Exchange-traded funds (ETFs) offer covered call writers and put-sellers the advantage of instant diversification and generally have a lower implied volatility associated with them compared to individual stocks. Whether we are dealing with stocks or ETFs, each security must be evaluated on its own merit before using it as the underlying security. In this article, I am highlighting NYSE:ASHR (DB X-trackers Harvest CSI 300 China A-Shares), which provides cap-weighted exposure to the Chinese equity market, where foreign investors have historically had very limited access. This is because China has a “mostly closed” capital account, whereby investors, as well as companies and banks, cannot move money in and out of the country except in accordance with strict rules. Capital account liberalization is part of China’s current reform efforts, and the fact that this exchange-traded fund exists is evidence that China is moving to open up its capital markets. The inception of this ETF was 11-6-13 and the security now holds net assets over $1.4 billion.

Technical perspective

This security earned its way onto our Premium ETF Report in late July, 2014, and has remained there ever since. Let’s have a look at the technical chart over the past year:

ASHR: One-Year Price Chart as of 6-9-15

ASHR became a staple of the Premium ETF Report in late July 2014, after the 20-day exponential moving average (EMA) crossed above the 100-day EMA and the price bars continued to remain at or above the short-term EMA. The price in July was $24.00 and as of 6-12-15 it is above $55.00.

Implied volatility both an asset and a liability

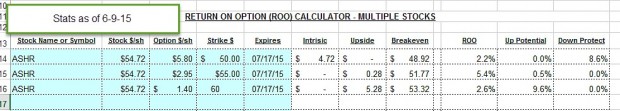

Many Chinese securities that trade on US exchanges (American Depository Receipts or ADRs) are highly volatile due to the nature of the Chinese economy and the lack of transparency associated with these stocks or ETFs. This is a factor we must all consider before using ASHR as an underlying security. As of 6-9-15, ASHR’s implied volatility was three and a half times that of the S&P 500 (45.85 compared to 13.50). This means we are incurring more risk to the downside when utilizing this security. The good news is that this high level of volatility results in higher option premiums. On 6-9-15, with ASHR trading at $54.72, I checked the option chains for the July 17, 2015 $50.00, $55.00 and $60.00 strike prices. The results represent five-week returns. Here is the information as shown in the multiple tab of the Ellman Calculator:

Covered Call Calculations for ASHR

Initial returns

- $50.00: 2.2% or 22% annualized

- $55.00: 5.4% or 54% annualized

- $60.00: 2.6% or 26% annualized

Potential final one-month returns

- $50.00: 2.2% but comes with 8.6% downside protection of the 2.6% profit

- $55.00: 5.9%

- $60.00: 12.5%

Bearish outlook

It would make sense to favor the $50.00 strike price because we are generating a nice 2.6% five-week return, which will be realized as long as share value does not decline by more than 8.6% by expiration Friday.

Bullish outlook

Both the near-the-money $55.00 and the out-of-the-money $60.00 strikes make sense because both offer favorable initial five-week returns. The $60.00 strike is the most aggressive position to take because it offers the highest potential total returns, although lower initial returns than the $55.00 strike.

Breakeven

The calculator also shows us that the higher the strike we select, the greater is our potential total return, but also the more risk we are incurring as the breakeven also moves higher.

Discussion

Our Premium ETF Reports will identify securities that are out-performing the S&P 500 and some, like ASHR, can out-perform over a significant time frame. When such an exchange-traded fund is identified, we still need to evaluate additional factors before including it in our option-selling portfolios. We must be certain that the premium returns meet our goals and the implied volatility matches up with our personal risk tolerance. Another decision that must be made regarding ASHR is whether we are comfortable with a Chinese security, which is notoriously less transparent than a corresponding US security. If these criteria meet our trading requirements, there can be enormous opportunities with an ETF like ASHR.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI