Which is the best market to invest in, Asian or European?

Recent economic data do not bode well for Europe: the eurozone economy is expected to contract in the third quarter and not return to significant growth.

Despite having avoided a recession following the Russian invasion of Ukraine, the eurozone is struggling with several problems.

Rising energy prices, high financing costs, and falling demand in export markets such as China are straining the region's economy.

The European economy is currently going through a difficult phase of stalling.

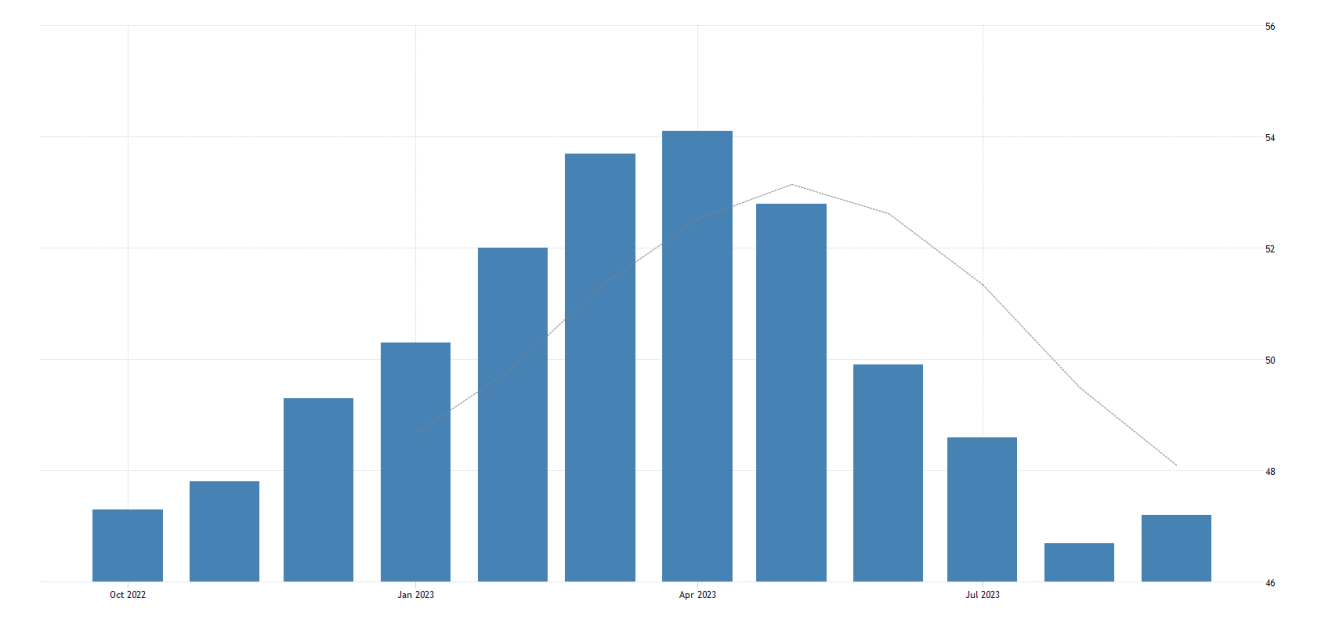

According to the flash Composite Purchasing Managers' Index (PMI) for the eurozone, composed by S&P Global and considered a reliable indicator of overall economic health, we are below 50 points with a reading of 47.1.

This is a worrying figure that signals a negative economic condition in the region.

The manufacturing sector continues to be the main obstacle, with a steadily worsening order situation.

Due to high financing costs affecting the disposable income of indebted consumers, many are reducing their spending.

This is also reflected in the index of new businesses in the service sector, which fell to 46.4 from 46.7, reaching its lowest level since February 2021.

According to S&P Global, the two largest countries in the area led the decline in economic activity.

Although the crisis is easing in Germany, the situation is worsening in France.

It is well known that the German manufacturing sector has been going through a difficult period recently.

The French economy has suffered a setback, with both the service and manufacturing sectors deteriorating since November 2020.

Weak demand has been observed across the country, and confidence for the next 12 months has declined significantly.

The French economy is heading for difficult times.

Given the current economic conditions, I prefer not to invest in the U.S. (US 500) and European indices (DAX) at this time, mainly because of rising inflation and aggressive central bank policy.

Betting on the Italian market (FTSE MIB) is also risky.

Public debt in Italy is very high and is having a negative impact on bond yields, affecting debt costs.

With a debt-to-GDP ratio of over 140 percent, Moody's (NYSE:MCO) currently ranks Italy at Baa3, just one notch above junk, with a negative outlook.

Currently, I am focusing my investments on the Asian market, particularly the Nikkei 225 and Hang Seng index.

In Japan, inflation is under control and interest rates are negative.

In China, after eight years, the government has resumed buying stocks, and even if only slightly, we have seen a lowering of interest rates.

I also follow Bitcoin and mining companies closely.

With the possible approval of ETFs underway and the growing acceptance of Bitcoin by companies-the latest to join was Ferrari-there is a strong likelihood of seeing new price records by 2024.