Regions Financial (NYSE:RF) is scheduled to report second-quarter 2019 results on Jul 19, before the opening bell. The bank’s results are estimated to reflect year-over-year rise in both revenues and earnings.

This Birmingham, AL-based company’s first-quarter 2019 earnings compared favorably with the prior-year quarter’s earnings, recording 5.7% increase. Easing margin pressure, lower expenses and higher revenues were the positive factors. However, lower fee income, backed by reduced capital markets and mortgage banking income, were major drags.

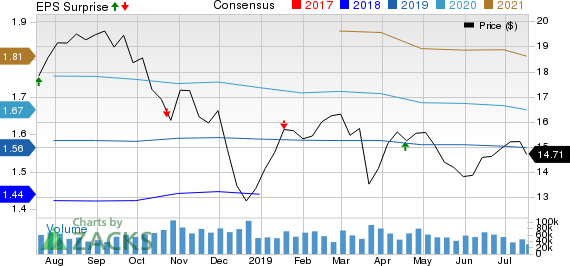

Further, the Zacks Consensus Estimate for second-quarter earnings has remained unchanged at 39 cents over the last 60 days. This, however, suggests a year-over-year improvement of nearly 14.7%. The Zacks Consensus Estimate for sales of $1.48 billion indicates around 3% growth from the prior-year quarter’s reported tally.

Notably, the company’s share price has appreciated post first-quarter earnings. For the three-month period ended Jun 30, 2019, the stock has gained around 1.9%.

Will the upcoming earnings release give a boost to Regions’ stock? This depends largely on whether or not the firm is able to post a beat in the second quarter.

Factors to Influence Q2 Results

Soft Loan Growth: Per the Fed’s latest data, rise in loans are likely to remain low on a sequential basis for the June-end quarter. Particularly, weakness in revolving home equity loans, commercial and industrial (C&I), and commercial real estate loans might offset growth in consumer loans.

Notably, management’s expectations of subdued loan growth in 2019 might be reflected in this quarter. The bank projects average loans to display year-over-year growth in low-single digits.

Net Interest Income (NII) Might Disappoint: A soft lending scenario during the to-be-reported quarter is predicted to impede growth in net interest income (NII) to an extent. Moreover, the company’s net interest margin might be affected due to the yield-curve flattening, the Fed’s accommodative policy stance and steadily rising deposit betas.

Also, the Zacks Consensus Estimate for average interest earning assets of $111.2 billion for the quarter is stable sequentially. Further, the consensus estimate of $969 million for NII reflects around 1% sequential growth.

Non Interest Income Might Escalate: The persistent decline in non-interest income has weighed on the top line for the past few years. Fixed income trading revenues are will likely remain muted on a year-over-year basis due to challenging trading environment during the quarter.

Nonetheless, consumer spending trend was stronger during the April-June quarter, which will likely bolster the bank’s credit and debit card revenues. In a reversal in trend, mortgage banking performance is also projected to improve on the back of lower mortgage rates, which drove refinancing activities during the quarter. Seasonality aided mortgage banking revenues too.

Notably, the Zacks Consensus Estimate for capital market revenues is $50 million, up 19% sequentially, while commercial credit fee income is marginally up to $18.2 million.

Expenses to Remain Stable: The bottom line will likely reflect its efficient expense management during the quarter to be reported. Notably, the company is on track for a $400-million expense reduction this year. While investing in revenue-generating areas, the company intends to keep expenses stable.

Here is what our quantitative model predicts:

Regions does not have the right combination of two key ingredients for a possible earnings beat — a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or at least 3 (Hold).

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: The Earnings ESP is currently pegged at -0.14%.

Zacks Rank: Regions’ currently carries a Zacks Rank of 3, which increases the predictive power of ESP. But we also need to have a positive ESP to be confident of a positive earnings surprise.

Conversely, we caution against stocks with a Zacks Rank #4 or 5 (Sell rated) going into an earnings announcement.

Stocks That Warrant a Look

Here are some stocks you may want to consider, as according to our model, these have the right combination of elements to post an earnings beat this quarter.

Ares Capital Corporation (NASDAQ:ARCC) is slated to release results on Jul 30. The company has an Earnings ESP of +1.02% and carries a Zacks Rank of 2, at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Earnings ESP for Cullen/Frost Bankers, Inc. (NYSE:CFR) is +0.13% and it also carries a Zacks Rank of 3. The company is scheduled to report quarterly numbers on Jul 25.

TD Ameritrade Holding Corporation (NASDAQ:AMTD) has an Earnings ESP of +0.03% and holds a Zacks Rank of 3. It is set to report June quarter-end results on Jul 22.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Regions Financial Corporation (RF): Free Stock Analysis Report

Cullen/Frost Bankers, Inc. (CFR): Free Stock Analysis Report

TD Ameritrade Holding Corporation (AMTD): Free Stock Analysis Report

Ares Capital Corporation (ARCC): Free Stock Analysis Report

Original post