Investing.com’s stocks of the week

The €64,000 Question:

Yet another breakdown in talks between Greece and their European overlords begs me to ask the question, is a Grexit actually a blessing for the euro? Going one step further, does current EUR/USD strength reflect confidence in a deal, or are the long term benefits of a stronger euro without Greece driving trade?

Some brilliant quotes from IMF Chief, Christine Lagarde overnight:

“There is an urgent need for dialogue with adults in the room.”

“We can only arrive at a resolution if there is a dialogue. Right now we’re short of a dialogue.”

The current bailout for Greece expires on June 30 (yes, next Tuesday), when Athens is also due to repay the IMF around €1.6 billion. Most scary for markets craving certainty was Lagarde saying if the payment is not made on time, Greece will be declared to be in default and would disqualify itself from receiving any further IMF funds.

“There would be no grace period or possibility of delay to loan payments that are due on 30 June.”

With these quotes, The IMF has taken a stance that we haven’t yet seen. One of no more garbage. This highlights just how close to the end we are, and is a huge contributing factor to why trading in EUR/USD has been so unpredictable.

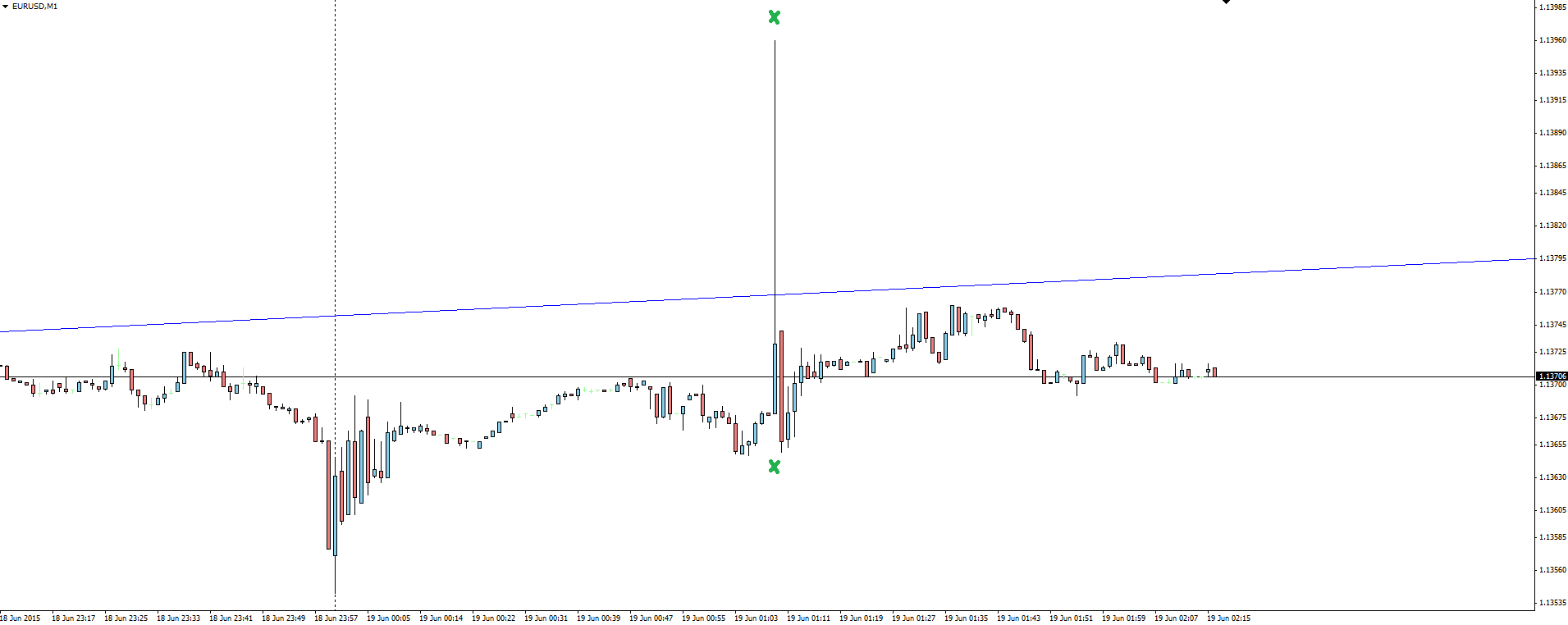

EUR/USD 1 Minute:

Click on chart to see a larger view.

Take a look at the 1 minute price action of EUR/USD, as already thin US/Asian session crossover trade was exacerbated by the current climate.

With uncertainty keeping the market not positioned one way or the other, any post event moves are unlikely to be fueled by the liquidation of positions, but market depth is certainly going to be interesting. Heck, I’ve read analysts not being surprised to see 1000 pip EUR/USD SWINGS between parity and 1.2000 if Greece does in fact default and is forced out of the euro. Insanity!

So no, I can’t answer either of the questions I asked at the top of this blog, and anyone who tells you they can is lying. It’s all a wait and see.

———-

On the Calendar Today:

Friday:

JPY Monetary Policy Statement

JPY BOJ Press Conference

CAD Core CPI

CAD Core Retail Sales

USD FOMC Member Williams Speaks

———-

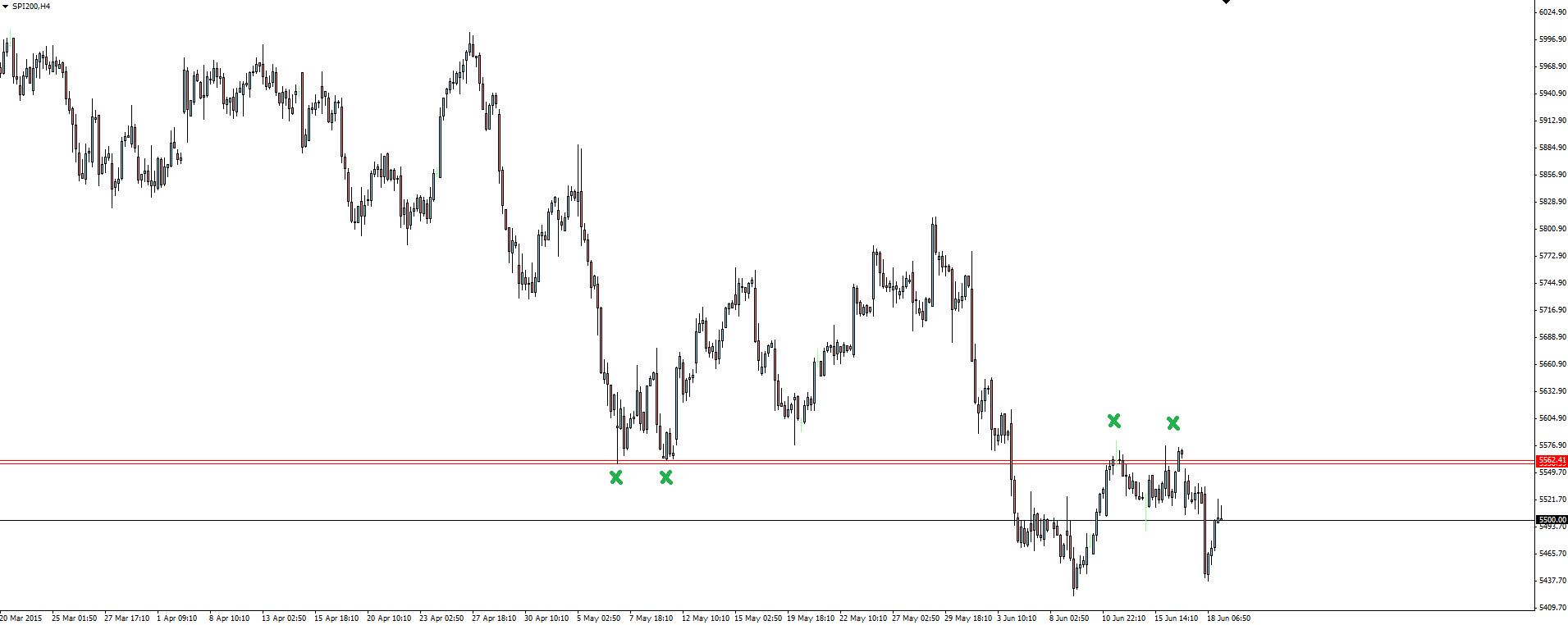

Chart of the Day:

SPI 200 4 Hourly:

Click on chart to see a larger view.

A simple and effective technical setup on the Australian SPI 200.

Zooming into the 4 hour chart, we can see that after a major support level was broken, price retraced to cleanly re-test it as resistance. Textbook stuff on a market that not many outside of Australian futures traders generally trade. I highly recommend taking a look for yourself and adding this one to your watch list.