The Swiss franc was among the very few currencies that managed to stand their ground against the U.S dollar in May. USD/CHF reached 1.0238 in late-April. The last time the pair traded this high was in January 2017, two and a half years ago. Unfortunately for the bulls, a 230-pip decline dragged the rate back down to 1.0009 by May 24th.

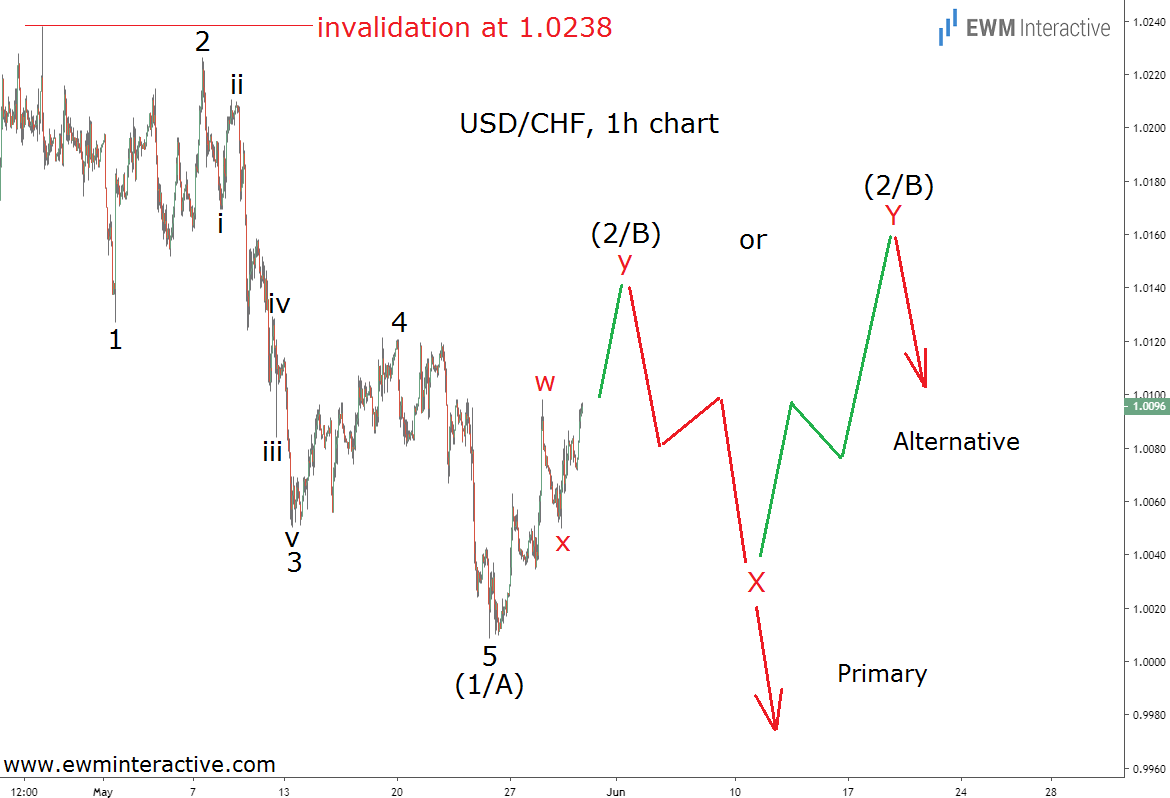

A look at the past five years reveals that this is the fourth time USD/CHF tried to break the resistance area between 1.0200 and 1.0400. The previous three attempts were not successful. It is still too early to tell if the bulls are going to get the job done this time. However, the hourly chart below reveals an Elliott Wave pattern, which doesn’t bode well for their ambitions.

The pattern in question is called an impulse. It is a five-wave structure, labeled 1-2-3-4-5, where wave 3 is the longest and waves 1 and 4 don’t overlap. The problem is that according to the Elliott Wave theory, this pattern points in the direction of the larger trend.

This means that once the current three-wave recovery in wave (2/B) is over, more weakness can be expected in USD/CHF. It is too early to tell what wave (2/B) is going to look like. It can develop as a small double zigzag or extend into a larger corrective structure. The above chart visualizes both options.

The good news that brings some clarity is that however wave (2/B) chooses to develop, it shouldn’t exceed the starting point of wave (1/A) at 1.0238. As long as this key level holds, the odds remain in the bears’ favor due to the impulse pattern already in place.