Investor reaction to Equifax Inc.’s (NYSE:EFX) latest quarterly results were mixed as evident from yesterday’s late-hour trade. Following the company’s third-quarter 2017 results, the stock fell approximately 2.5%, then recovered and went up to nearly 1%. Finally, at the close of after-hour trading, it was down less than 1%.

Analysts and investors were waiting for the credit information provider’s third-quarter results to have a better picture of the impact of the data breach incident on the company’s financial performance. Notably, this September, Equifax announced that very sensitive personal data of approximately 143 million consumers has been stolen from its database.

The company recorded $87.5 million of costs related to the data breach, which was the main reason behind the 27.5% decline in its third-quarter GAAP earnings. The company reported GAAP earnings of 79 cents, down from $1.09 posted in the year-ago quarter.

Equifax stated that it is still not sure how much its bottom-line results have been impacted by the above-mentioned data breach. In its 10-Q filing with the Securities & Exchange Commission (SEC), the company reported that over 240 class-action lawsuits have been filed against Equifax. It is currently facing probe from a number of investigating agencies and regulators.

However, SEC’s rule of reporting financial results on a non-GAAP basis gave it a scope to overshadow the debacle. On non-GAAP basis (which excludes one-time items including the costs related to data breach), the company managed to report year-over-year earnings growth.

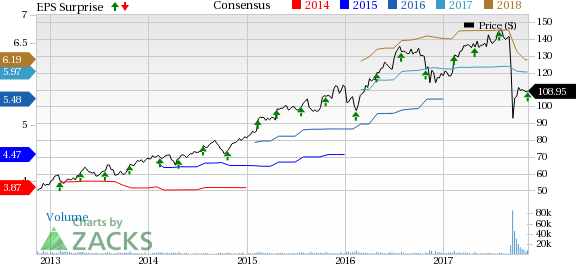

Equifax’s non-GAAP earnings of $1.53 per share came in 6.3% higher than the year-ago quarter. Moreover, quarterly earnings surpassed the Zacks Consensus Estimate of $1.49 and were toward the upper-end of management’s guidance rage of $1.50-$1.54 (midpoint: $1.52).

It is quite possible that investors will have different opinions on the company’s bottom-line results, which may have resulted in such volatility during yesterday’s late-hour trade. Furthermore, it is possible that investors will be waiting for the third-quarter earnings conference call, which is scheduled to be held today before the market opens, for a better view on its growth prospects.

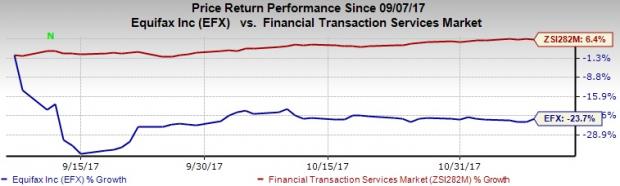

Notably, the stock is on a downtrend since it reported the data-breach incident on Sep 8. It has lost 23.7% of its value since then, while the industry to which it belongs to has gained 6.4%.

Let’s discuss quarterly results in detail.

Revenues

Equifax’s top-line performance was also not impressive. Revenues of $834.8 million missed the Zacks Consensus Estimate of $847 million as well as management’s guided range of $853-$861 million. Although, the figure was up 3.8% on a year-over-year basis, it was the slowest growth rate in the last several quarters.

Lackluster top-line performance was mainly due to the dismal performance at its U.S. Information Solutions (USIS) division which registered a year-over-year 3% decline in revenues to $307.7 million, reflecting a complete sign of impact from the data-breach scandal. The division witnessed revenue decline at all its sub-segments. Revenues from Online Information Solutions, Mortgage Solutions Services and Financial Marketing Services dropped 4%, 2% and 1%, respectively.

However, the company’s other segments continue to perform well.

Revenues from the International division (including Europe, the Asia Pacific, Canada and Latin America) advanced 12% year over year to $239.8 million. On a constant-currency basis, revenues increased 10%. Growth was mainly driven by the Veda Group acquisition, which increased the Asia-Pacific region’s contribution to revenues to $81.2 million, up 10% year over year. Moreover, revenues registered growth of 16%, 11% and 11% in Latin America, Canada and Europe, respectively.

Revenues from the Workforce Solutions segment climbed 9% year over year to $186.4 million, primarily on the back of 13% revenue growth in Verification Services. Revenues from Employer Services remained flat year over year.

Global Consumer Solutions contributed $100.9 million to total revenues. The figure was flat on a year-over-year basis.

Operating Results

Equifax’s adjusted EBITDA increased approximately 8.1% to $312.5 million. Adjusted operating EBITDA margin expanded 150 basis points (bps) to 37.4%. Adjusted net income came in at $185.9 million or $1.53 per share compared with $175.2 million or $1.44 per share reported a year ago.

Balance Sheet & Cash Flow

Equifax exited the reported quarter with $315.4 million in cash and cash equivalents, down from the previous quarter’s balance of $403.9 million. Total long-term debt (excluding current portion) was $2.04 billion, flat quarter over quarter. During the nine-month period ended Sep 30, 2017, Equifax generated cash flow of $508.7 million from operational activities.

In the first three quarters, the company paid dividend of $140.7 million. Also, Equifax’s board of directors approved a quarterly cash dividend of 39 cents to be payable on Dec 15 to shareholders of record date as of Nov 24. Notably, the company has a history of paying quarterly dividend for more than 100 years.

Our Take

We believe that due to ongoing uncertainty the company has not provided outlook for the forthcoming quarter. Therefore, we will have to wait for the company’s conference call today to have a clearer picture about its future prospects.

Its escalating expenses related to the cyber attack will remain a drag on the company’s profitability. Also, per its 10-Q filing, the company expects to incur more expenses in the form of legal and professional services associated with the data-breach incident. Furthermore, it stated that its expenses might flare up due to increased investments in IT and security solutions as well as insurance services.

The brand image and creditability of Equifax has been in question and is facing huge customer criticism, while cybersecurity companies are questioning its preparedness and response to the massive data breach. Moreover, with lawmakers and investigating agencies probing the mishap, its troubles are unlikely to end any time soon.

We believe the entire issue may result in loss of customers and the company may also have to make huge compensation to its clients. This may have an adverse impact on the company’s financial performance in the near term.

Currently, Equifax carries a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the same space include Envestnet, Inc. (NYSE:ENV) , Global Payments Inc. (NYSE:GPN) and Total System Services Inc. (NYSE:TSS) , all carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Envestnet, Global Payments and Total System Services have long-term expected growth rates of 15%, 14.6% and 12.8%, respectively.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Equifax, Inc. (EFX): Free Stock Analysis Report

Total System Services, Inc. (TSS): Free Stock Analysis Report

Global Payments Inc. (GPN): Free Stock Analysis Report

Envestnet, Inc (ENV): Free Stock Analysis Report

Original post

Zacks Investment Research