Standard Greece:

After everything we’ve spoken about leading into last night, and the importance that markets, let alone the Greek people, are placing on these meetings, we get headlines flashing across the wires such as this:

“Senior officials say there’s been a mix-up with the documents sent to the bailout monitors.”

We then see follow up quotes trickling through like this:

“It’s not so dramatic, but they sent the wrong one by mistake.”

What makes it even more hilariously incompetent is that this isn’t the first time that the wrong documents have been sent through from the Greek side! Oh but you’re probably right guys, this isn’t all that important anyway. We all know we’re still going to be here for a while yet.

Reform Summary:

After the 11 page proposal… well the right one… was eventually received, the terms on which Greece were willing to move on were known. Greece has accepted that its pension system needed to be reformed, and said it would save money by decreasing pension contributions, health payments by retirees and a new tax on businesses.

This has always been the biggest sticking point, as Tsipras was elected on the promise that Greece would not bow to European demands for cuts that would hurt citizens the most. Tsipras seems to have found a slight loophole by leaving pension rates untouched, which allows him to say that he has fulfilled his mandate to the people. Greece has also set a higher VAT rate and agreed to continue to push for GDP targets.

If final approval is given, a deal would be signed by European leaders when they meet for a two-day summit in Brussels on Thursday.

Jean-Claude Juncker:

“My aim is a deal by the end of the week.”

EUR/USD 5 Minute

Click on chart to see a larger view.

Look at the 5 minute chop that we’ve been expecting. Once more, don’t get caught up trading headlines!

———-

On the Calendar Today:

HSBC Flash Manufacturing data out of China is the big one during the Asian session, but with Sydney house prices an ever present concern for the RBA, it’s probably worth keeping an eye on the House Price Index reading out of Australia just beforehand.

Again, Greek headlines will drive Europe rather than these PMI’s until we reach the US session.

Tuesday:

AUD HPI

CNY HSBC Flash Manufacturing PMI

EUR French Flash Manufacturing PMI

EUR German Flash Manufacturing PMI

USD FOMC Member Powell Speaks

USD Core Durable Goods Orders

———-

Chart of the Day:

Look at these AUD/NZD charts… 1300 pips from parity in only a few weeks!

AUD/NZD Weekly:

Click on chart to see a larger view.

Crazy to look back in our Vantage FX News Centre Technical Analysis posts on the way down and playing for a break out below. We got a bit of a push down, but we sure didn’t get the break. By that stage I thought that I’d missed the boat on my chance to get long with good risk:reward. I’m happy with my reasons for making that call at the time, but of course it’s frustrating to see a move like that off a juicy level.

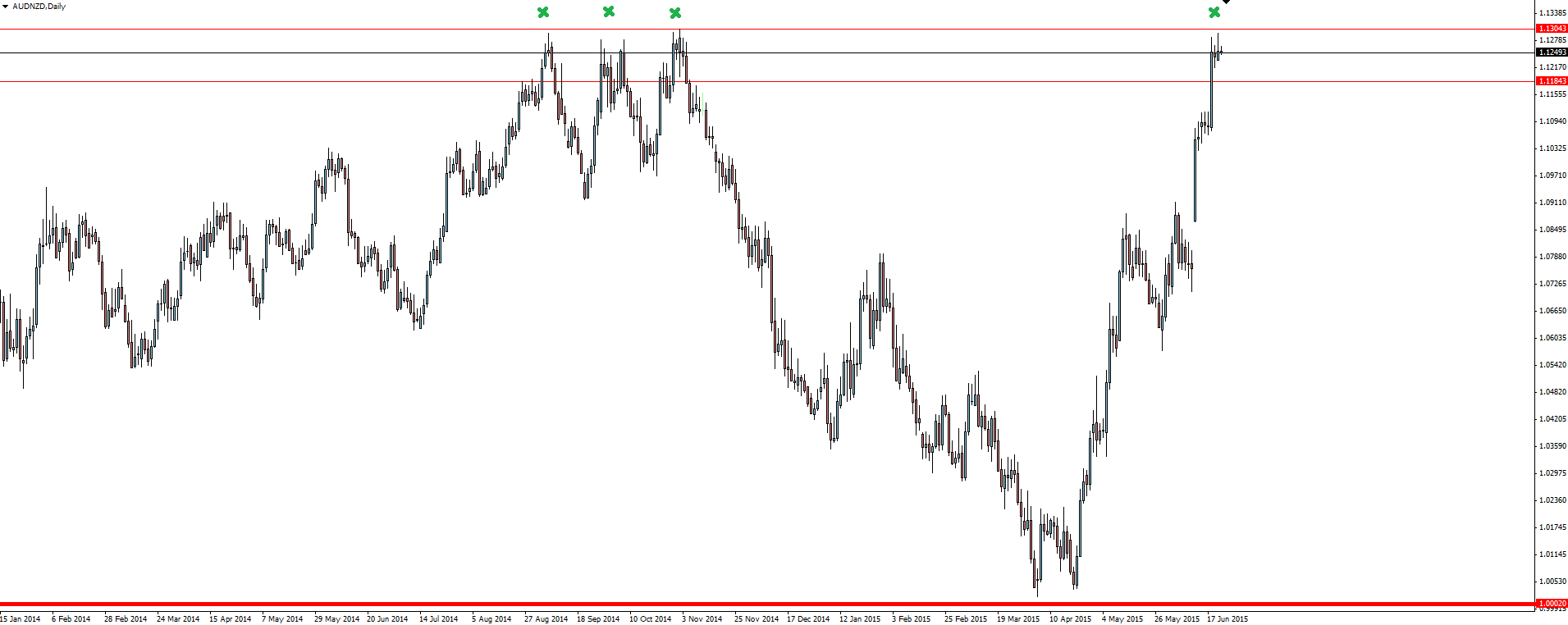

AUD/NZD Daily:

Click on chart to see a larger view.

Similar to the GBP/USD chart of the day in yesterday’s Morning Blog, we have a chart that has gone parabolic. A vertical line straight up and now into a resistance zone.

One of my favourite sayings in trading is:

“There is no such thing as overbought or oversold.”

I’m not even going to put a stochastic indicator on my chart, I can see that the reading would have told me to sell weeks ago. But charts like this are strong for a reason. Don’t jump into shorts for the sake of it.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Asian Session Morning: Not THOSE Documents, THESE Documents!

ByVantage

AuthorDane Williams

Published 06/22/2015, 09:15 PM

Updated 01/13/2022, 05:55 AM

Asian Session Morning: Not THOSE Documents, THESE Documents!

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.