Markets worldwide got hit even harder this past week with the Dow Industrials down -17% and down over - 32% YTD as humanity battles the spreading virus.

The massive drop of almost over 40% in IWM (Small Caps) this year highlights the extreme liquidity issues facing smaller companies with lower cash reserves and higher debt levels.

The Dow, S&P 500, and IWM are all trading beneath their 200-week moving averages.

Both the Dow and the Russell 2000 moved into death crosses on their daily charts and broke through key levels on their weekly charts that we highlighted last week.

Despite the huge spread in yields between high yield corporate debt to US Long bonds, it was hard to find bids on corporates.

This key ratio (TLT/HYG) continues to implode and deepen the risk-off sentiment. Even general obligation mini debt could be trouble and the Fed is looking into shoveling money there as well.

This past week’s highlights:

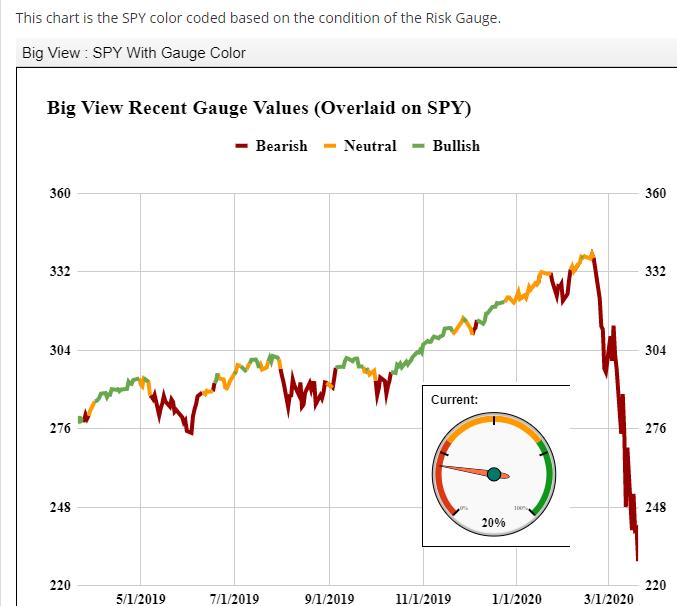

- Risk Gauges are still in risk-off mode

- Utilities underperformed stocks as people are selling anything that has a bid to raise cash

- Credit markets are showing extreme stress with corporate debt (LQD) taking the brunt

- Value stocks continue to underperform Growth stocks

- Market Internals and Sentiment are stabilizing at current deeply oversold levels

- Brother Biotech (IBB) is holding up best among sectors

- Volatility (VXX) exploded but backed off on Friday despite the sell-off to new lows

- Emerging markets are under extreme pressure but outperforming the S&P 500 on a relative basis