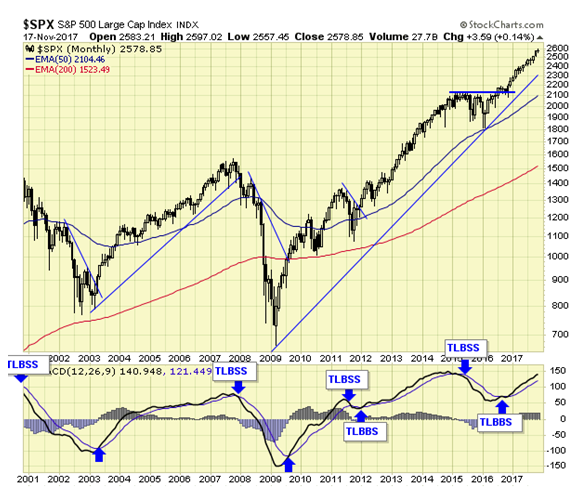

Our benchmark S&P 500 is on a major buy signal.

New money should wait for a correction and cycle bottom to accumulate for long term holding.

Oil sector (via OSX) is on a major sell signal.

Investors should wait for the next major buy signal.

A major correction in the major indexes is long overdue.

VIX has now made a new low, and when (not if) the downtrend is broken on a monthly basis, investors should consider hedging or under weigh in equity holdings.

Summary

Current investing model favors equities, therefore, investors should remain overweighed with stocks or stock ETFs for maximum growth.

A monthly breakout on the VIX will be the first warning sign that a market correction is imminent.

Disclosure: We do not offer predictions or forecasts for the markets. What you see here is our simple investing model which provides us with simple investing decision making. Entry points and stops are provided in real time to subscribers, therefore, this update may not reflect our current positions in the markets.