Premium communications technology and services provider, Telefonaktiebolaget LM Ericsson (BS:ERICAs) (publ) (NASDAQ:ERIC) recently announced that it has been chosen to help Vodafone Group Plc (NASDAQ:VOD) evolve its 4G network in southern England. This apart, Ericsson will aid Vodafone UK to prepare for the impending rollout of the 5G networks in the region.

Leveraging on Ericsson’s Massive MIMO and Carrier aggregation technology, Vodafone UK expects to improve its radio signals quality, capacity and user data rates. Per the agreement, Ericsson will also help Vodafone with technology trials, product validation, commercial deployment and professional services.

According to Vodafone, these initiatives will help it to expand its 4G network footprint and create new capabilities for customers. Moreover, the companies have inked a memorandum of understanding to focus on key areas. These include 5G radio non-standalone and standalone, 5G use-cases and 5G site deployment scenarios. Ericsson and its partner believe that their combined strength will help improve customer experiences as well as monitor and control of IoT on a real time basis.

Over the past couple of years, a host of factors have plagued Ericsson, which has left the stock battered. Most of the company’s troubles stem from drying-up investments from major telecom equipment makers across the world. These companies continue to slash investments in 4G and 3G services while waiting for the introduction of 5G networks. In addition, slowdown in spending by wireless carriers is making matters worse.

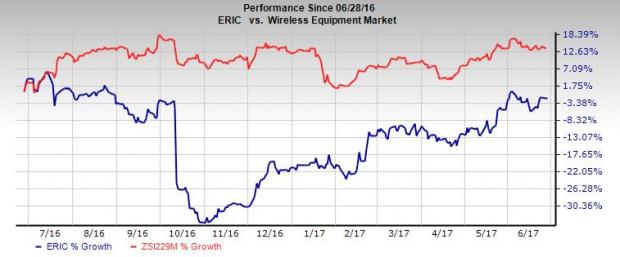

Ericsson’s shares have lost 1.9% over the past one year, as against the Zacks categorized Wireless Equipment industry’s average gain of 13.8%. The consensus analyst community is not favoring the stock either. The Zacks Consensus Estimate for full-year 2017 earnings has gone down from 29 cents to 27 cents due to two downward estimate revisions versus zero upward.

Apart from grappling with a slowdown, Ericsson also has to face sky-rocketing restructuring expenses in its continued efforts to turn around its fortunes. In Mar 2017, the company rolled out an elaborate version of this restructuring plan in a bid to contain costs and focus on strategic areas. It has warned investors against huge profit cuts resulting from substantial provisions, write-downs and restructuring charges relating to these efforts.

This apart, rising competition in the wireless networking equipment market and ongoing industry consolidation makes us believe that challenging times for the Zacks Rank #5 (Strong Sell) stock are here to stay.

Top picks

Top picks in the broader sector include Cohu, Inc. (NASDAQ:COHU) and Applied Materials, Inc. (NASDAQ:AMAT) . Both stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Cohu has a striking earnings surprise history, with an average positive surprise of 121.2% over the trailing four quarters, beating estimates all through.

With four back-to-back beats, Applied Materials has an average positive surprise of 3.3% for the trailing four quarters.

Sell These Stocks. Now.

Just released, today's 220 Zacks Rank #5 Strong Sells demand urgent attention. If any are lurking in your portfolio or Watch List, they should be removed immediately. These are sinister companies because many appear to be sound investments. However, from 1988 through 2016, stocks from our Strong Sell list have actually performed 6X worse than the S&P 500.

See today's Zacks ""Strong Sells"" absolutely free >>.

Cohu, Inc. (COHU): Free Stock Analysis Report

Ericsson (ERIC): Free Stock Analysis Report

Vodafone Group PLC (LON:VOD): Free Stock Analysis Report

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

Original post