Morning View:

“Spartans! Ready your breakfast and eat hearty… For tonight, we dine in hell!”

Deadline week has arrived for Greece. Sure, we’ve heard that before but this time there will be no more can kicking. Either a deal will be struck between Greece and their creditors, or they will default on their debts.

The ECB has been pumping yet more liquidity into the Greek banking system over the weekend to assure that the system continues to operate under the huge strain that record bank withdrawals are causing. Greek banks are trying to encourage customers to convert cash into investment equity or use another European subsidiary to at least keep them on the books in some capacity, but to no avail.

So banks can handle the withdrawal requests, customers have been forced to file ‘pre-orders’ over the weekend. These pre-orders already reaching over €1 billion and adding to the already reported €4.2 billion already withdrawn.

“If there is no deal on Monday, God knows what Tuesday will look like. Even the ECB is not sure on the road-map thereafter.”

One Greek banker was quoted as saying.

Greek Prime Minister Alexis Tsipras has handed a new offer of reforms to creditors, but once again, it's not expected to be enough to move forward. There is only so much hope and goodwill that can be used, and it looks like it has been all but used up.

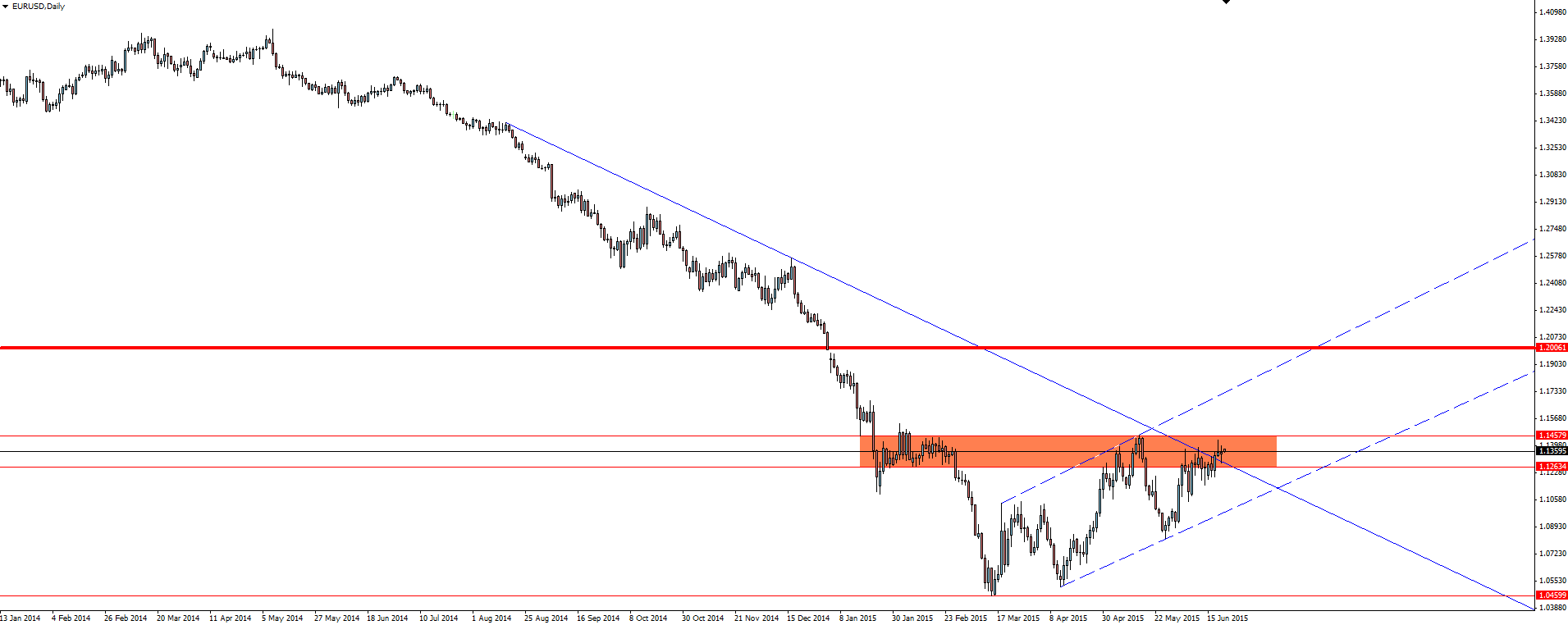

EUR/USD Daily:

Click on chart to see a larger view.

Either way, the resilience that EUR/USD has shown throughout this uncertainty has been remarkable.On Friday, I questioned whether a Grexit would actually be euro positive and this still could well be the case. But for general market stability moving forward, we need something concrete, or backed by this technical zone, we could see a hard sell off in the coming weeks.

This is the week.

———-

On the Calendar Today:

China is off today in observance of the Dragon Boat Festival. It is a traditional holiday that commemorates the life and death of the famous Chinese scholar Qu Yuan.

Later on tonight, we have the Euro Summit and Eurogroup meetings. I’ve been pretty negative and outspokenly pessimistic of the way that Greek headlines have been spiking markets, but this morning on Twitter (NYSE:TWTR), it seemed to have been taken to a new level. This IS the end game and EVERYONE is sick of it.

Twitter indicating market sentiment first once again. If you aren’t using this tool for financial news, why not?

We cap the night off with US Existing Home Sales, which is always a good leading indicator. Mark this one down.

Monday:

CNY Bank Holiday

EUR Euro Summit

EUR Eurogroup Meetings

USD Existing Home Sales

———-

Chart of the Day:

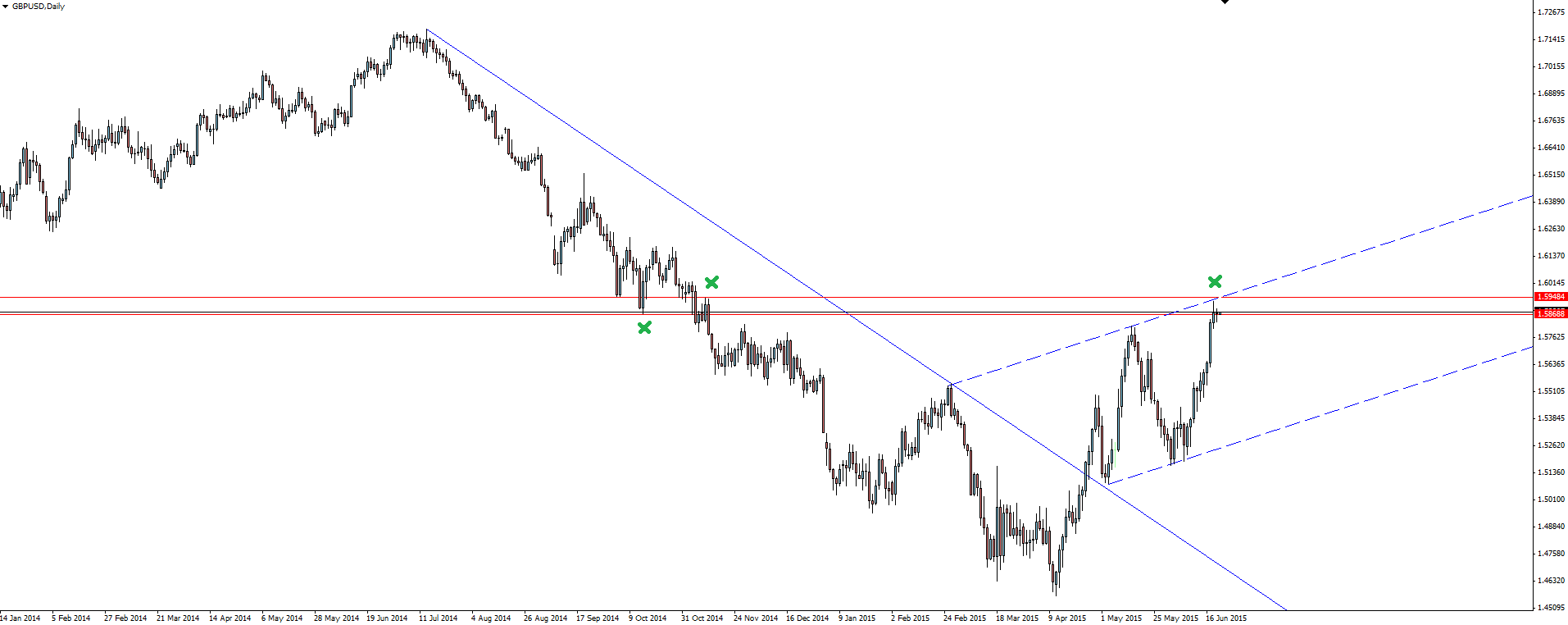

All the Greek headlines have the euro stealing the show. Flying under the radar a bit has been cable, making new highs after a solid week of bullish closes.

GBP/USD Daily:

Click on chart to see a larger view.

GBP/USD is starting to look a bit parabolic on the daily. But does that mean it’s a sell? Not on it’s own, but there are a few supporting technical factors that say it possibly is.

First of all, the horizontal resistance zone we have pushed into has been a previous area that has got a reaction. The fact we have stalled here, albeit very momentarily, shows that sellers are waiting at this level. Secondly, if after this new higher high, you view the daily trend as having changed, you are at upper channel resistance within the new bullish channel.

Something else that I don’t really like drawing on my chart, but always worth keeping note of, is that we are almost exactly on the 50% fib retracement.

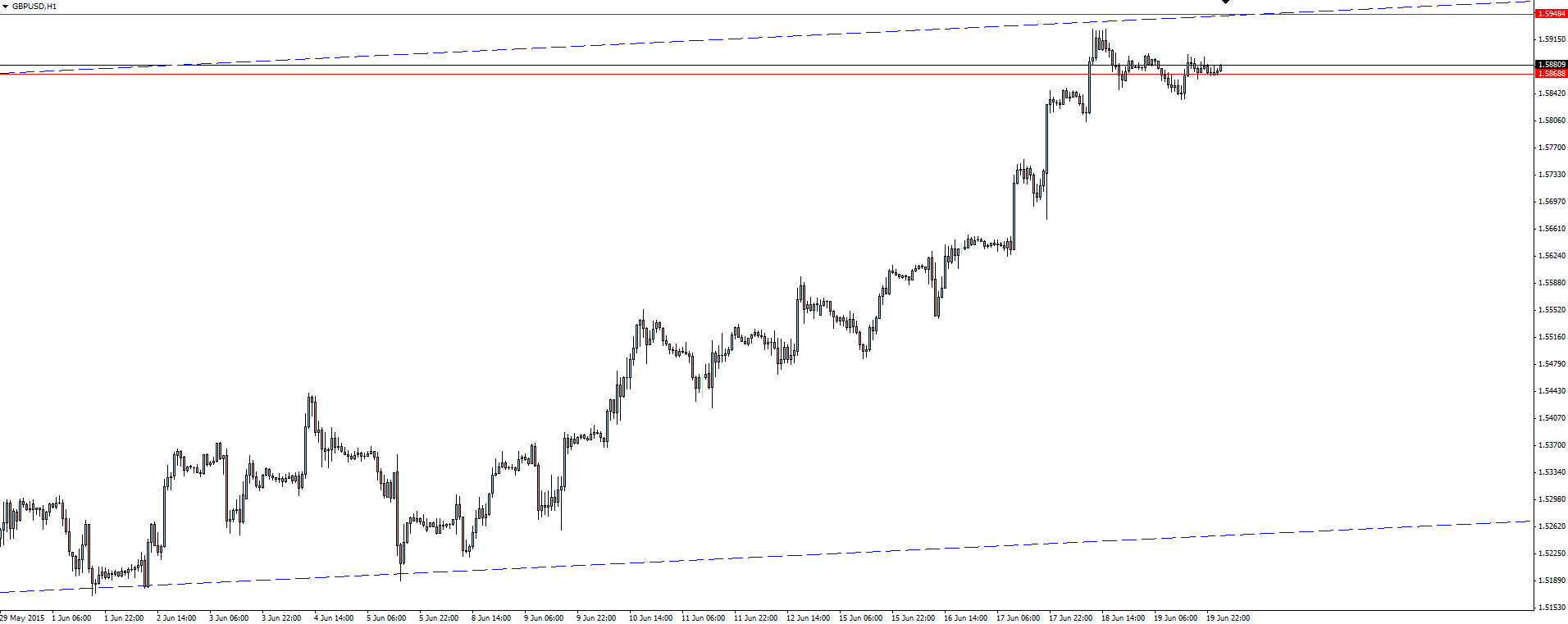

GBP/USD Hourly:

Click on chart to see a larger view.

The hourly however, continues to look like your average bullish run. I’m not jumping all over this short yet, but keep watching how price reacts inside and off the current zone we are in.