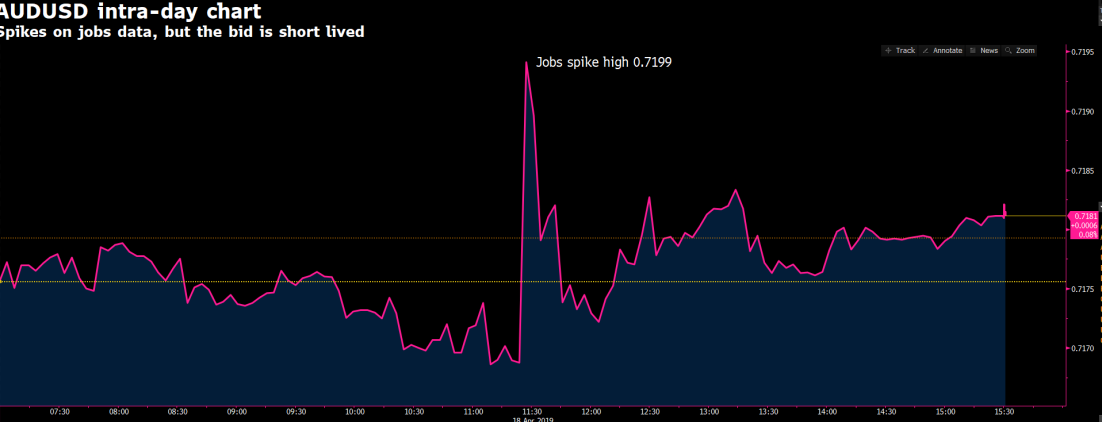

In Australia, we’ve seen the Aussie March payrolls coming in with net creation of 25,700 jobs, which was almost in-line with the average monthly job creation seen over the past 12-months. It's hard to bet against the Aussie labour market it seems, with a sizeable 48,300 full-time jobs created in the month. Granted, the unemployment rate ticked up to 5.0%, but the initial move was one where the market saw this as a good read for the Aussie economy, with AUD/USD spiking 30 pips into 0.7199. Sellers have kicked into gear though, which is fair as this jobs report offers no clarity to the conundrum floated recently by RBA member Guy Debelle, where there is disagreement between a strong labour market and weak productivity and growth. The jobs read doesn’t take a rate cut off the table in any shape though, especially if we get a quarterly trimmed mean inflation print (next Wednesday) of 0.3%, which would be just below the consensus of 0.4% and that takes the year-on-year rate to 1.6%.

We have seen a small element of rate cuts being priced out of the Aussie rates market, with the June cash rate futures now priced for 5bp (basis points) of cuts, down from 6.5bp just before the release. We can look further out the rates curve, and see better selling, although buyers are stepping back in as we hit the close. It’s interesting then to see the ASX 200 fell 20-odd points into a low of 6252.9 on the jobs print. Why? The equity market is a derivative of rates and bond pricing… and if cuts are modestly priced out and we sense higher bond yields, then equity will face headwinds.

That said, the structure of the daily chart of the ASX 200 gives us no clear signal to be short, and positioned as such is a low probability trade right here. Granted, it feels like there are modest downside risks to equity markets, but I will wait for the price action and the technical set-up to give me greater clarity that the bid will come out of the market and we see the rate of change pick up to the downside.

I still have EUR/AUD firmly on the radar, as a daily closing break below horizontal support at 1.5710 would give me confidence that a trend may actually play out. Again, it's tough to be long AUD in the face of Wednesdays Aussie CPI print, but a close through 1.5710 would likely coincide with another weak print in tonight’s EU PMI series, with German PMI due at 17:30 aedt and EU PMI thirty minutes later.

In fitting with the better data of late, it feels as though the higher probability though is we see stabilisation in these key EUR data points and, again, this will provide confidence the worst is behind us.

US retail sales are due at 22:30aedt and the consensus are calling for a solid snapback here to 1% from -0.2% in the prior month. We know the Fed will be watching this print, as consumption is a key metric. So, for those holding USD exposures, be aware that will USD implied vol is low, and therefore few are positioned for punchy moves, even if the outcome of this print will get the headlines. Good numbers from Europe and the US, and the calls that the worst has past will resonate, and this will have many questionings if this consistent dovish stance in rates pricing is warranted.

Wrapping up here for the week, so have a great Easter,