For hump Wednesday, I am asking the question on whether the two premier diet drug companies are finally over the hump and have stopped the bleed?

Today I read this:

WEIGHT-LOSS DRUG COVERAGE RISES AMONG LARGE US EMPLOYERS IN 2024: MERCER SURVEY 44% of US employers with 500+ employees now cover weight-loss drugs, up from 41% in 2023. Among employers with over 20,000 employees, 64% offer coverage, compared to 56% last year. Coverage includes GLP-1 drugs like Wegovy (Novo Nordisk) and Zepbound (Eli Lilly), shown to reduce weight by 15-20%. Rising obesity drug costs contributed to a 5% increase in annual healthcare costs per employee, now averaging $16,501 for self-insured plans.

Clearly, the “thin” trade or “vanity” trade is gaining traction.

It is quite clever that large firms incentivize employees with benefits to buy the obesity drugs.

Why not promote better health and self-esteem?

I would think the logical conclusion is a happier staff, a happier work environment equals increased production.

Plus, I cannot help but perseverate on the domino effect of a percentage of the population thinner, now wanting to do injectables, use better skin care products, wear more makeup, buy better clothes, go to the gym, and so on..

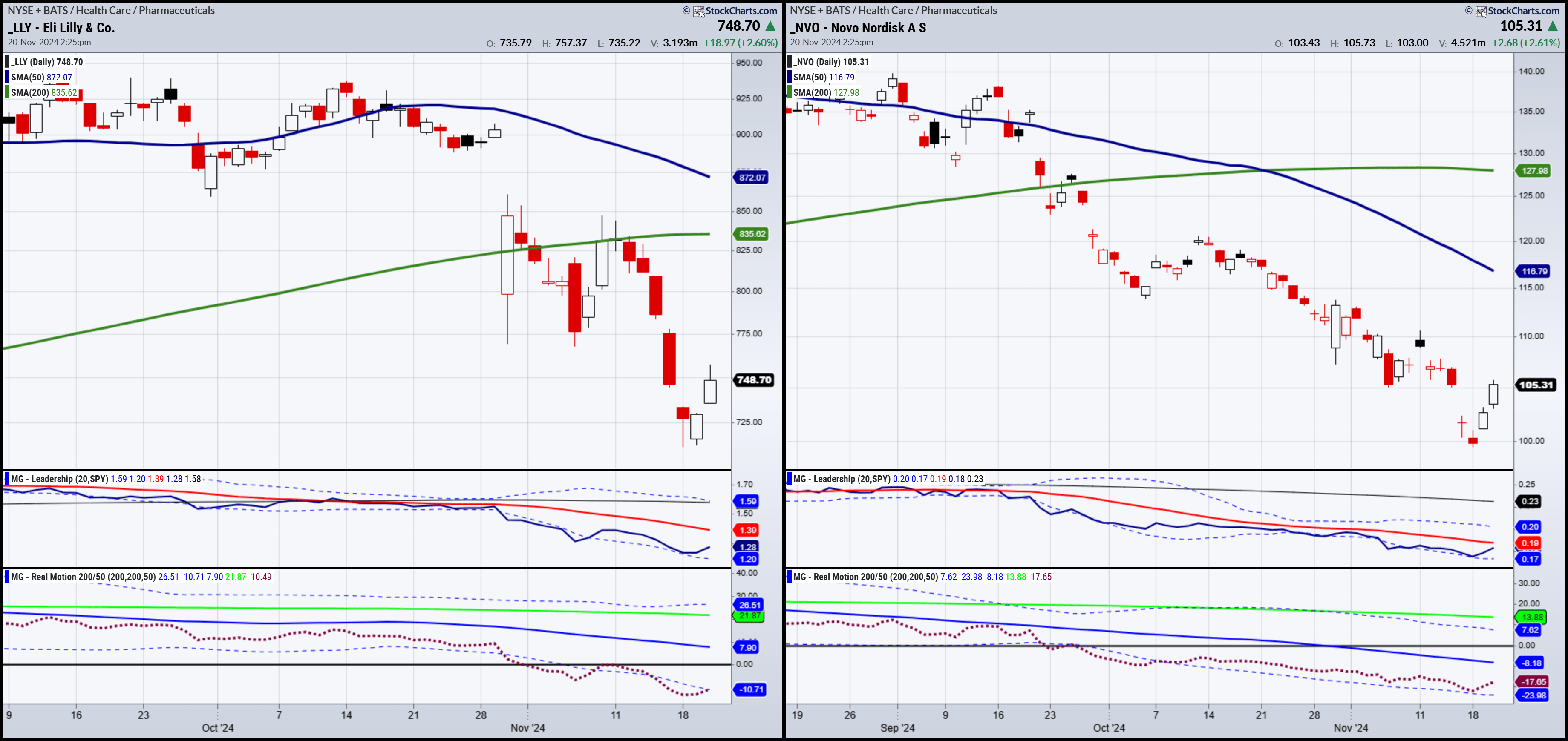

Regardless, both the stocks of Novo-Nordisk (NYSE:NVO) and Elli Lilly (NYSE:LLY) stopped falling in price.

The question is, are they a buy at these levels?

Eli Lilly made a reversal bottom low on Monday after a gap lower.

Today’s price action was confirmation.

Real Motion shows a mean reversion buy signal.

While LLY well underperforms SPY, that is not as much a concern now with a clearly defined risk under Monday low 711.40.

Novo-Nordisk also had a clear reversal bottom low on Monday.

Plus, the price filled the gap left from last week’s big drop.

Real Motion never flashed a Bonafide mean reversion. However, the Leadership indicator tells us that NVO’s performance is not too far behind the benchmarks.

I love the strong reversal pattern on stocks I am watching as mega-trends in infancy.

I lead you to the water.

ETF Summary

(Pivotal means short-term bullish above that level and bearish below)

- S&P 500 (SPY) 575 support 600 resistance

- Russell 2000 (IWM) 227 support 244 the area to clear

- Dow (DIA) 430 support

- Nasdaq (QQQ) 500 now pivotal

- Regional banks (KRE) 65 pivotal

- Semiconductors (SMH) 235 the 200-DMA to hold 250 resistance

- Transportation (IYT) Looks good if it holds over 71

- Biotechnology (IBB) 132 support 138 now resistance

- Retail (XRT) Support 77.00 resistance 79

- iShares iBoxx Hi Yd Cor Bond ETF (HYG) 79.50 pivotal and back below