It’s been a fairly quiet night across markets, and we see a mixed open for Asian equities. And, with little data to drive through the coming 12 hours or so, it’s likely to be a day of position management and assessing further probabilities around key events later in the week, such as Thursday’s ECB meeting.

There hasn’t been much new news for Asian traders to need to discount. A huge spike in US consumer credit (to $23.29b vs $16b eyed) has perked the interest of some but hasn’t been overly influential on pricing. A step back in time, and we saw a worrying EU Sentix investor confidence report, amid an uninspiring, yet slight-better-than-forecast UK GDP and industrial production. But it’s all Brexit here, and there hasn’t been any earth moving developments, other than Parliament voting to force the Tory government to publish its plans for a no-deal Brexit.

It hasn’t stopped the GBP from having an upbeat session, gaining against all G10 currencies, bar the NOK (best performer in G10 FX), with GBP/CHF gaining nearly 1% and printing a strong outside period on the daily chart.

While trading the GBP is for the brave, GBP/CHF has the potential for 1.2344 (the 38.2 retracements of the May to August sell-off), and I don’t mind what I see in GBP/USD either (see below), with price firmly closing above the May downtrend and appears to be forming a base. While I am loath to go anywhere near the pound, I like what I see in the price action, as I do in the vol space, with GBP/USD 1-month implied volatility falling from 12.69% last week to currently sit at 8.74% and the 33rd percentile (12-month range). If GBP/USD kicks up through 1.2354 again, I would be looking for longs, with a stop through 1.2234, which is in-line with the implied weekly move on the week in options markets (priced by the ATM straddle).

By way of guides, the S&P 500 finished unchanged at 2978, tracking a 20-handle range of 2989 to 2969 on the session, although breadth wasn’t too bad, with 59% of stocks closing higher. Volumes were a touch over the 30-day average, while cyclicals nicely outperformed defensive sectors, while the Russell 2000 rallied 1.3%, so I have closed my long-held short Russell 2000/long S&P 500 idea and will look to re-establish this pairs trade in the coming days/weeks.

We saw high yield credit narrow 1bp vs investment-grade (IG) credit, although there has been so much corporate IG debt issuance of late that moves have been somewhat distorted. We’ve seen selling across the fixed income curve, with the long-end underperforming (UST 10s closed +8bp at 1.64%) and that is interesting, given some brave calls for a possible cyclical upturn in the US economy, that we find the US 2s vs 10s yield curve steepening 3.5bp, which has pushed financials to easily outperform (the S&P 500 financial sector closed +1.5%), while WTI crude gaining 2.7% has also contributed. So, all-in-all, the bulls will acknowledge they have won a small skirmish here, and the broad quality of the overnight journey from A to B has been of reasonable quality, although, I would have liked the VIX index to move lower from 15%, which it hasn’t.

As far as calls go, S&P 500 futures are 0.3% lower from 16:10aest (the official close of the ASX 200), and Aussie SPI futures are 12-points lower through the same period, hence a softer feel to the ASX 200 open is expected and consider we also face a 4.3-point headwind, with six stocks going ex-dividend on open. The Hang Seng, CSI 300 and A50 cash indices should open on a flat note, but keep an eye on the A50 index, as an upside break of 14,000 would be clearly bullish, and attract some good old FOMO capital.

Looking forward to event risk, in Asia, we get NAB business conditions/confidence (11:30aest), which, depending on the outcome is probably good for 10-pips in AUD/USD, in a market seeing the next cut from the RBA in November (priced at 72%). AUD/USD is grinding towards 69c and building on the weekly outside period we saw last week. If we are going to break the figure and head towards the 70c level, it feels as though USD/CNH will need to move below 7.1000. Elsewhere we get UK employment data, US NFIB small business confidence and Canadian housing starts. All small fry relative to Brexit, ECB and FOMC meetings and even a Trump tweet.

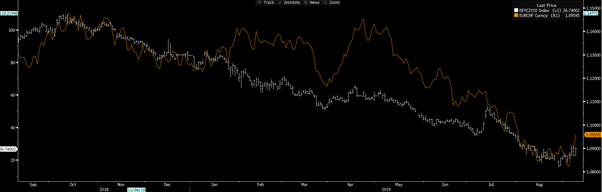

Another pair on the radar is EUR/CHF, which again has broken the near-term downtrend and has broken out after a price consolidation.

The bulls, it seems are taking some control, although this could be more EUR shorts looking to take some off the table and, in the options world, EUR/CHF weekly implied vols are contained, even with the ECB meeting due on Thursday. Some better selling in German bunds is helping EUR appreciation, and EUR traders will be watching the tape this week in EU banks, although the German 2s vs 10s curve will be key. If the ECB really want to get in front of the economic slowdown, they need a steeper curve. How they go about that is incredibly problematic, as to achieve this, the ECB would need aggressive easing of rates and less on the asset purchase front. A steeper curve means a higher EUR/CHF.

(German 2s vs 10s curve vs EURCHF)