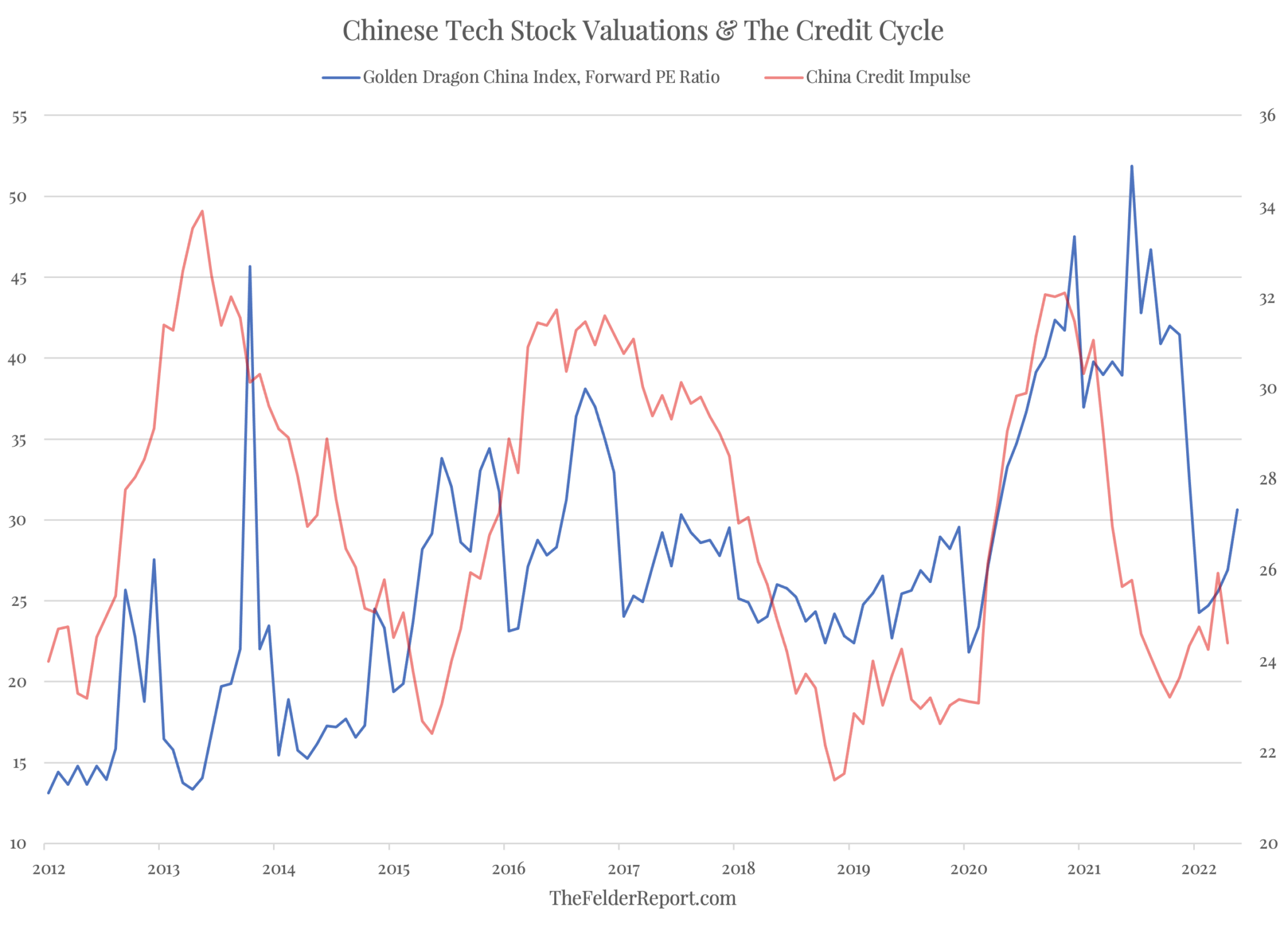

Back in January, I drew attention to the dramatic divergence between US and Chinese tech stocks. Over the course of 2021, the former soared while the latter crashed. The major difference, I argued at the time, was the divergence in monetary policy. In China, a tightening of the credit cycle led to a major reset in the valuations of big tech stocks in the country. Of course, a regulatory crackdown also played a major part in the process.

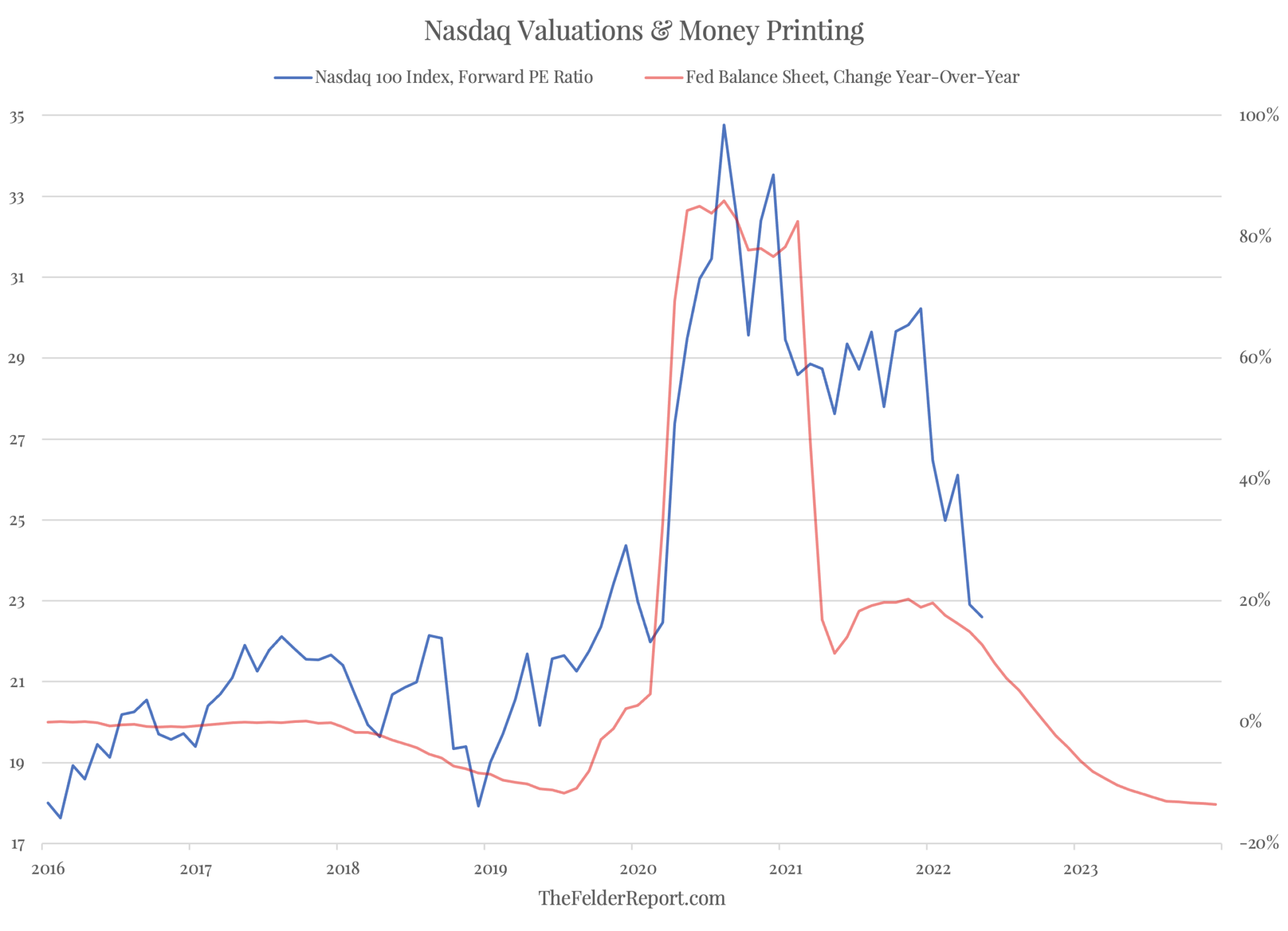

In contrast, here in the US the Federal Reserve was still pouring monetary fuel on the market fire, supporting risk appetites and thus valuations. That changed this year, with the Fed beginning to follow in the footstep of the Bank of China by embarking on a major tightening of monetary policy of its own. In addition, big tech stocks in the US also now face a major regulatory crackdown of their own, both here and in Europe.

The lesson that might be gleaned from China’s experience is that a reset in valuations for US tech stocks may not be complete until the Fed’s monetary tightening has first been completed. What’s more, it’s not just the “P” in the PE Ratio that must be considered but also the “E.” If valuations continue to revert to more normal levels AND earnings estimates continue to come down (as leading indicators suggest), then the decline in prices may have only just begun.

It’s not my favorite price analog in the world but there’s almost an 80% correlation between the NASDAQ 100 index and the Golden Dragon China index when the latter is set forward nine months. If big tech stocks are, indeed, following in the footsteps of their Chinese counterparts, due to a bearish shift in both monetary policy and earnings trends, then is it so hard to believe that they may also give back all of their monetary-fueled gains?