Arena Pharmaceuticals, Inc.’s (NASDAQ:ARNA) shares jumped over 40% on Jul 11, after the company announced that a phase II study, evaluating its pipeline candidate ralinepag for treatment of pulmonary arterial hypertension (PAH), has met its primary endpoints.

However, the company’s shares declined 1% in after-hours trading on Tuesday, post its announcement that funds will be raised through an underwritten public offering.

Arena plans to offer and sell 150 million shares of its common stock, subject to customary closing conditions. The underwriters are expected to be granted with an option to buy up to 22.5 million additional common shares after deducting the underwriting discounts and commissions to cover over-allotments. The completion or the actual size or terms of the offering were not made public by the company.

Citigroup (NYSE:C), Leerink Partners, Cantor Fitzgerald & Co. and UBS Investment Bank are serving as joint book-running managers for the public offering.

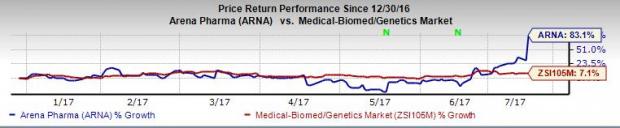

Arena’s shares have significantly outperformed the Zacks classified Medical-Biomed/Genetics industry so far this year. Shares of the company surged 83.1%, while the industry registered an increase of 7.1%.

Top line data from the phase II study on ralinepag has demonstrated a statistical significance for the candidate in improving pulmonary vascular resistance (PVR) compared with placebo.

Notably, PVR worsened from baseline in patients who were given a placebo. On the contrary, treatment with ralinepag resulted in an improvement of 29.8% in PVR compared with placebo and 20.1%, when compared with baseline. It has also come up with numerical improvement in patient’s ability to exercise as measured by a six-minute walk distance test.

The company has also said that the positive data from the study paves way for an expedited initiation of a phase III program.

The company has been facing a marginal increase in cash burn rate after it decided to shift focus to its clinical pipeline of early to mid-stage candidates. At the end of Dec 2016, the company had roughly $90.7 million of cash and cash equivalents. However, the above mentioned public offering is expected to boost Arena’s cash position.

Zacks Rank & Key Picks

Arena currently carries a Zacks Rank #2 (Buy). Few other stocks worth considering in the healthcare sector are Astrazeneca (LON:AZN) PLC (NYSE:AZN) , Enzo Biochem, Inc. (NYSE:ENZ) and Exelixis, Inc. (NASDAQ:EXEL) , each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Astrazeneca’s earnings per share estimates inched up from $1.84 to $1.85 for 2017 and from $1.83 to $1.89, over the last 60 days. The company has delivered positive earnings surprises in all the four trailing quarters with an average beat of 142.60%. Astrazeneca’s shares have rallied 21.6% so far this year.

Enzo’s loss per share estimates has narrowed from 12 cents to 7 cents for 2017 and from 11 cents to 3 cents for 2018 in the last 30 days. The company has delivered positive earnings surprises in all the last four quarters with an average beat of 55.83%. Shares of Enzo surged 61.1% so far this year.

Exelixis’s earnings per share estimates moved up from 17 cents to 18 cents for 2017 over the last 30 days. The company has delivered positive earnings surprises in all the four trailing quarters with an average beat of 512.11%. Exelixis’s shares have soared 70.4% so far this year.

More Stock News: 8 Companies Verge on Apple-Like Run

Did you miss Apple (NASDAQ:AAPL)'s 9X stock explosion after they launched their iPhone in 2007? Now 2017 looks to be a pivotal year to get in on another emerging technology expected to rock the market. Demand could soar from almost nothing to $42 billion by 2025. Reports suggest it could save 10 million lives per decade which could in turn save $200 billion in U.S. healthcare costs.

A bonus Zacks Special Report names this breakthrough and the 8 best stocks to exploit it. Like Apple in 2007, these companies are already strong and coiling for potential mega-gains. Click to see them right now >>

Astrazeneca PLC (AZN): Free Stock Analysis Report

Arena Pharmaceuticals, Inc. (ARNA): Free Stock Analysis Report

Enzo Biochem, Inc. (ENZ): Free Stock Analysis Report

Exelixis, Inc. (EXEL): Free Stock Analysis Report

Original post

Zacks Investment Research