At first glance, Michigan and Louisiana don’t seem to have much in common: One shares an extensive border with Canada, and the other is in the Deep South.

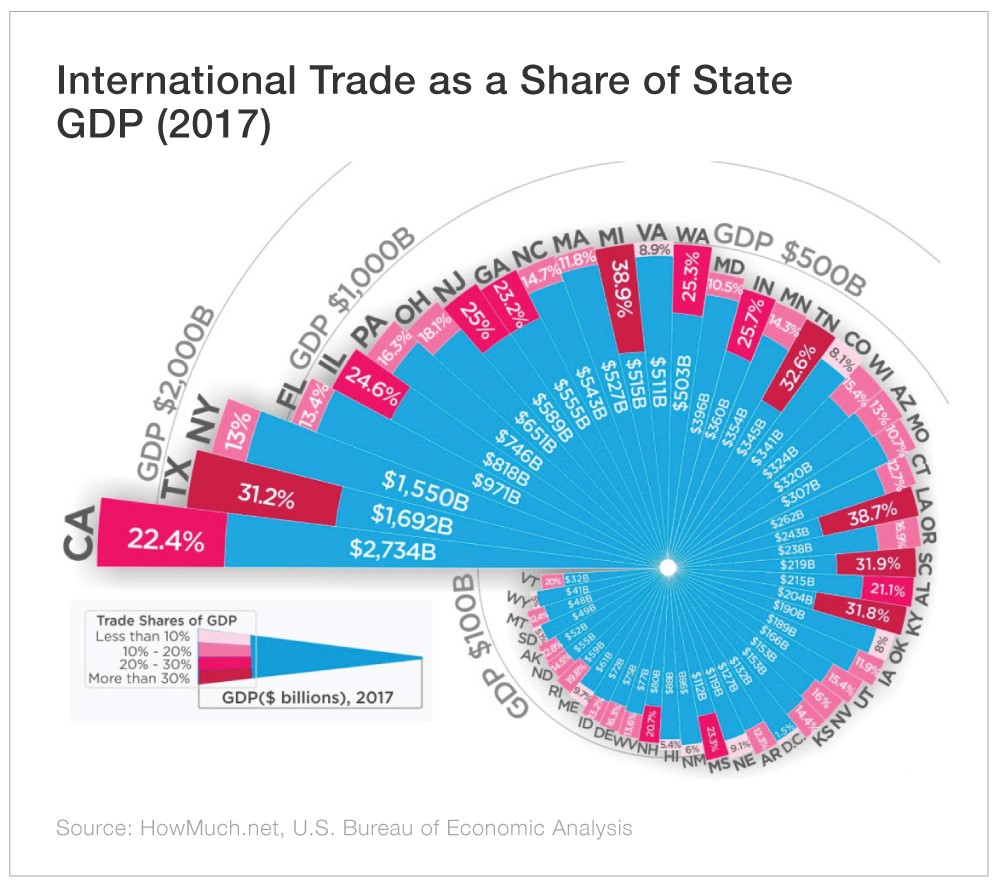

But the economies of these two states have an important similarity: Both derive more than a third of their gross domestic products (GDPs) from international trade.

They’re not exactly outliers, either. As you can see from this week’s chart, 40 of our 50 states would lose a double-digit chunk of their economies without international trade.

However, this chart isn’t about why trade is good or bad. It’s simply meant to remind you that there’s a lot of economic activity going on outside of the United States.

So if you want a truly diversified portfolio, you need some international investments.

Foreign Bargains

The U.S. is a great place to invest your money. We still have the world’s largest economy and largest stock market by far. But we account for only about half of the global stock market.

And while U.S. stocks look worryingly expensive to some observers, foreign markets can be unbelievably cheap.

Take emerging markets, for example. They represent more than half of the world’s GDP but account for a puny 10% of global stock market capitalization. And the iShares MSCI Emerging Markets (NYSE:EEM) trades for 15 times trailing earnings, compared with 24 times for the S&P 500.

Many investors focus too much on the U.S. market because they don’t know how to invest in foreign stocks. After all, they were effectively off-limits to the average American investor until a couple decades ago.

An Easy Fix

Exchange-traded funds (ETFs) have existed only since the mid-90s, but they’ve since grown into a huge and popular asset class. ETFs are especially useful for investing overseas. They allow investors to buy a basket of foreign stocks with a few clicks of a mouse.

Our ETF Strategist Nicholas Vardy has written extensively about using ETFs to get into attractive foreign markets.