Ashland Global Holdings Inc. (NYSE:ASH) announced that it will raise the price of maleic anhydride in North America by 2 cents per pound, which will be effective on all orders shipped on and after Sep 1, or as contracts permit.

According to Ashland, the hike is mainly in response to increases in costs of key raw materials. The latest move is expected to ensure effective service to customers in terms of quality and performance along with the ability to reinvest in the company’s product line.

Ashland, in its third-quarter fiscal 2017 earnings call, said that it has made significant progress with its pricing initiatives and sees year-over-year price gains to be more than raw material cost increases in the fiscal fourth quarter.

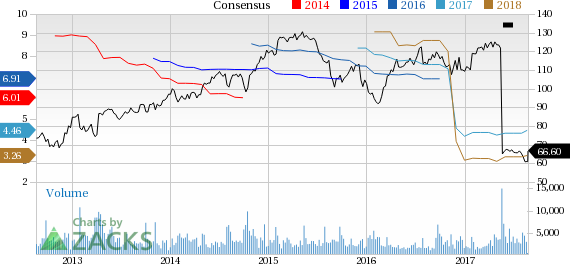

Shares of Ashland have declined 5.8% in last three months, underperforming the industry’s 1.7% dip.

Ashland reported a net loss from continuing operations of $16 million or 26 cents per share in the third quarter of fiscal 2017 (ended Jun 30), against a net income of $24 million or 38 cents in the year-ago period. Barring one-time items, adjusted earnings were 83 cents per share which beat the Zacks Consensus Estimate of 70 cents.

Revenues increased roughly 10% year over year to $870 million. The figure topped the Zacks Consensus Estimate of $839.3 million.

According to Ashland, the Specialty Ingredients unit recorded a 7% year-over-year increase in revenues while the sales of Composites grew by 20% on the back of disciplined pricing and robust volume expansion in various global end markets. Intermediates and Solvents unit also witnessed a 9% increase in sales owing to continued recovery in butanediol pricing and improving global demand.

Ashland closed the acquisition of Pharmachem Laboratories, Inc., a leading provider of quality ingredients to wellness and health industries and high-value differentiated products including flavor and fragrance houses. The acquisition was a key contributor to Ashland’s sales in the third quarter. The company expects to achieve meaningful cost synergies from leveraging combined capabilities along with tax synergies resulting from Pharmachem integration.

Ashland currently carries a Zacks Rank #3 (Hold).

Stocks to Consider

Some better-ranked stocks in the basic materials space are The Chemours Company (NYSE:CC) , POSCO (NYSE:PKX) and Kronos Worldwide Inc. (NYSE:KRO) . All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

Chemours has expected long-term earnings growth rate of 15.5%.

POSCO has expected long-term earnings growth rate of 5%.

Kronos has expected long-term earnings growth rate of 5%.

Zacks' 10-Minute Stock-Picking Secret

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

But here's something even more remarkable: You can master this proven system without going to a single class or seminar. And then you can apply it to your portfolio in as little as 10 minutes a month.

Learn the secret >>

Ashland Global Holdings Inc. (ASH): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

POSCO (PKX): Free Stock Analysis Report

Original post