Apple Inc (NASDAQ:) is set to report its fourth-quarter fiscal 2017 earnings on Nov 2. As usual, we expect the flagship device – iPhone – to steal the limelight.

iPhone, since its launch in 2007, has been the mainstay of the tech giant’s revenues. On an average, 50-60% of its quarterly revenues come from iPhone. The about-to-be reported quarter saw the launch of the much awaited iPhone 8 and iPhone 8 Plus. The new models were launched on Sep 22 while the much anticipated iPhone X is scheduled for a Nov 3 launch.

The pricing of the latest iPhone 8, 8 Plus and iPhone X reflects Apple’s continuing focus on maintaining its premium brand image. However, this has affected growth, particularly in cost sensitive regions like South East Asia.

Apple Inc. Price and EPS Surprise

Apple Inc. Price and EPS Surprise | Apple Inc. Quote

To gain market share against the likes of Samsung (KS:), Huawei, Oppo, Vivo and Xiaomi, Apple has been offering significant discounts on iPhone 7 and iPhone 7 Plus in rapidly growing markets like India and China. This has helped in driving sales and the trend is expected to continue in the soon-to-be reported quarter.

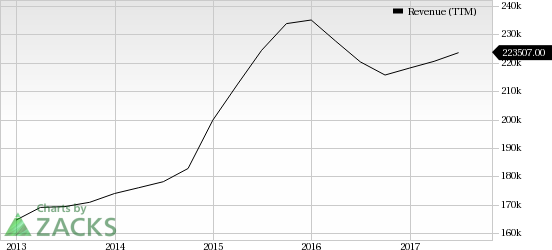

Apple Inc. Revenue (TTM)

Apple Inc. Revenue (TTM) | Apple Inc. Quote

This is well reflected in the Zacks Consensus Estimate. For the fourth quarter, the Zacks Consensus Estimate projects an increase of 1.3% year over year in China sales to $8.9 billion. It marks a reversal from the recent trend of decelerating sales in China. The last reported quarter witnessed a 10% year-over-year decline in sales from the region.

However, we don’t expect any significant contribution from the latest models as the quarter’s results will include sales for the first nine days only. Reportedly, demand for iPhone 8 and iPhone 8 Plus has been mostly sluggish, primarily affected by lower prices of iPhone 7 as well expectations for iPhone X.

For the fourth quarter, the Zacks Consensus Estimate for total iPhone units sold is 46.4 million, up 2% from the actual figure reported in the year ago quarter. Total revenues from iPhone and related products and services are projected to be around $29.6 billion, up 5.2% from the actual figure reported in the prior-year quarter.

At present, Apple carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stay tuned as we bring you more on Apple ahead of the upcoming earnings announcement.

Stocks to Consider

Here are some stocks that, per our model, have the right combination of elements to post an earnings beat this quarter:

Alibaba Group Holding Limited (NYSE:) with an Earnings ESP of +2.52% and a Zacks Rank #3.

Kemet Corp. (NYSE:) with an Earnings ESP of +7.46% and a Zacks Rank #1.

NVIDIA Corp. (NASDAQ:) with an Earnings ESP of +0.53% and a Zacks Rank #1.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>