On May 30th USD/CHF was trading near 1.0100 in an attempt to recover from a decline from 1.0238 to 1.0009. The bulls had managed to add more than 90 pips and seemed determined to get the job done. Unfortunately for them, there was an Elliott Wave pattern suggesting their efforts were most likely going to be fruitless.

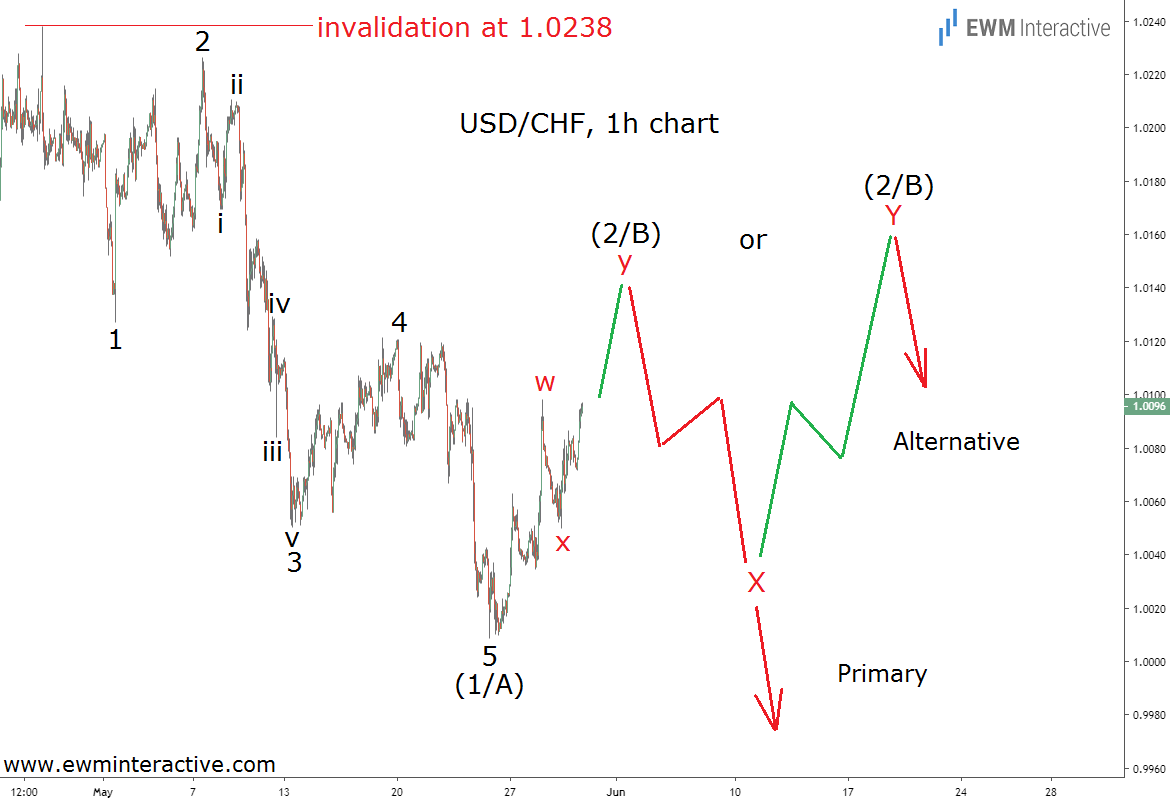

That day we wrote an article about this pattern, warning that as long as 1.0238 holds, “the odds remain in the bears’ favor.” The chart below, visualizing the pattern, was included in that article.

The pattern we are talking about is called an impulse. It is a five-wave structure, labeled 1-2-3-4-5, which points in the direction the larger trend is going. Therefore, once the corresponding three-wave corrective recovery in wave (2/B) was over, another decline in wave (3/C) was supposed to follow.

The exact shape and duration of wave (2/B) could not be predicted, but the important thing was that as long as 1.0238 – the starting point of wave (1/A) – was intact, the outlook was going to stay negative. Twelve days later, it is time to take a look at an updated price chart of USD/CHF.

Turns out wave (2/B) was practically over on May 30th. 1.0238 was never tested and the anticipated decline wave (3/C) arrived much sooner than initially expected. On June 5th, USD/CHF fell to 0.9854, losing over 240 pips in just five trading days.

USD/CHF Bears Should Keep an Eye on 1.0009

As of this writing, the pair is hovering around 0.9915 in what appears to be a consolidation in progress. It fits in the position of wave (4) of a larger five-wave impulse which has been unfolding from the top at 1.0238. The guideline of alternation states that if the second wave was a sharp recovery, we can expect the fourth wave to move sideways.

A triangle or a flat correction both meet this description. Whatever the market is going to choose, waves (1) and (4) cannot overlap. This rule allows us to identify the bottom of wave (1) at 1.0009 as our invalidation level for this count. As long as USD/CHF trades below it, more weakness in wave (5) towards 0.9850-0.9800 can be expected.