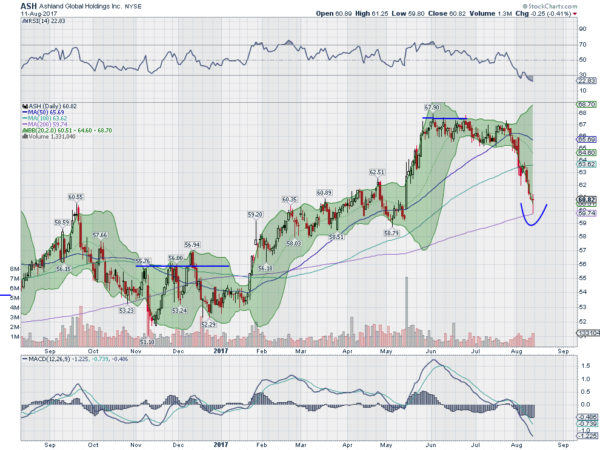

Ashland, Ticker: ASH

Ashland Global (NYSE:ASH) rose steadily from January through to a top in June. It consolidated and then pulled back violently over the last 4 weeks. Friday it touched the 200 day SMA and printed a Hammer (possible reversal). The RSI and MACD are both oversold and showing signs of reversing. Look for a higher close Monday to participate higher…..

Interactive Brokers, Ticker: IBKR

Interactive Brokers (NASDAQ:IBKR) consolidated over the winter and then dropped back in March. Since then it has moved steadily higher reaching the latest consolidation zone 2 weeks ago and settling. The RSI is overbought but pulling back while the MACD is near a cross down. Look for a push out of consolidation to participate higher or on the short side…..

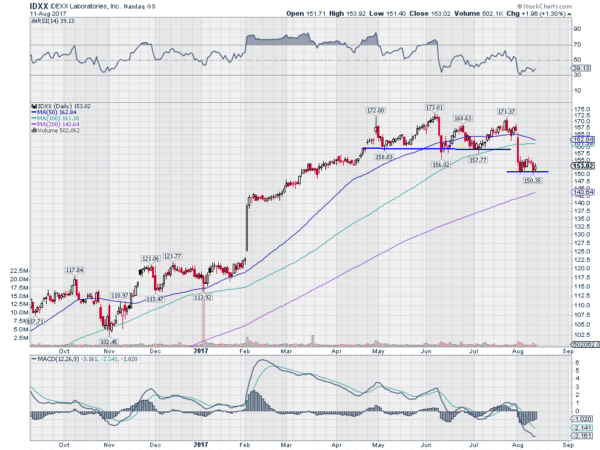

IDEXX Labs, Ticker: IDXX

IDEXX Laboratories (NASDAQ:IDXX) rose from a November low to consolidate from December through February. It took off from there to a new consolidation over support from May through July. It broke that support to the downside to start August and has consolidated since. The RSI stalling in the bearish zone while the MACD is falling. Look for push lower to participate to the downside…..

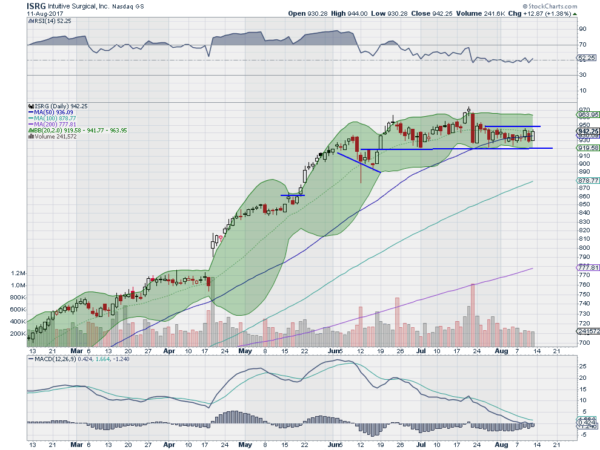

Intuitive Surgical ISRG, Ticker: ISRG

Intuitive Surgical (NASDAQ:ISRG) moved higher with a gap up out of consolidation in April. It continued until a new plateau started to build in June over support. The consolidation has tightened and has price pinned between the 20 and 50 day SMA over the last 4 weeks. The RSI is holding in the bullish range with the MACD leveling. Look for a push higher to participate to the upside…..

Toronto Dominion, Ticker: TD

Toronto Dominion (TO:TD) is pulling back from a lower high and entering a prior support/resistance range. The RSI is at the lower edge of the bullish zone with the MACD falling and near zero. Look for a bounce or break lower to participate further…..

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which heading into August Options Expiration sees the equity markets showing some signs of tiring, especially the IWM.

Elsewhere look for gold to continue higher while crude oil consolidates at resistance. The US Dollar Index bounce may be over while US Treasuries are biased higher in the short run. The Shanghai Composite and Emerging Markets (NYSE:EEM) are both looking better to the downside short term in their uptrends.

Volatility has crept up but may be stretched, but worth paying closer attention to it in the short run. This changes the bias to lower for the equity index ETF’s SPY (NYSE:SPY), IWM and QQQ. Their charts all show some signs of weakness in the short term, especially the IWM, but less weakness longer term especially the QQQ. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.