Though benefits from a stabilizing economy and gradually improving interest-rate scenario had positioned the investment-management industry well, investment managers might be affected by the Fed’s monetary policy, with the first rate cut this year, along with lower expectations for inflation despite a solid labor market. Further, margin compression and escalating compliance and technology costs will likely dampen investment managers’ profits in the near term.

Nevertheless, most investment managers have waived off majority of their fees with the rates rising since 2016. This decline in fee waivers has aided companies’ top-line growth. Moreover, asset managers are anticipated to record revenue growth in the quarters ahead, backed by increase in assets under management (AUM).

Performance of equity markets remained favorable in second-quarter 2019 as reflected by the nearly 3.8% quarterly growth and 8.2% year-over-year rise of the S&P 500 Index, resulting in a higher AUM.

Therefore, we are focusing on two investment managers — Federated Investors (NYSE:FII) and Ameriprise Financial, Inc. (NYSE:AMP) .

Federated, with a market cap of $3.25 billion, is a publicly-owned investment manager providing services to its clients and invests in public equity and fixed income markets globally. Ameriprise operates as a provider of various financial products and services to individual and institutional clients in the United States and globally, and has a market cap of $16.5 billion.

Federated currently carries a Zacks Rank #2 (Buy), with a Growth Score of B, while Ameriprise carries a Zacks Rank #2, with a Growth Score of C. Our research shows that stocks with a Growth Score of A or B, when combined with a Zacks Rank #1 (Strong Buy) or 2, offer the best upside potential.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Though both asset managers have similar business trends, deeper research into the financials will help decide which investment option is better.

Price Performance

Both asset managers have outperformed the industry (up 8.2%), year to date. While shares of Federated have gained 20.9%, Ameriprise’s stock climbed 21%. So, Ameriprise performed better than Federated.

Dividend Yield

Both companies have been deploying capital in terms of dividend payments to enhance shareholder value. Federated has a current dividend yield of 3.36%, while Ameriprise has a dividend yield of 3.07%.

As compared with the industry’s average of 2.95%, shareholders of Federated gain more.

Leverage Ratio

Ameriprise has debt-to-equity ratio of 0.80 as compared with the industry average of 0.55. But, Federated, with ratio of 0.26, has an edge over Ameriprise.

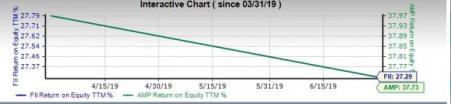

Return on Equity (ROE)

ROE is a measure of a company’s efficiency in utilizing shareholders’ funds. ROE for the trailing 12-months for Federated and Ameriprise is 27.29% and 37.73%, respectively. While both stocks scored above the industry’s level of 13.24%, Ameriprise reinvests its earnings more efficiently.

Earnings Estimate Revisions & Growth Projections

The Zacks Consensus Estimate for 2019 earnings of Federated inched up about 1.6%, over the last 30 days. The same for Ameriprise moved 1% north for the current year, during the same time frame.

Moreover, Federated’s 2019 earnings are projected to jump 13.8% year over year. For Ameriprise, the Zacks Consensus Estimate is pinned at $16.06 for 2019, reflecting a year-over-year increase of 7.5%.

Hence, Federated reflects better earnings growth prospects.

Sales Growth

Sales for Ameriprise for the ongoing year are projected to be down 4.9% year over year to $12.2 billion. For Federated, the Zacks Consensus Estimate is pegged at $1.3 billion for 2019, reflecting year-over-year growth of 14%.

Therefore, Federated has an edge here as well.

Conclusion

Our comparative analysis shows that Federated is better positioned than Ameriprise when considering earnings and sales growth expectations, dividend yield, leverage ratio and valuation. Ameriprise wins on price performance and reinvesting potential.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Federated Investors, Inc. (FII): Free Stock Analysis Report

Ameriprise Financial, Inc. (AMP): Free Stock Analysis Report

Original post

Zacks Investment Research