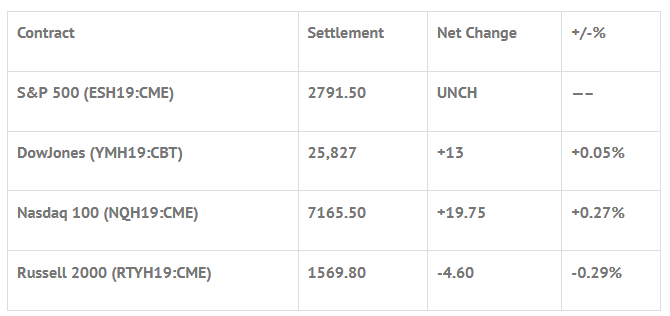

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 6 out of 11 markets closed higher: Shanghai Comp +1.57%, Hang Seng +0.26%, Nikkei -0.60%

- In Europe 9 out of 13 markets are trading lower: CAC -0.15%, DAX -0.25%, FTSE +0.33%

- Fair Value: S&P +0.15, NASDAQ +2.39, Dow -7.24

- Total Volume: 1.2mil ESH & 753 SPH traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes MBA Mortgage Applications 7:00 AM ET, ADP (NASDAQ:ADP) Employment Report 8:15 AM ET, International Trade 8:30 AM ET, EIA Petroleum Status Report 10:30 AM ET, Loretta Mester Speaks 12:00 PM ET, John Williams (NYSE:WMB) Speaks 12:10 PM ET, and Beige Book 2:00 PM ET.

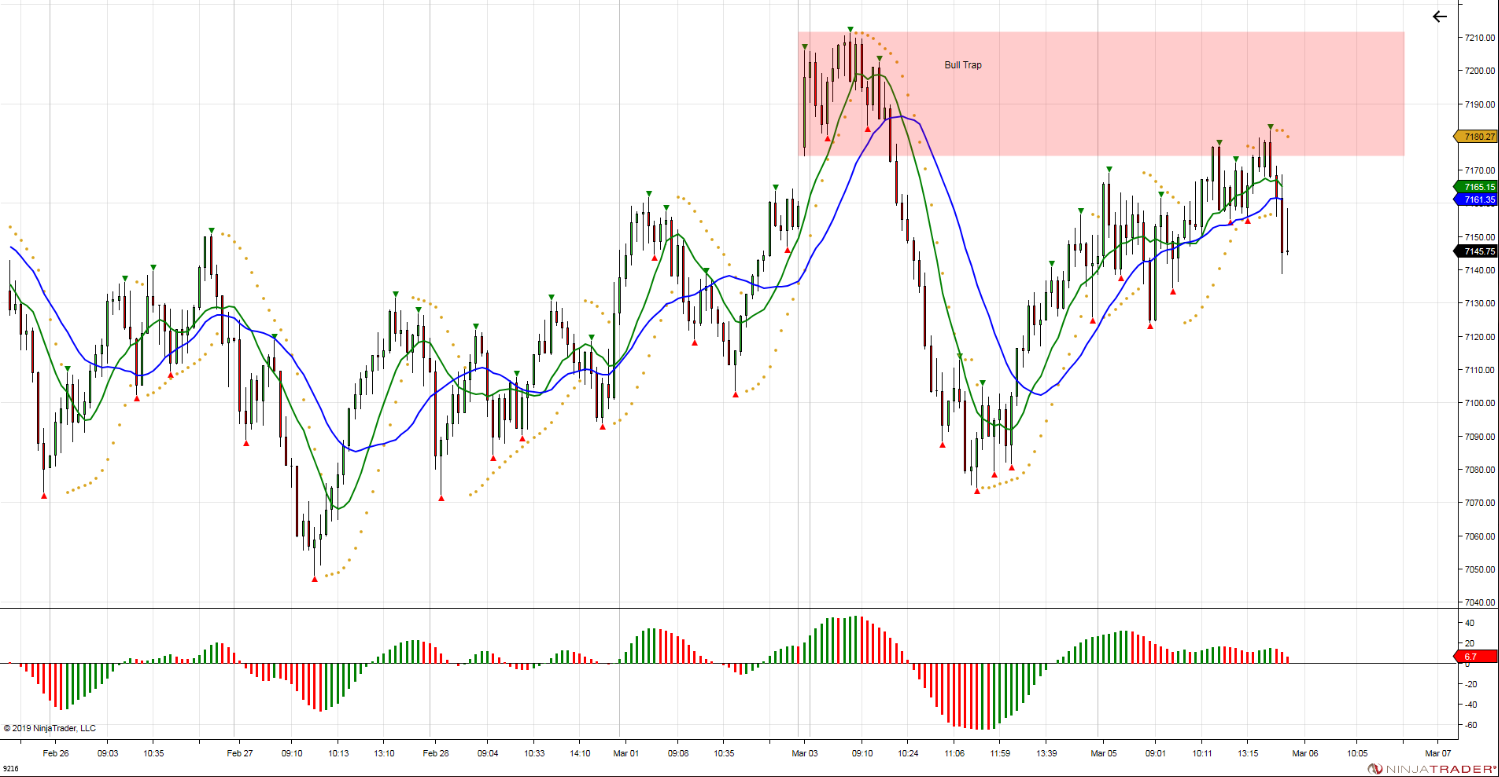

S&P 500 Futures: #ES #NQ Inside Day

Chart courtesy of Stewart Solaka @Chicagostock – $NQ_F Monday’s buyers trapped above. Someone come rescue them or pull the rug from underneath…

We live in a funny world. According to cybersecurity firm McAfee, North Korean hackers targeted US ‘critical infrastructure’ during Trump-Kim summit, and while President Trump is pushing to get a trade deal, Chineses hackers have been targeting U.S. universities searching for maritime military secrets. According to iDefense, a cybersecurity intelligence unit of Accenture (NYSE:ACN) Security, Beijing has targeted at least 27 universities in the U.S. We know some people do not like President Trump, but how much intellectual property has been stolen from the U.S.?

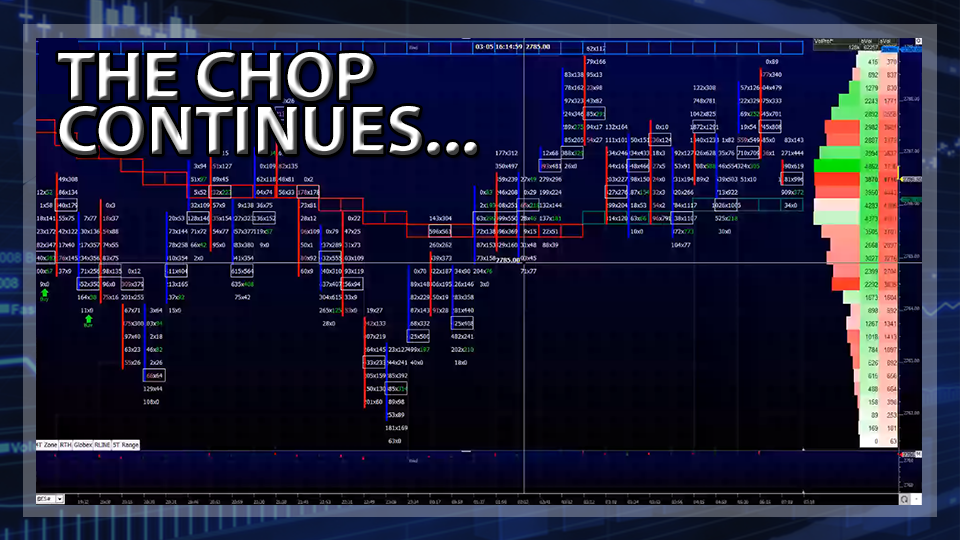

During Monday nights Globex session, the S&P 500 futures (ESH19:CME) printed a high of 2798.75, a low of 2785.25, and opened Tuesday’s regular trading hours at 2794.75. After the open the ES upticked to the 2795.25 area and then sold off down to 2783.75 at 8:54 am. After trading back up to a lower high at 2793.50, it then sold off down to a higher low at 2785.00 before rallying up to another lower high at 2791.75 at 9:36.

The next move was down to 2784.50, and then the ES made two more stabs at the vwap at 2790.75 and 2790.50, and two higher lows at 2785.25 and 2786.00. From there, the futures got hit by a buy program that pushed the futures up to a new high of the day at 2796.00 just before 11:00.

The drops and pops continued into the later parts of the day, with the ES selling off below the vwap down to the 2790 area, rallying back up to 2795.25 just before 12:30, and dropping back down to 2787.75, then trading back up to 2796.00 a few minutes after 2:00 CT.

In the final hour of trade the ES pulled back down to 2791.75 as the MiM went from over $600 million to buy to down to $400 million to buy. On the 2:45 cash imbalance the ES traded 2794.75 as the MiM buys widened out to $1.2 billion. On the 3:00 cash close the ES traded 2791.00 and settled at 2789.50, down -2.00 handles on the day.

In the end, the overall tone of the ES was mixed. In terms of the days overall trade, total volume was just over 1.2 million futures contracts traded.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.